Vitalik Buterin: Ethereum is overcoming the scaling trilemma

Buterin says zkEVMs and PeerDAS push Ethereum past the scaling trilemma.

The network of the second-largest cryptocurrency is successfully overcoming the blockchain trilemma thanks to advances in zkEVM and the launch of PeerDAS, according to Ethereum co-founder Vitalik Buterin.

Now that ZKEVMs are at alpha stage (production-quality performance, remaining work is safety) and PeerDAS is live on mainnet, it’s time to talk more about what this combination means for Ethereum.

These are not minor improvements; they are shifting Ethereum into being a…

— vitalik.eth (@VitalikButerin) January 3, 2026

He expects the first nodes of a new type to appear as early as 2026, alongside higher gas limits. Between 2027 and 2030, zkEVM should become “the main validation standard”.

The long-term aim remains a shift to distributed block production — reducing centralisation risks and creating a level playing field for participants from any region.

“Now that Ethereum has PeerDAS and zkEVM solutions (small parts of the network are expected to use them in 2026), we get: decentralised consensus and high throughput,” — Buterin said.

In his view, the blockchain trilemma is effectively solved, as the required technologies already run on mainnet or “have reached production-level performance; only their safety remains.”

PeerDAS (Peer Data Availability Sampling) is a data-availability sampling technique that became a key component of the recent Fusaka upgrade. The protocol reduces node load and boosts the blockchain’s overall performance.

Record on-chain metrics

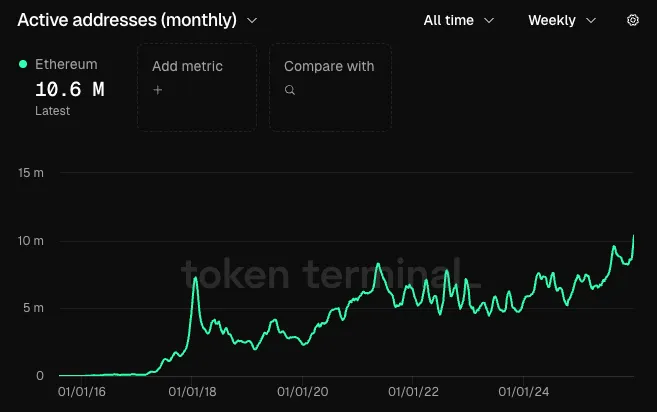

Ethereum’s network activity remains elevated. Alongside record transaction demand, the number of active addresses is rising:

On-chain transfers in stablecoins set a new record in the fourth quarter, topping $8 trillion.

According to Blockworks, in 2025 the supply of stablecoins on Ethereum grew by roughly 43% — from $127 billion to $181 billion.

X user BMNR Bullz noted that this trend reflects real asset use rather than speculation.

“These are global on-chain payments […]. The infrastructure is already in place, adoption is accelerating,” — he added.

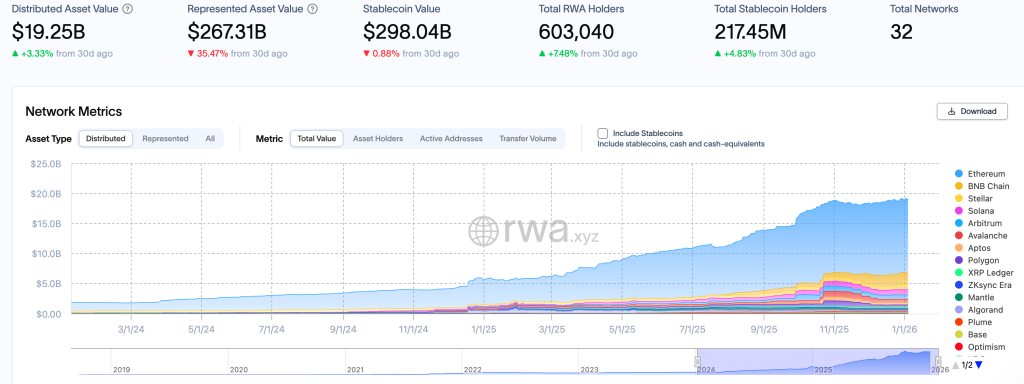

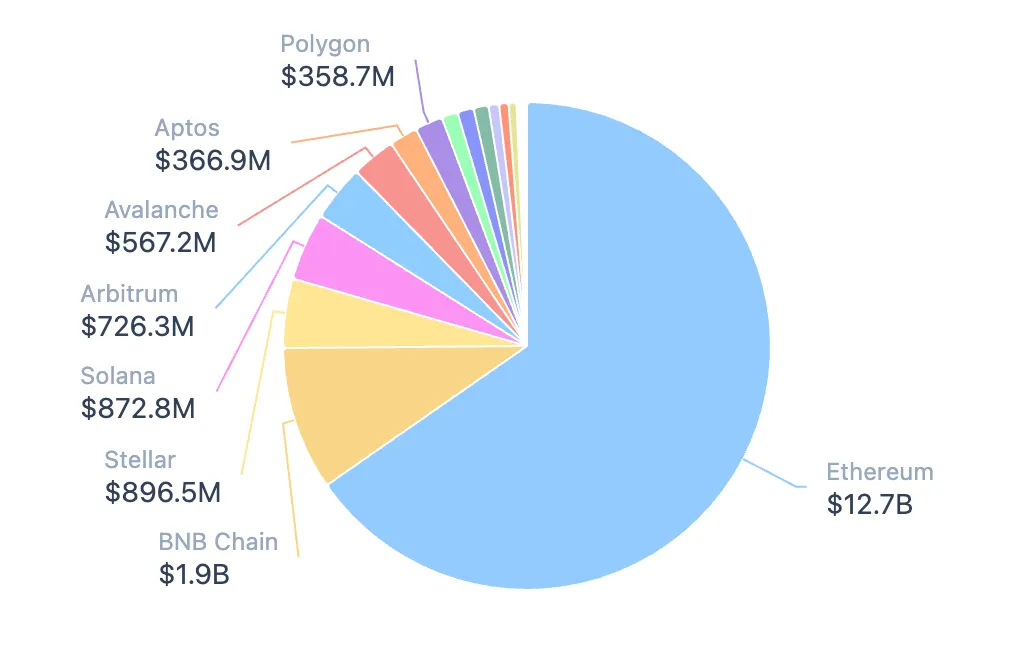

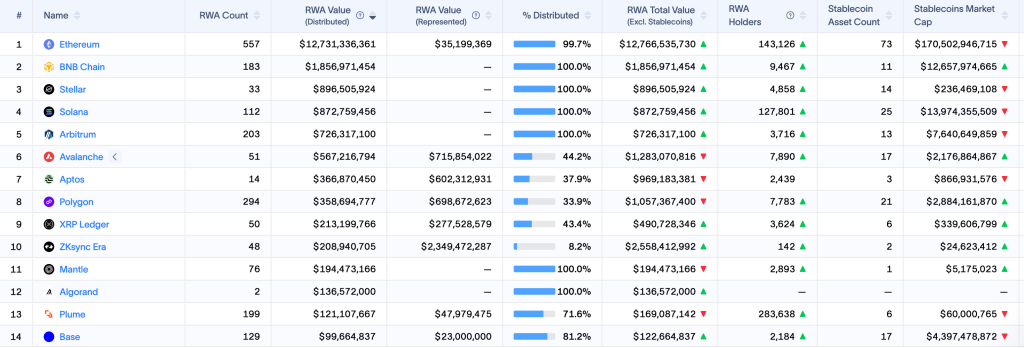

King of tokenisation

Ethereum leads activity in tokenising real-world assets (RWA). The platform’s share of the segment, worth over $19 billion, is about 65%.

Stablecoins worth $170 billion have been issued on the Ethereum network. TRON ranks second with $81 billion, and Solana third with $14 billion.

At the time of writing, Ethereum trades around $3160. Over the past seven days the asset has risen by 4.8%, according to CoinGecko.

Earlier, for the first time since July, the queue to stake ether was larger than the queue to withdraw.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!