Uniswap’s Market Share Dwindles Amidst DEX Competition

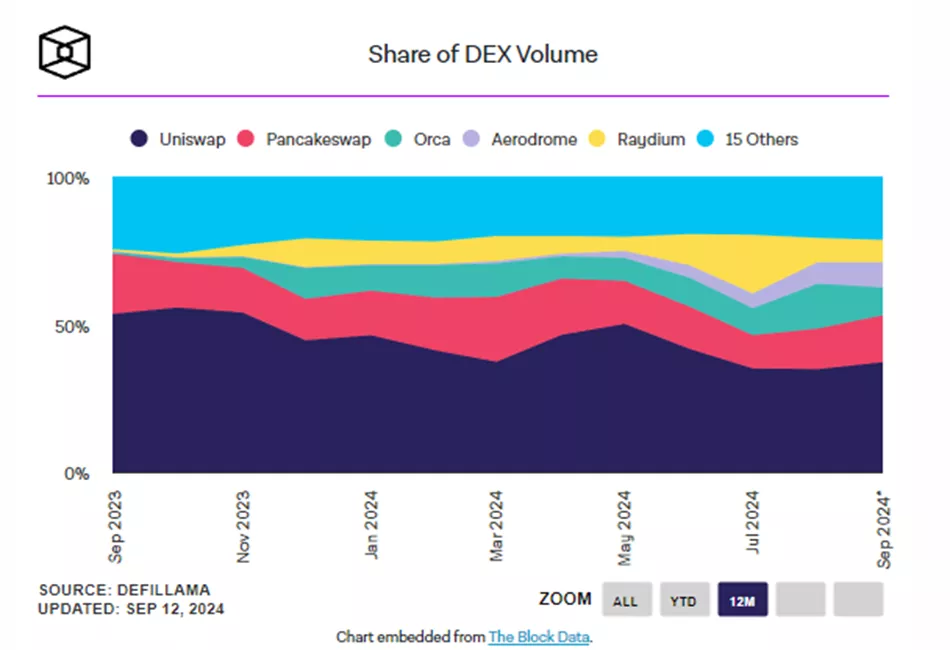

Uniswap’s share in the DEX market has declined from over 50% in October 2023 to the current 36%. Analysts at The Block attribute this trend to increasing competition and innovation in the sector.

Uniswap has ceded some of its market position to Aerodrome, whose share has surged to 7%. Other beneficiaries include Orca, which has grown from 9% at the start of the year to 12%.

According to experts, the gradual reduction of the leader’s share in favor of smaller players indicates sustained changes, as users discover and transition to more competitive DEXs with long-term benefits rather than short-term incentives.

Analysts have described the decentralized exchange sector as thriving overall. In August, monthly trading volumes reached $140 billion.

In their view, the diversification of the landscape could act as a catalyst for innovation and enhanced user capabilities:

- Competitive innovation. The emergence of new protocols forces leaders like Uniswap to remain vigilant. Although in February the project announced a fee-sharing model with token holders, regulatory issues quickly halted these plans, highlighting the complex environment for DEXs.

- User benefits. Competition leads to improved features, enhanced tools, and potentially lower fees.

- Ecosystem resilience. The expansion of the DEX ecosystem reduces single points of failure and fosters a more robust DeFi landscape.

- Tailored solutions. Different platforms can occupy specific niches and address unique user needs, resulting in a more refined and convenient user experience.

According to The Block, launching a successful DEX involves not only algorithms but also creating an appealing user experience, ensuring high liquidity, and navigating the regulatory “minefield.”

Strategies for success include:

- Incentive programs to attract liquidity providers.

- User-friendly interfaces that simplify complex DeFi concepts.

- New features like limit orders or cross-chain swaps.

- Strategic partnerships with DeFi protocols.

Back in September, the CFTC fined Uniswap Labs $175,000 for offering digital asset derivatives.

In May, an organization associated with the popular DEX urged the SEC to reconsider a potential lawsuit.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!