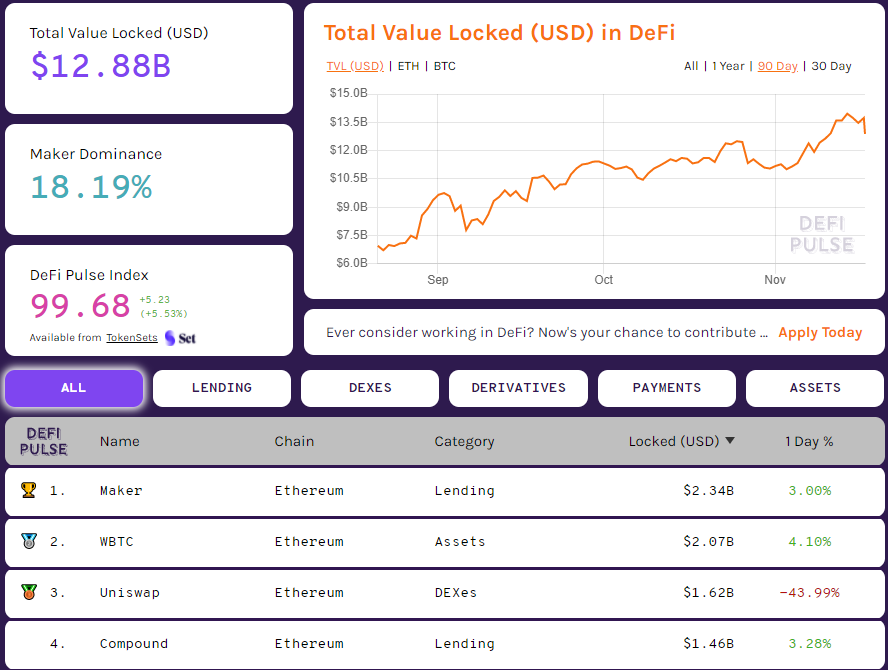

Uniswap slips to third place in DeFi Pulse ranking

The largest decentralized exchange, Uniswap, has slipped to third place in the DeFi Pulse TVL ranking. The most likely reason is the ending of the liquidity mining program for the UNI token.

At the top of the ranking now sits Maker ($2.34 billion), followed by the Bitcoin-backed WBTC ($2.07 billion). At the time of writing, Uniswap’s TVL stood at $1.62 billion.

Data: DeFi Pulse.

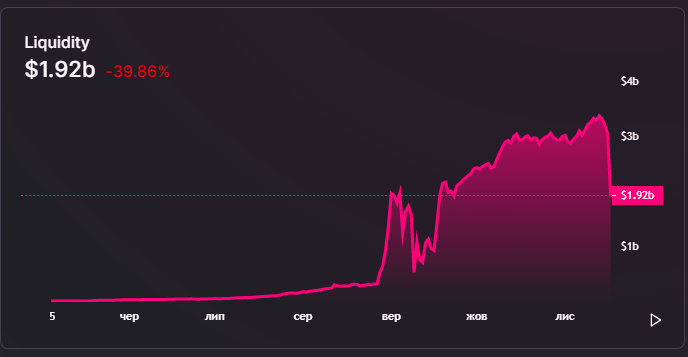

Below is a chart showing Uniswap’s liquidity decline — from $3.36 billion (November 13) to $1.92 billion.

Data: Uniswap.

A significant influx of liquidity is being drawn to platforms competing with Uniswap, including SushiSwap.

Data: SushiSwap.

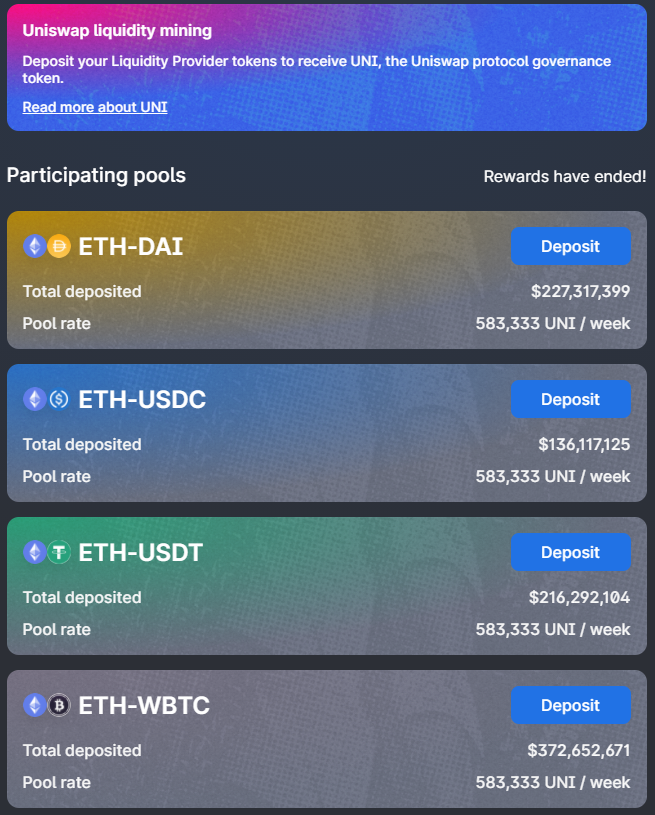

The timeline for the end of the Uniswap liquidity mining program was announced in September, together with the launch of the UNI governance token. It was reported that the program would run until November 17.

The rewards were distributed through four liquidity pools: ETH/USDT, ETH/USDC, ETH/DAI, and ETH/WBTC. A total of 20 million UNI tokens were allocated across the pools, with each receiving 5 million tokens.

‘Rewards are over!’, the UNI liquidity mining program page says. Data: Uniswap.

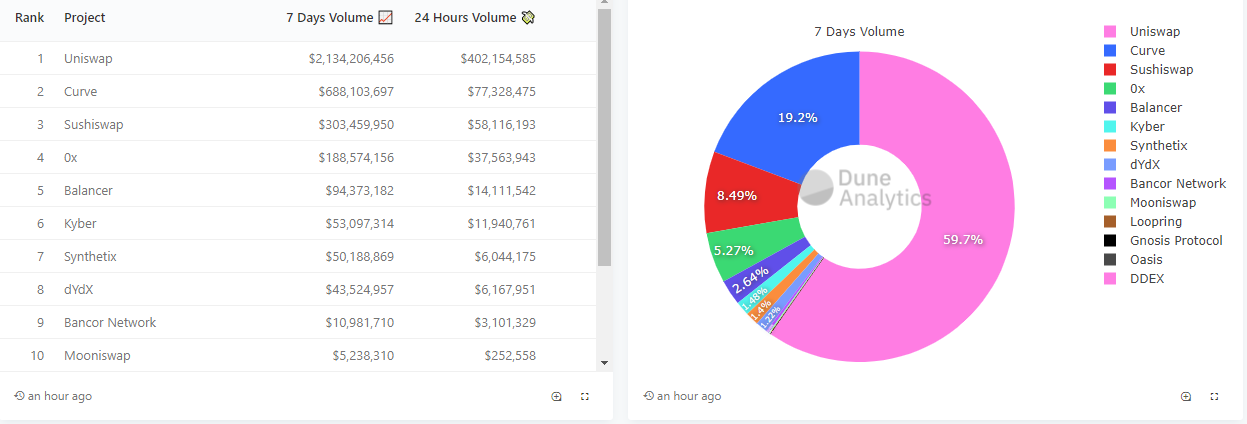

Uniswap remains the leader among DEXs, accounting for almost 60% of trading volume in its market segment.

Uniswap turnover remains far higher than Curve and SushiSwap. Data: Dune Analytics.

Learn how Uniswap became the first DEX to beat Coinbase by trading volume in our article.

Subscribe to ForkLog news on Telegram: ForkLog FEED — the full news feed, ForkLog — the most important news and polls.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!