Week in review: Bankman-Fried released on bail; Bitcoin legalised in Brazil

The founder of FTX, Sam Bankman-Fried, was released on $250 million bail; Paxful CEO Ray Youssef criticised Ethereum; Bitcoin was recognised as a payment method in Brazil; and other events from the past week.

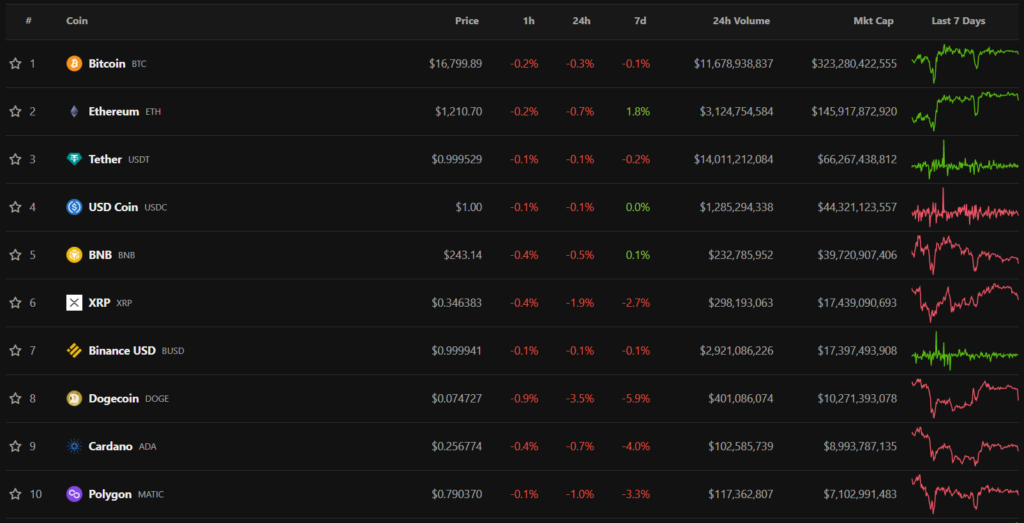

Bitcoin fails to clear the $17,000 level

Over the past week, the price of the leading cryptocurrency moved in a relatively narrow range below $17,000, testing the psychological level a few times. At the time of writing, the asset was trading near $16,800.

For the week, almost all top-10 cryptocurrencies by market cap were in the red. The worst performer was the meme cryptocurrency Dogecoin, down 5.9%. Ethereum performed best, with prices rising 1.8%.

The aggregate market capitalisation of cryptocurrencies stood at $841 billion. Bitcoin’s dominance index rose to 38.4%.

Ex-CEO of Alameda Research and co-founder of FTX plead guilty and agreed to cooperate with investigators

Former Alameda Research head Caroline Ellison and FTX co-founder Gary Wang pleaded guilty to charges by the US Department of Justice related to the collapse of Sam Bankman-Fried’s business empire, and agreed to cooperate with investigators.

The Securities and Exchange Commission (SEC) separately charged Ellison and Wang. The Commodity Futures Trading Commission (CFTC) did the same. The regulators accuse them of fraud and deceiving investors.

According to the SEC complaint, the former head of Alameda Research engaged in “automated purchasing” of the utility token FTT on various platforms to inflate the asset’s price. The Commission described the token as an “illiquid crypto security” .

Under the plea agreement Ellison will hand over all proceeds obtained from the offenses to the authorities. In exchange for cooperating with government authorities she will not be prosecuted in the ongoing criminal case.

Ellison has already told the court that, together with Bankman-Fried, she deliberately misled creditors about the amount of the loan extended to FTX.

The agreement does not include ‘criminal tax violations’ related to Ellison’s participation in a scheme to commit fraud and deceive clients of FTX and Alameda from November 2009 to November 2022.

The agreement does not shield her from investigations into crimes classified as securities and commodities fraud, as well as conspiracy to launder money.

Meanwhile, Bankman-Fried extradited to the United States and released on $250 million bail. Federal prosecutors described this amount as the highest ever for pre-trial hearings.

The agreement did not require an actual cash payment; it served as a personal guarantee. The founder is obliged to appear in court as needed, and his release is secured by real estate—his parents’ home in Palo Alto (Santa Clara County, California).

Boris Johnson’s brother leaves Binance amid crypto-market crisis

Former universities and science minister Joseph Johnson has resigned from the post of adviser to Binance-backed payments company Bifinity.

According to The Telegraph, the move was prompted by growing pressure over Binance’s financial transparency and the intensifying crisis in the crypto sector. He confirmed the resignation to the outlet.

At the same time, Binance has emerged as one of the main beneficiaries of the FTX collapse. The company significantly strengthened its position—with the share of the platform among those that only support crypto-asset trading rising from 82.7% to 87%.

This week, Changpeng Zhao announced that his company increased its investment in the regulated Indonesian crypto exchange Tokocrypto.

Vitalik Buterin names three key paths for cryptocurrency adoption

Mass adoption of non-custodial wallets, inflation-resistant stablecoins, and account-based websites running on Ethereum technology represent “huge” opportunities yet to be realised, stated by Ethereum co-founder Vitalik Buterin.

He acknowledged that the market is entering a more mature stage and competition is intensifying, making the opportunity to close such gaps less obvious.

Earlier this week, Buterin criticised Elon Musk for his approach to content moderation on Twitter.

“Acting quickly and decisively in response to catalysts when it comes to bans is a path to authoritarianism,” he wrote in a discussion on censorship on the social network.

On 19 December, Musk ran a poll on whether he should step down as CEO of Twitter. A majority of users voted for the billionaire’s resignation.

Paxful CEO criticises Ethereum and announces delisting of the asset

In a customer email, Paxful CEO Ray Youssef informed clients that on 22 December the platform would delist Ethereum.

Among the reasons, he cited the blockchain’s shift to Proof-of-Stake, a perceived lack of decentralisation and governance by a small group, and the presence of fraudulent projects within the ecosystem.

What to discuss with friends?

- Bitcoin moves linked to the bankrupt QuadrigaCX exchange.

- Mass account hacks reported on Telegram.

- The bear market figure criticised Bitcoin exchange audits.

- Huobi announced the launch of a Visa debit card.

Vinnik seeks US bail release

The Russian national Alexander Vinnik, accused of laundering at least $4 billion through the BTC-e exchange, has petitioned a U.S. court for release on bail amid the pace of the case.

Attorneys for the defendant said that Vinnik has been detained for several months, but the court’s required documents have not yet been provided. Within 60 days they hope to obtain case-related documents for review.

Bitcoin recognised as a payment instrument in Brazil

In Brazil, Bitcoin will be usable both as a payment instrument and an investment asset. The law establishing this status was signed by President Jair Bolsonaro.

The head of state approved the Congress-proposed document without changes. It will take effect 180 days after signing. The law characterises Bitcoin as a digital representation of value.

Waves CEO announces the launch of a new stablecoin

CEO and founder of Waves Platform, Sasha Ivanov stated plans to launch a new stablecoin, prompting a flood of negative comments on Twitter.

Ivanov wrote that he would not disclose further details about the asset until the USDN unpeg issue is resolved. He further explained that the release of the new coin is necessary to create a protocol better suited to current market conditions.

In the comments, users criticised the launch of the new coin.

On 22 December, the Waves team presented a plan for “priority” recapitalisation of USDN. The developers proposed:

- Include in collateral the ecosystem-product tokens of Waves (WX, VIRES, SWOP, EGG and WEST) worth $15 million. These assets would be donated by the projects themselves;

- Restart USDN swaps;

- Offer SURF and NSBT holders the opportunity to earn additional income from arbitrage of ecosystem tokens;

- Restore unconditional withdrawal of assets for users who contributed USDN to the Vires.Finance protocol.

Ivanov also stated that in Q2 2023 the platform will launch a new stablecoin with a hard peg and an adaptive overcollateralisation architecture. He emphasised that the asset will have no relation to USDN.

Also on ForkLog:

- Bobby Lee forecasted the continuation of the bear market over the next two years.

- Bitcoin mining difficulty rose by 3.27%.

- Peter Schiff named the reason for MicroStrategy’s investments in digital gold.

- In Ukraine, free cryptocurrency literacy training will begin .

What else to read?

Traditional digests cover the week’s main events in cybersecurity and artificial intelligence and .

The cryptocurrency industry is drawing more institutional players. That is reflected in new investments in infrastructure and increasing attention companies are giving to Bitcoin as an asset class. The most important events of the past weeks are in the ForkLog review.

Follow ForkLog’s Bitcoin news in our Telegram — cryptocurrency news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!