US Tokenized Treasury Market Predicted to Reach $2.7 Billion

- The market for tokenized US Treasury obligations is expected to reach between $2.12 billion and $3.93 billion by the end of the year.

- DAO investments could become a key driver for sector growth.

- Fidelity is considering launching a stablecoin.

The market for tokenized US Treasury obligations could reach $2.66 billion by the end of 2024, according to Cointelegraph.

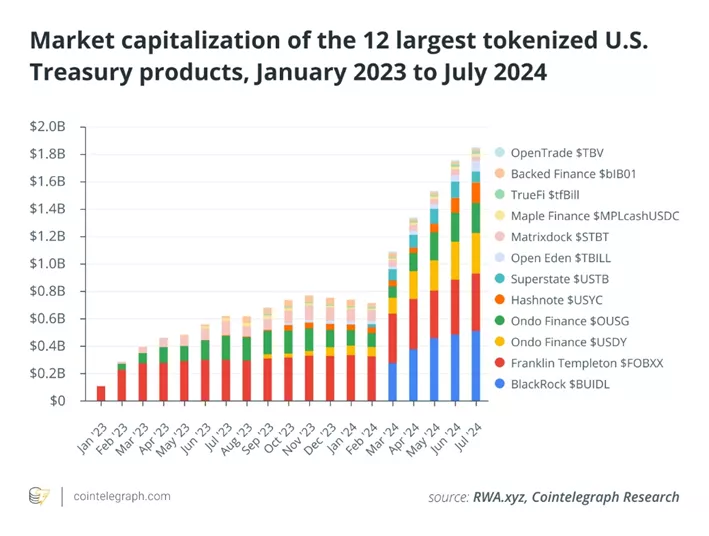

Over the 12 months from July 2023, the total capitalization of the segment increased by more than 150%, reaching $1.85 billion.

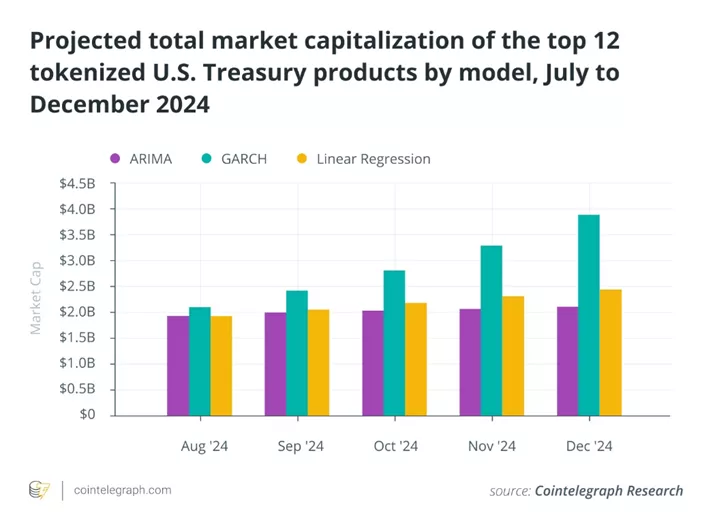

The dynamics shown above formed the basis for modeling using ARIMA, GARCH, and linear regression methods.

The first method estimated the market at $2.12 billion by year-end, the second at $3.93 billion, and the third at $2.47 billion. Researchers interpret these as bearish, bullish, and base scenarios, respectively.

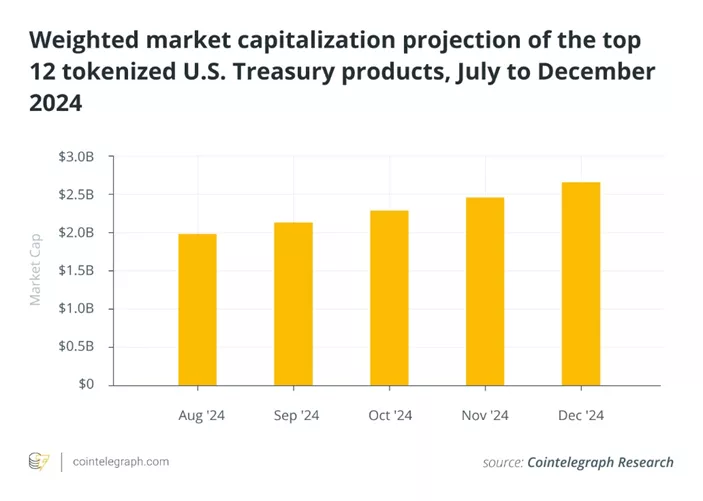

A weighted combination of the three models suggests a capitalization of $2.66 billion.

The Role of DAOs

The publication highlighted the interest of DAOs in tokenized Treasuries. Decentralized organizations Arbitrum and MakerDAO announced plans to invest approximately $25 million (~1% of the treasury) and $1 billion (~19%) respectively in such instruments.

Most DAOs lack reserves in stablecoins that can be easily converted into tokenized Treasuries. Nonetheless, some structures are now allocating funds from the treasury into RWA to ensure long-term stability, experts noted.

Researchers suggested that besides direct purchases, DAOs could establish partnerships with tokenized Treasury issuers and attempt to use their project assets as collateral.

According to DeepDAO, the total size of DAO treasuries was $24.3 billion as of July 30.

Cointelegraph reports that allocating 1% (bearish), 5% (base), and 10% (bullish) of funds into tokenized US Treasury obligations could result in an additional inflow of $243 million, $1.22 billion, and $2.43 billion, respectively. In relative terms, this would mean an increase of 13-31% from the current $1.85 billion.

The publication also noted the upcoming easing of the Fed‘s policy in September, with potential continuation in subsequent meetings.

“When the market enters conditions of lower rates but stagnant inflation, the appeal of US Treasury bonds as an investment will diminish,” experts warned.

Fidelity’s Plans

In an interview with The Block, Fidelity’s head of digital asset management, Cynthia Lo Bessette, mentioned exploring tokenization and hinted at launching new products.

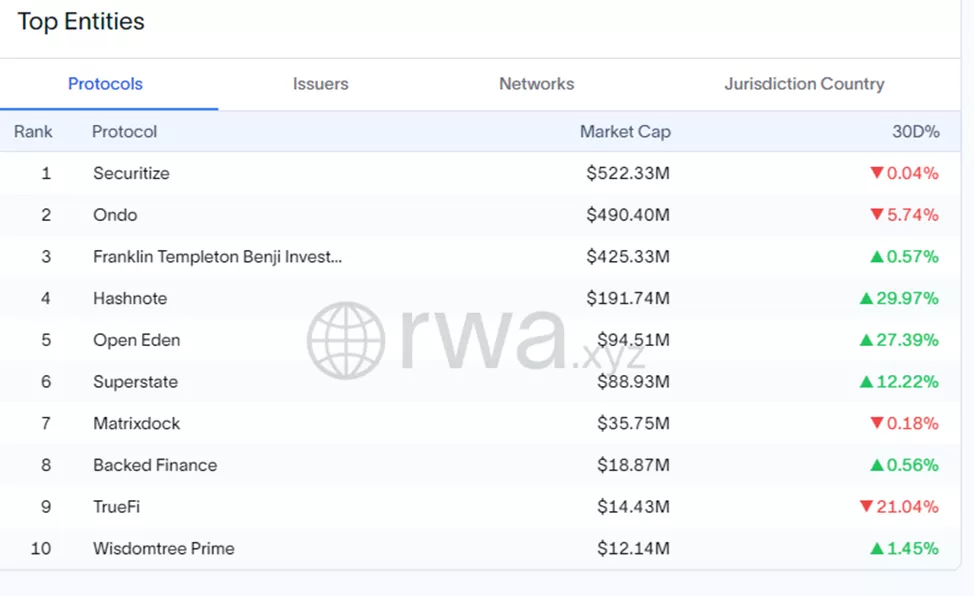

According to rwa.xyz, the company ranks third in the sector among issuers.

Lo Bessette noted that the company is surveying clients about their interest in tokenization and assessing the feasibility of transferring certain RWAs to the blockchain. She did not rule out the launch of a Fidelity stablecoin as a tool that has already proven its utility, highlighting interest in credit and structured products.

Over the past year, Fortune 100 companies have increased the number of supported blockchain initiatives by 39% to a “record level,” according to Coinbase. Corporations are focusing on RWA tokenization.

Previously, the assets under management of BlackRock USD Institutional Digital Liquidity (BUIDL) surpassed the $500 million mark.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!