US Inflation Slows Further as Bitcoin Dips Below $60,000

In July, annual inflation in the United States reached 2.9%, down from 3% the previous month. This figure surpassed market expectations, which had anticipated a continuation of the previous growth rate.

On a monthly basis, the consumer price index rose by 0.2% following a 0.1% decline in June. This result matched the consensus forecast.

Excluding food and energy prices, the index increased by 0.2% compared to the previous month and by 3.2% from July last year. In the previous report, the figures were 0.1% and 3.3%, respectively.

Analysts had expected a decrease in annual rates to 3.2% and an increase in monthly rates to 0.2%.

Prices for services excluding housing and energy rose by 0.21% after declines of 0.05% and 0.04% in the previous two months. The Fed highlighted the importance of this metric in analyzing the inflation trajectory. The rates did not exceed the average values typical for 2022 and 2023.

Another key indicator for monetary authorities, rental prices, increased by 0.36% compared to 0.27% in June—below the average for the past two years.

Hours after the inflation data release, the leading cryptocurrency plunged below $60,000.

Despite the positive nature of the macro data, it did not lead to sustained Bitcoin purchases. An initial price surge triggered strong selling, returning the rate to $61,200—the level before the macro statistics were published. A similar pattern emerged in Ethereum.

At the time of writing, the daily growth rates of the first and second cryptocurrencies are 4.3%.

The muted reaction may be attributed to the increase in the housing cost component. According to Omair Sharif of Inflation Insights, this indicator casts doubt on the recent series of lower CPI figures.

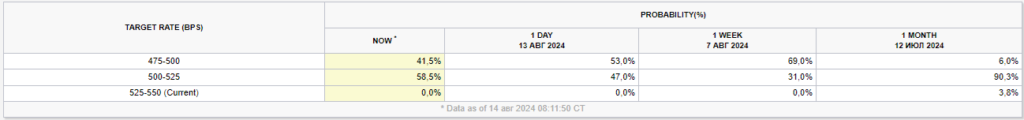

Nevertheless, this will not affect expectations for the Fed to begin easing policy in September, according to Bloomberg. Market participants will focus on the size of the rate cut (25 or 50 basis points), influenced by employment data for August and the next report on consumer price dynamics.

In the futures market, traders reduced the probability of a 50 basis point rate cut from 53% the day before to 41.5%.

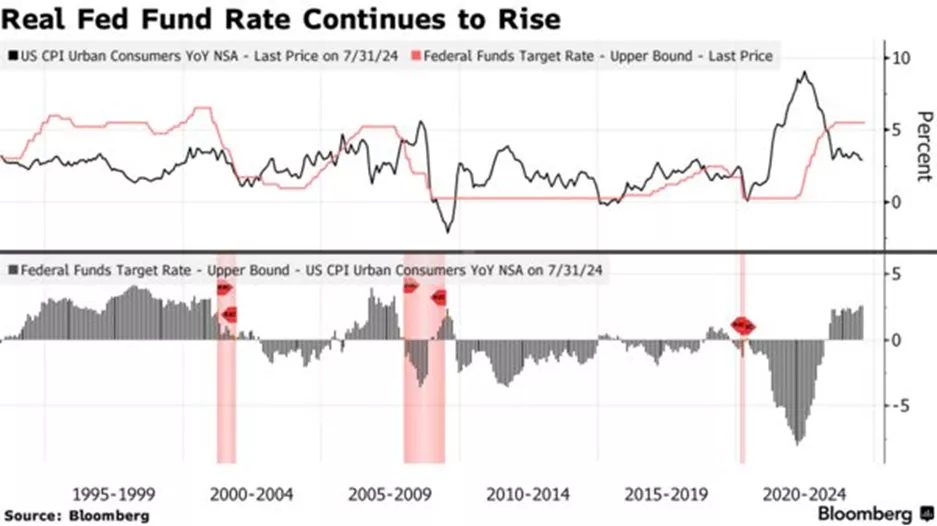

With the reduction of annual core inflation to 2.9%, the real Fed rate has risen to 2.6%—the highest level since 2007. The Fed needs to ease policy just to prevent the metric from tightening further, the agency noted.

Previously, FalconX’s head of research, David Lawant, stated that the digital gold rate could leave the established corridor due to changes in the Fed’s monetary policy and the US elections.

Back in earlier reports, former BitMEX CEO Arthur Hayes predicted Bitcoin would rise to $100,000 by the end of the year.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!