US Inflation Surge Triggers $400 Million Outflow from Crypto Funds

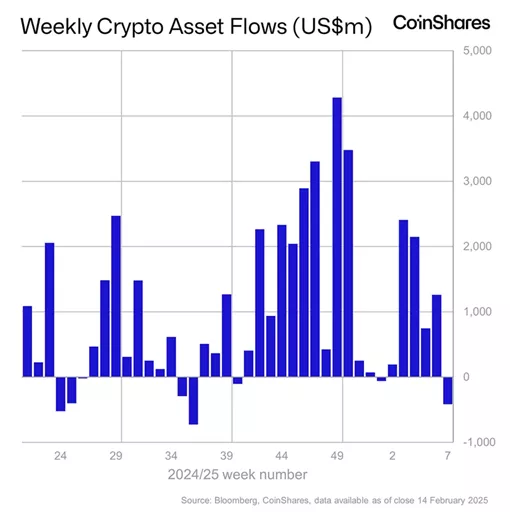

Between February 8 and 14, cryptocurrency investment funds experienced an outflow of $415 million, following an inflow of $1.3 billion in the previous reporting period, according to data from CoinShares.

This marks the first outflow following an “unprecedented 19-week inflow of $29.4 billion, driven by the reaction to Donald Trump’s victory in the US presidential election.”

The reversal was prompted by the consumer price index exceeding forecasts and subsequent hawkish rhetoric from Fed Chair Jerome Powell in Congress, experts noted.

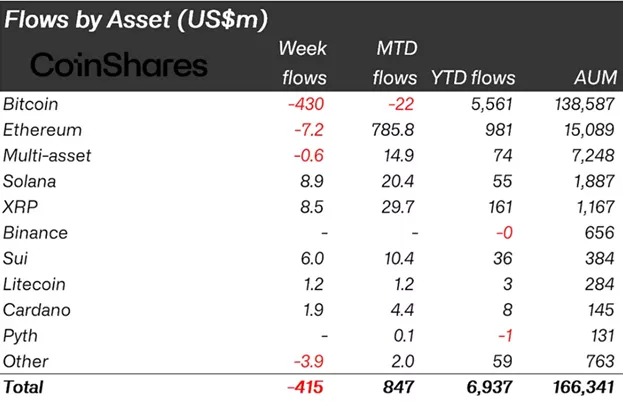

Bitcoin-based instruments, sensitive to interest rate changes, faced an outflow of $430 million (previously, inflows amounted to $407 million).

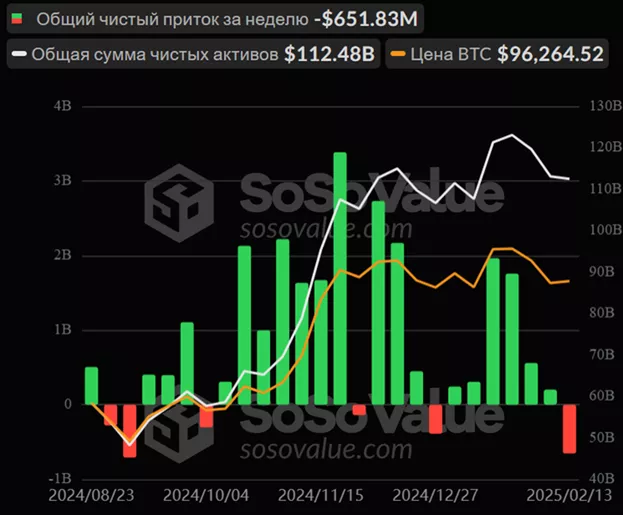

In the segment of US spot Bitcoin ETFs, investors withdrew $157.8 million from products. Prior to this, there had been positive momentum for six consecutive weeks.

From structures allowing short positions on digital gold, clients withdrew $9.6 million (previously, inflows were $0.1 million).

Following a surge of $783 million, Ethereum funds recorded an outflow of $7.2 million.

Inflows into XRP-based products slowed from $21.1 million to $8.5 million.

Competitors based on Solana, Sui, and Cardano attracted $8.9 million, $6 million, and $1.9 million respectively.

Earlier, CryptoQuant concluded that Bitcoin might enter a new bearish phase due to a decline in investors’ risk appetite.

CoinDesk noted a predominance of demand for call options with a strike price of $110,000 and an expiration date of March 28.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!