Vanguard Invests Over $9 Billion in Strategy Shares Despite Bitcoin Criticism

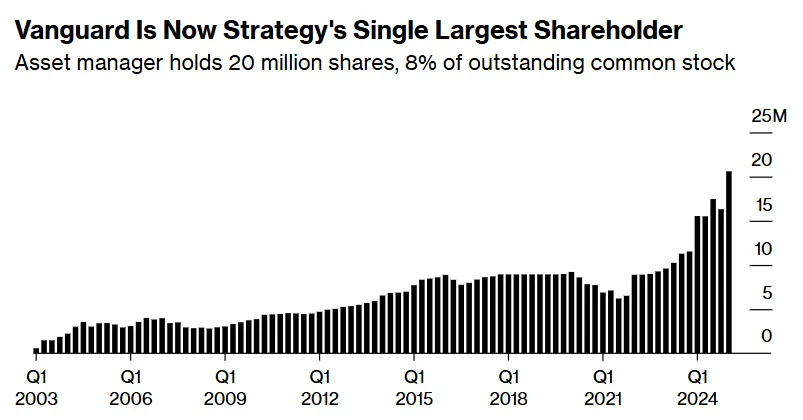

Investment firm Vanguard, which regards Bitcoin as an “immature speculative asset,” has become the largest institutional holder of Strategy shares, according to Bloomberg.

The company holds nearly an 8% stake valued at $9.26 billion, comprising over 20 million securities. The largest block of 5.7 million shares is held in the Total Stock Market Index Fund (VITSX).

Vanguard did not deliberately choose Strategy shares. The acquisition occurred automatically as the company is part of various stock indices. Vanguard’s passive funds are required to track their structure by purchasing the corresponding assets.

The firm’s management has repeatedly expressed its disapproval of cryptocurrencies, describing them as “unsuitable” for long-term investors and refusing to add spot Bitcoin ETFs to its platform.

“We do not believe this asset has a place in a portfolio,” said former Vanguard CEO Tim Buckley.

Bloomberg analyst Eric Balchunas described the situation as ironic.

“God has a sense of humor. By choosing the path of index funds, Vanguard is obliged to own all stocks, whether they like them or not,” he explained.

Strategy founder Michael Saylor views the event as a “powerful signal of growing institutional support for Bitcoin.” In his view, it reflects the acceptance of digital gold as a reserve asset by the traditional financial community.

Strategy is the largest corporate holder of the leading cryptocurrency. At the time of writing, the company holds 601,550 BTC.

Major Shareholder of the ‘Asian Strategy’

Japanese investment company Metaplanet announced that Fidelity Investments’ subsidiary, National Financial Services (NFS), has become its largest shareholder with a 12.9% stake.

According to the statement, NFS owns 84.4 million of the firm’s securities valued at approximately $820 million.

Fidelity’s brokerage division typically acts as a custodian for clients trading on the company’s platforms.

Metaplanet CEO Simon Gerovich noted that the firm’s shareholder base “continues to evolve as global access expands.” The official statement indicated that an independent data audit with Fidelity’s subsidiary has not yet been completed.

Amidst this, Metaplanet shares fell more than 7% during the Asian trading session, according to Yahoo Finance.

The investment company, dubbed the “Asian Strategy,” has raised over $1 billion this year to create a corporate Bitcoin reserve. Recently, the company increased its holdings to 16,352 BTC — worth $1.64 billion.

Earlier, the firm unveiled a “$555 million” plan to issue new shares to accumulate 1% of Bitcoin’s maximum supply. Metaplanet also plans to allocate $5 billion to its U.S. subsidiary and use reserves to acquire “profitable businesses,” including a digital bank.

Earlier, TD Cowen raised the target price for Strategy shares from $590 to $680.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!