Vitalik Buterin Proposes Solutions for Ethereum Staking Economy Challenges

Ethereum co-founder Vitalik Buterin, in the third part of his essay on the “potential future” of the network, examined the risks of centralization in the Proof-of-Stake mechanism due to economic pressures and proposed solutions.

Possible futures of the Ethereum protocol, part 3: The Scourgehttps://t.co/mtzH1ZxTak

(I tried my best to be fair to all sides of the debates here!)

— vitalik.eth (@VitalikButerin) October 20, 2024

In his view, the existing economies of scale in Ethereum naturally lead to the dominance of large stakers. This increases the likelihood of a 51% attack, transaction censorship, and “other crises.”

Moreover, through MEV, a small group can capture value that should belong to all users, Buterin noted.

There are two areas of risk concentration:

- the block-building process;

- the provision of capital for staking.

“Large participants can afford to run more sophisticated generation algorithms, increasing their income. They also handle the inconveniences of locked funds more efficiently by releasing them as LST,” the programmer emphasized.

Improving the Block “Conveyor”

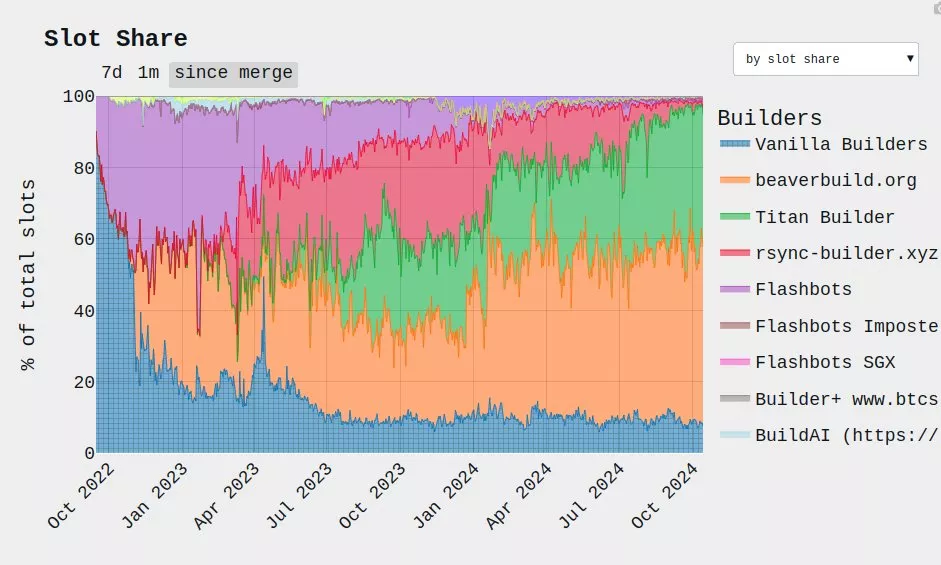

Most Ethereum blocks today are created through off-protocol proposer-builder separation using the MEVBoost solution. Various variations of this process maintain a decentralized set of validators, but concentration among “specialized participants” is observed, Buterin pointed out.

Since early October, two major entities have determined the content for approximately 88% of blocks, he noted.

In his opinion, this does not pose risks of a 51% attack or transaction censorship (100% control is needed). However, theoretically, a user’s operation can be delayed by two to five minutes, which in some cases (such as DeFi liquidations) allows for market manipulation.

Among other negative consequences of block creators’ strategies to maximize income, Buterin listed:

- user losses on token swaps due to “sandwich attacks”;

- network congestion with such operations and increased gas prices for everyone.

The Ethereum co-founder sees the solution in further segregation of block production tasks. This is ensured by the existing concept of “inclusion lists” with various variations like auction mechanisms or parallel proposers.

Encrypted mempools, where the block builder does not see the transaction content until later, could be an addition.

Buterin aims to transfer more authority to stakers and further decentralize their activities.

Fixing the Staking Economy

Currently, about 30% of Ethereum’s market supply is locked. Buterin believes that further growth of this share to maximum levels poses several risks, including:

- turning staking from a process of earning additional income into an obligation for all cryptocurrency holders;

- weakening trust in the slashing mechanism — penalties for dishonest behavior;

- the flow of Ethereum’s “monetary” network effect into one LS protocol;

- additional issuance of approximately ~1 billion ETH per year, which will mostly go into liquid staking.

The expert considers it possible to mitigate these problems by limiting penalties. For example, imposing them on ⅛ of the locked funds. Another option is a two-tier staking scheme, where anyone can participate without risking sanctions.

“The main counterargument here is that we still need to provide the “risk-free level” with some useful role and a certain level of risk,” Buterin pointed out the contradiction.

He identified another important topic in the staking economy as the “capture” of MEV. Currently, the income from operations is received by block proposer delegates. Buterin emphasized that the existence of this revenue stream is “extremely inconvenient” for the protocol because:

- it has an unstable nature, difficult to assess (on average, a staker can receive it once every four months) and provokes centralization (joining large pools);

- it shifts the balance of incentives in favor of block proposals over confirmations;

- it complicates the management of staking yield.

“We can solve these problems by finding a way to make MEV income understandable for the protocol and capture it,” the Ethereum co-founder expressed confidence.

This closely intersects with the support of solo staking, he noted. Currently, the cheapest cloud solution for running a node costs about $60 per month. With a minimum lock of 32 ETH, this reduces annual yield by approximately 0.85%.

Buterin wrote about ways to encourage individual staking, including drastically reducing the deposit size and optimizing equipment requirements, in the first part of his essay.

At the Shanghai Blockchain Week 2024, he identified the lack of a unified ecosystem as Ethereum’s most pressing issue.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!