Vitalik Buterin Praises Base’s Achievements in L2 Solutions

Vitalik Buterin praised Base's approach to decentralization amid sequencer debates.

Ethereum co-founder Vitalik Buterin has commended the approach of the developers behind the layer-two solution Base for their focus on decentralization amidst discussions about the shortcomings of sequencers and comparisons of such platforms with CEX.

Base is doing things the right way: an L2 on top of Ethereum, that uses its centralized features to provide stronger UX features, while still being tied into Ethereum’s decentralized base layer for security.

Base does not have custody over your funds, they cannot steal funds or… https://t.co/0EMdThg4gU

— vitalik.eth (@VitalikButerin) September 22, 2025

“Base is doing everything right: it is an L2 on top of Ethereum, using centralized features to enhance user experience while remaining connected to the decentralized base layer for security,” the expert noted.

He added that the Coinbase-supported solution does not control users’ funds:

“…they cannot steal assets or block withdrawals.”

According to him, quality layer-two solutions are non-custodial.

“These are extensions of Ethereum, not just servers with a hash-sending function,” Vitalik emphasized.

Are L2s Not So Bad?

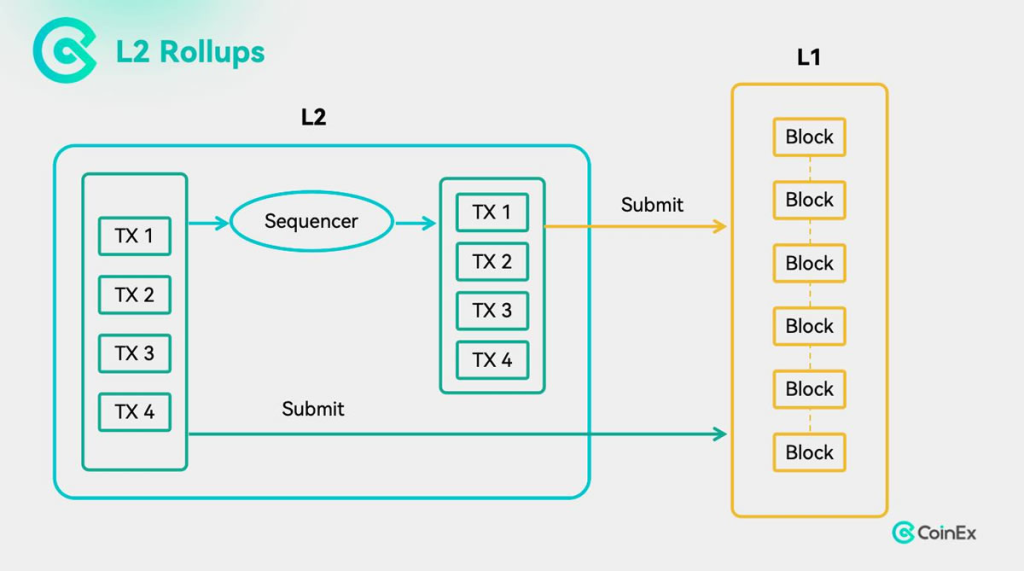

Buterin’s comments came amid criticism of the “second layer” of the crypto ecosystem. Many L2s use a centralized transaction ordering mechanism to reduce fees and prevent front-running by bots.

The topic was highlighted by recent remarks from SEC Commissioner SEC Hester Peirce. She noted that such mechanisms could raise regulatory questions—especially if they resemble the operations of centralized exchanges.

“If you have a transaction matching mechanism that is effectively controlled by a single entity managing all its elements, then it is much more like an exchange, and we will have to consider this fact,” emphasized the “crypto mom.”

However, she stressed that if the matched assets are not securities, “then we generally have nothing to add.”

It’s Different

Coinbase’s Chief Legal Officer Paul Grewal noted that equating L2 sequencers with centralized exchanges distorts their purpose and functions.

According to him, the SEC views an “exchange” as a platform for bringing together buyers and sellers of securities. Meanwhile, layer-two solutions are “general-purpose blockchains that function as infrastructure.”

Such networks process messages in the form of code, invoke smart contracts, and form transaction bundles—be they payments, calls, or messages.

He compared L2s like Base to Amazon Web Services (AWS): both platforms run developer-written code, including trading applications. However, this does not make the infrastructure itself an exchange.

“If an exchange operates on AWS, does that mean AWS is an exchange? Obviously not,” Grewal noted.

Base co-founder Jesse Pollak also commented on the specifics of sequencer operations. According to him, users can conduct transactions both through Base and directly on the Ethereum network, maintaining decentralization and censorship resistance.

“It’s like a traffic regulator ensuring a smooth flow on a priority lane that allows vehicles to reach their destination faster,” the expert explained.

He emphasized that sequencers are not “transaction matching mechanisms” like those used on traditional exchanges.

“Matching engines match buy and sell orders at specified prices for trade execution. Sequencers do not do this—they merely determine the order of transaction processing,” Pollak added.

If layer-two solutions were considered exchanges, they would have to register with the SEC as trading platforms, meet a range of regulatory requirements, and operate under restrictions. Therefore, many industry participants oppose such classification.

In August, Base surpassed Solana in the number of tokens created per day.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!