Vitalik Buterin criticises MakerDAO’s plan to sell USDC worth $3.5 billion

Ethereum co-founder Vitalik Buterin criticized MakerDAO’s idea to rebalance the collateral backing the DAI stablecoin, which would involve selling $3.5 billion worth of USDC for ETH.

According to yEarn Finance developer known as banteg, the issuer of DAI is considering buying ETH on the market by converting all USDC from the peg stability module (PSM).

MakerDAO is considering a $3.5 billion ETH market buy, converting all USDC from the peg stability module into ETH.

— banteg (@bantg) August 11, 2022

Earlier, in compliance with sanctions, Circle blacklisted USDC addresses of 38 wallets Tornado Cash. One of the stablecoin operators blocked transfers of at least 75,000 USDC.

Against these events, the DeFi project MakerDAO began developing a contingency plan in case the protocol’s core smart contracts come under government sanctions, according to The Defiant. The outlet noted that plans to reduce dependence on USDC are being considered by other DeFi projects as well.

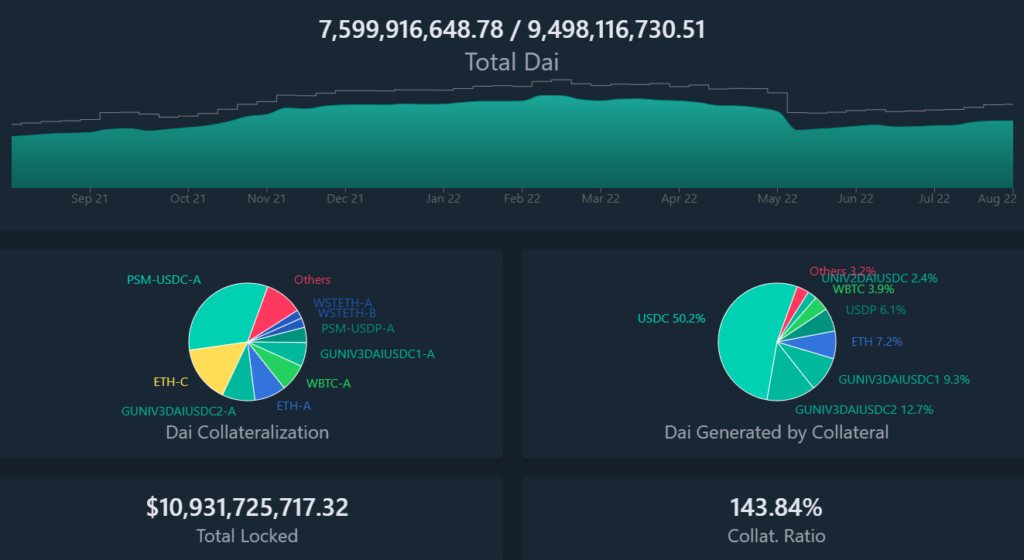

The diagram below shows the collateral structure backing DAI.

In response to banteg’s tweet, Vitalik Buterin called MakerDAO’s plan a terrible idea.

Errr this seems like a risky and terrible idea. If ETH drops a lot, value of collateral would go way down but CDPs would not get liquidated, so the whole system would risk becoming a fractional reserve.

— vitalik.eth (@VitalikButerin) August 11, 2022

“If Ethereum price collapses, the value of collateral would fall sharply, but CDP would not be liquidated. Therefore the entire system risks becoming a fractional reserve,” commented the Ethereum co-founder.

In his view, no collateral type other than Ethereum should exceed 20% of the total amount, as reported in Vitalik Buterin’s tweet.

MakerDAO leads DeFi Llama’s ranking with a TVL of $9.06 billion.

Earlier, Tornado Cash blocked Tornado Cash user accounts by the decentralized derivatives exchange dYdX.

Read ForkLog’s Bitcoin news in our Telegram — cryptocurrency news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!