Value locked in Aave’s DeFi protocol surpasses $1 billion

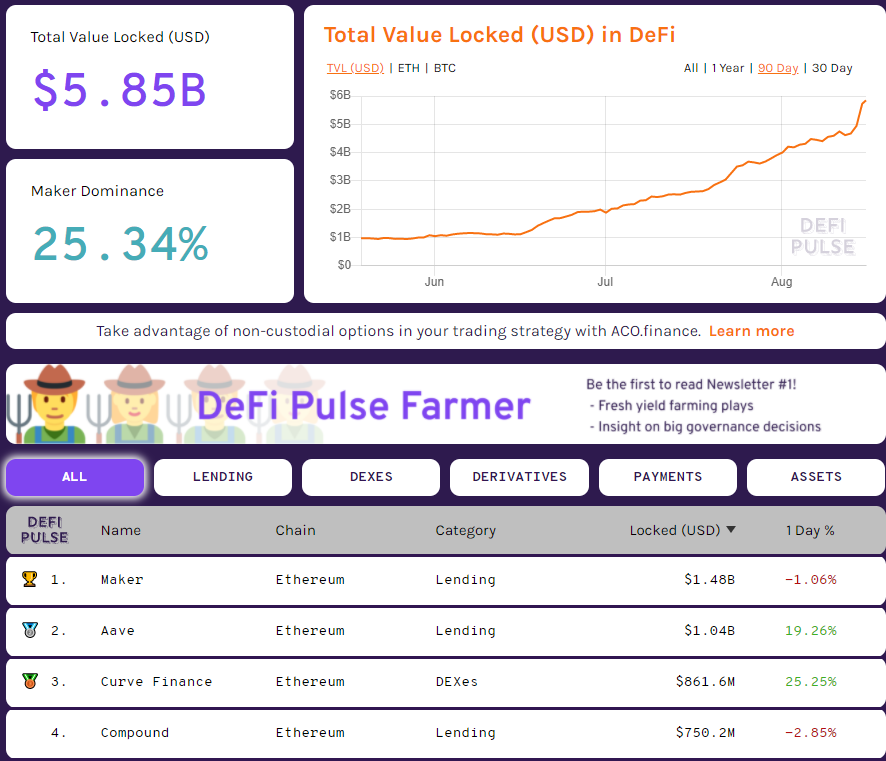

Aave’s lending protocol rose to the second spot in the DeFi Pulse ranking. The volume of funds locked on its smart contracts over a 24-hour period rose by 19.26%, surpassing $1 billion.

As shown in the screenshot below, Aave edged out the non-custodial trading platform Curve Finance and the once-leading project Compound.

Source: DeFi Pulse

The total value locked in the DeFi segment is approaching the $6 billion mark. MakerDAO still leads by a wide margin, its dominance index standing at 25.34%.

Recently, Aave unveiled the protocol’s second version with a set of new features, including native unsecured loans, delegated lending, and the tokenization of debt positions.

1/ Today we are excited to introduce the Aave Protocol v2, the new Money Market Protocol ready to push DeFi even further ! 👀👀👀https://t.co/yUHE1ShA2g

— Aave (@AaveAave) August 14, 2020

In July, Aave attracted $3 million through the sale of LEND tokens to Framework Ventures and Three Arrows Capital.

Subscribe to ForkLog news on Twitter!

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!