US Labour Market Report Boosts Bitcoin Towards $64,000

On the night of October 7, Bitcoin approached the $64,000 mark. The drivers were positive data from the US labour market last Friday and expectations of a Federal Reserve rate cut in November, writes The Block.

Experts noted that ongoing geopolitical tensions in the Middle East pose a risk to the rally of the leading cryptocurrency.

“Optimism has increased regarding a ‘soft landing’ for the US economy,” commented Presto Research analyst Min Zhong.

Rachel Lucas from BTCMarkets highlighted expectations of a Federal Reserve policy easing in November, which “encourages a more risk-on attitude among investors and positively impacts digital gold.”

The specialist also noted the reduction in exchange balances of coins as a factor easing selling pressure.

“To support this recovery, Bitcoin needs to break and hold the key resistance at $64,500. In this case, a retest of $66,000 is possible,” added Lucas.

Speculators in Play

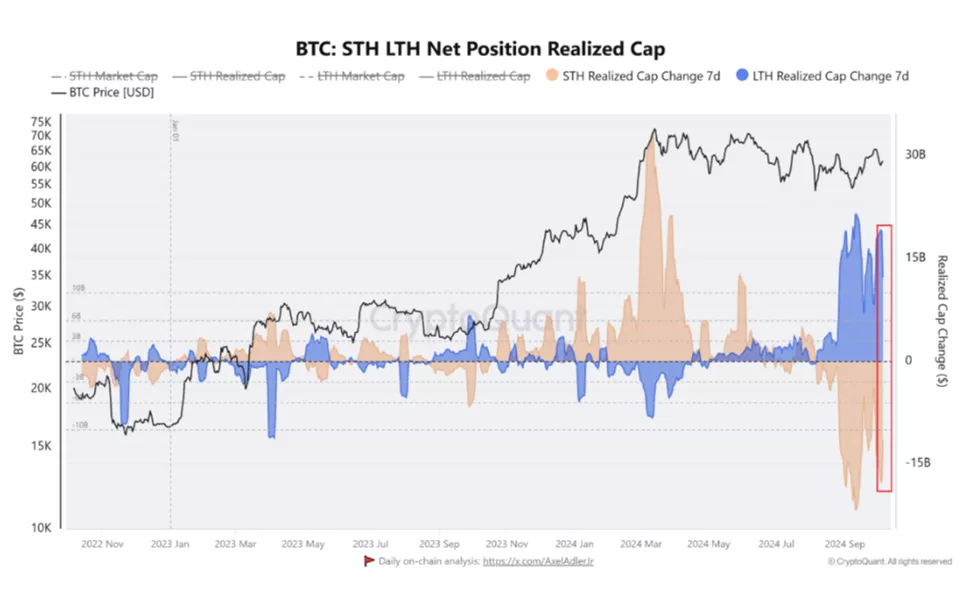

In CryptoQuant, increased participation of short-term investors in recent days was noted.

As of October 5, the realised market cap volume over the past seven days for this category of market participants increased by $6 billion. In other words, speculators (STH) are “increasing their longs,” while holders (LTH) are “taking profits,” specialists indicated.

Experts also identified prerequisites for the formation of a “golden cross” in the Coinbase premium, which serves as a signal for a short-term recovery in the leading cryptocurrency’s quotes.

Earlier, Canaccord noted that a Bitcoin rally is inevitable.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!