Venture-capital investors distance themselves from Silicon Valley Bank amid liquidity concerns

Five venture-capital firms focused on digital assets urged their portfolio companies to withdraw funds from Silicon Valley Bank (SVB). The Block reports.

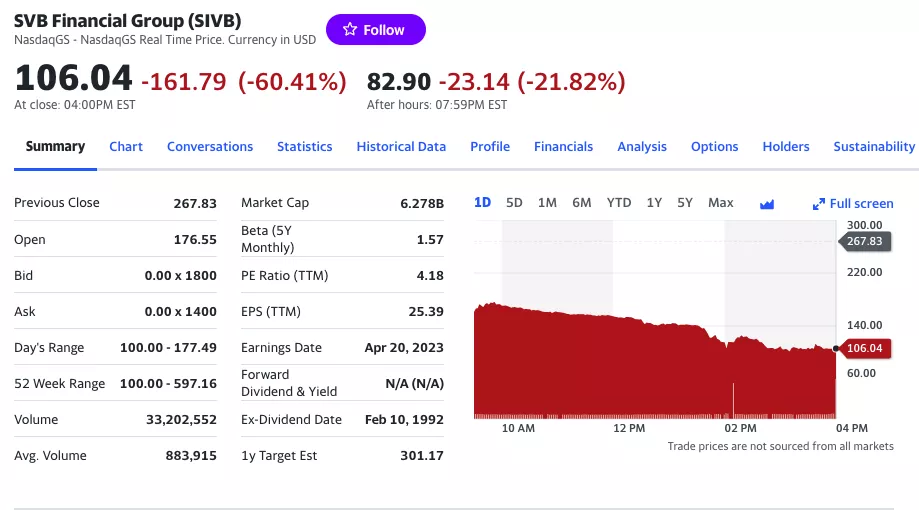

SVB shares fell more than 60% on March 9, and its market capitalisation declined by $10 billion. This followed the bank’s announcement that it would place nearly all of its securities for sale at $1.75 billion. In addition, the venture firm General Atlantic bought a stake in the bank for $500 million.

A call to withdraw funds was issued by: Mechanism Capital, Eden Block, and Pantera Capital. The other two investors are not disclosed.

SVB is the preferred bank for a wide range of technology startups in the United States. The company serves more than 2,600 fintech clients.

According to Bloomberg, the bank’s chief executive, Greg Becker, urged all sides to keep calm.

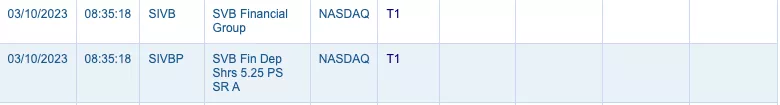

Nasdaq paused trading of SVB Financial Group shares. According to the exchange’s code descriptions, T1 denotes “awaiting significant news”.

According to Decrypt, this may involve a takeover of Silicon Valley Bank due to its inability to raise new capital.

The California Department of Financial Protection and Innovation (DFPI) closed Silicon Valley Bank and appointed the FDIC as receiver.

“As of December 31, 2022, SVB’s total assets were about $209 billion, and total deposits around $175.4 billion,” the statement said.

The causes cited were “insufficient liquidity and insolvency,” CoinDesk writes citing the DFPI’s statement. SVB depositors will have full access to their insured deposits no later than Monday morning, 13 March.

The founder of Pershing Square Capital Management, Bill Ackman, said that “the collapse of SVB could destroy an important long-term driver of the economy, as VC-backed companies rely on the bank for loans and holding their operating cash”.

The failure of @SVB_Financial could destroy an important long-term driver of the economy as VC-backed companies rely on SVB for loans and holding their operating cash. If private capital can’t provide a solution, a highly dilutive gov’t preferred bailout should be considered.

— Bill Ackman (@BillAckman) March 10, 2023

Earlier, a number of crypto companies distanced themselves from Silvergate Bank amid bankruptcy rumors.

Later, Silvergate Capital Corporation announced its plan to liquidate its subsidiary. The plan provides for full repayment of deposits.

Earlier in March, Silvergate Bank announced the cessation of operations of its own payment network SEN.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!

Related