US Inflation Slows as Bitcoin Struggles to Hold $56,500

In August, the annual inflation rate in the US stood at 2.5%, down from 2.9% the previous month. This figure matched market expectations.

On a monthly basis, the consumer price index rose by 0.2%, consistent with July’s increase. The result aligns with the consensus forecast.

Excluding food and energy prices, the index increased by 0.3% from the previous month and by 3.2% compared to August last year. The previous report showed figures of 0.2% and 3.2%, respectively.

Analysts had anticipated the annual and monthly rates to remain unchanged.

While the macroeconomic headlines were positive, the report’s details were less encouraging. Prices for services excluding housing and energy rose by 0.33% after a 0.21% increase in July and declines of 0.05% and 0.04% in May and June. The Fed has noted the importance of this metric in analyzing inflation trends.

Another key metric for monetary authorities, rental prices, increased by 0.49%, the highest since January, compared to a 0.36% rise in July.

The release of macroeconomic data triggered volatility in Bitcoin, with a predominance of selling. The price fell to the lows of the previous three hours ($56,300), from where it is attempting to recover. A similar pattern was observed in Ethereum.

At the time of writing, the daily growth rates of the first and second cryptocurrencies are 1.1% and 1.3%, respectively.

Bloomberg noted that the CPI data rule out the possibility of a 50 basis point rate cut by the Fed at its meeting on September 18. The initial negative reaction in risk assets may have been caused by traders who were counting on this outcome.

“New signs that inflation may be slightly more persistent than previously thought are likely to lead to a slower and shallower rate-cutting cycle,” commented Josh Jamner of ClearBridge Investments.

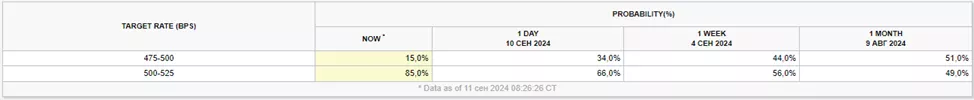

In the swaps market, quotes indicate almost complete confidence that the Fed will begin a policy easing cycle with a 25 basis point cut. The agency reminded that retail sales data on September 17 could influence the decision.

In the futures market, traders reduced the probability of a 50 basis point rate cut from 34% the day before to 15%.

According to Bitwise, the crypto market is expected to enter a growth phase in October-November following the resolution of macroeconomic and political uncertainties in the US.

Analyst and MN Trading founder Michaël van de Poppe predicted “final corrections” before a bull run.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!