Week in Review: Bitcoin holds above $29,000 as Binance announces launch of a local exchange in Kazakhstan

Bitcoin prices held above $29,000, Binance announced the launch of a local arm in Kazakhstan, Bybit said it would introduce mandatory user verification, and other events from the week just past.

Bitcoin holds above $29,000

On Wednesday, April 26, Bitcoin briefly broke through the $29,000 level and at one point rose above $30,000, but could not sustain above it — a correction below $27,500 followed.

However, by Thursday the price had recovered. At the time of writing, Bitcoin was trading near $29,800. Over the past 24 hours, prices were up by almost 2%.

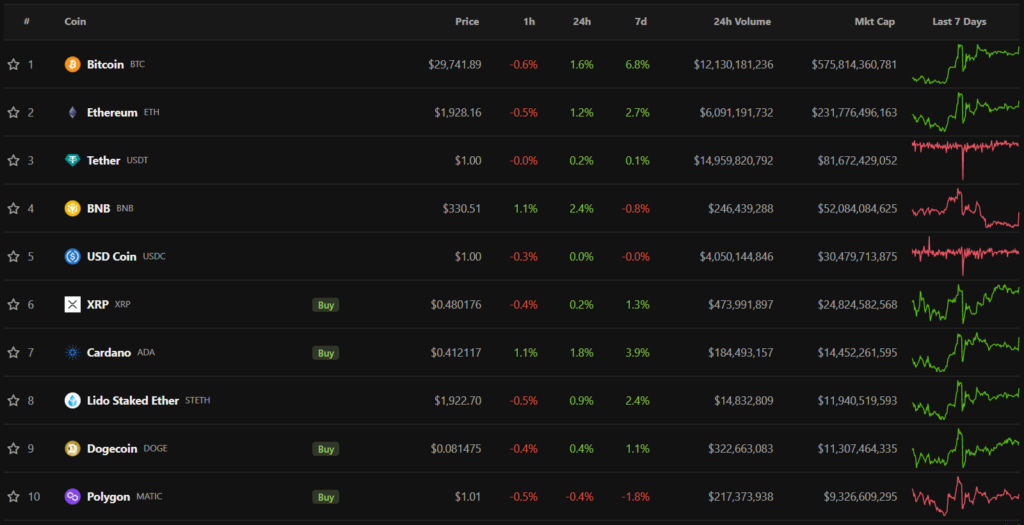

By week’s end, nearly all top-10 cryptocurrencies by market cap were in the green. Bitcoin led the gains — prices were up almost 7%.

The aggregate market capitalization of the crypto market rose to ~$1.27 trillion. Bitcoin’s dominance index climbed to 45.4%.

Bybit tightens KYC requirements

On May 8, the Bybit exchange will introduce mandatory verification for all users on the platform. The KYC level must be no lower than Level 1. Otherwise clients will lose access to the exchange’s products and services.

In a ForkLog interview, a company spokesperson said the changes are being introduced to improve security. The measure will not only help meet regulatory requirements but also provide an additional layer of protection against fraudsters.

Binance comments on crypto-card blocks for Russians in the EEA and announces a Bitcoin exchange in Kazakhstan

Several media outlets, citing users of the Binance exchange, reported that the platform allegedly began blocking crypto cards for Russians. According to the circulating information, this affected clients who passed verification with a Russian passport and obtained a physical card on the basis of a residence permit in the European Economic Area.

In a comment to ForkLog, Binance representatives said that at present no restrictions have been introduced on the use of crypto cards for users with valid residence permits in the EEA.

Regional director Vladimir Smerkis said that by mid-2023 Binance plans to launch a local office in Kazakhstan. The platform will offer exchange and conversion services, fiat on/off ramps, custody of crypto assets and exchange trading.

In June this year the company will also launch a Japanese subsidiary — based on the previously acquired Sakura Exchange BitCoin.

Changan Zhao took third place in Bloomberg’s ranking of the “25 Financial Titans.” According to the publication, the annual revenue of the largest crypto exchange exceeds $12 billion, and its market value was estimated at $28.2 billion.

Mr Zhao said that “all the figures are wrong” and he “doesn’t have even close to that amount.”

Assessment: StarkNet roadmap lays groundwork for a 2024 airdrop

The StarkWare-led push to develop L2 solutions presented a StarkNet roadmap focusing on performance and user experience in 2023 and on decentralisation of operations and governance in 2024. Journalist Colin Wu saw in the document signs of preparations for a potential utility token and an airdrop.

LayerZero announces integration with Polygon’s zkEVM. Polygon developers launch a zkEVM bridge

Omnichain protocol LayerZero announced an integration with zkEVM for Ethereum scaling.

Polygon Labs launched a cross-chain bridge linking Polygon and zkEVM. It is built on zero-knowledge proofs. Transfers to Ethereum may take 30–60 minutes.

TVL in liquid staking protocols nears $18 billion

The total TVL in liquid staking protocols reached a level of $17.81 billion, marking the first time it surpassed the DEX metric, according to DeFi Llama. Liquidity in Lido, Rocket Pool and Frax Ether rose by 10.54%, 25.13% and 36.45% respectively over the past month, indicating growing interest in the segment following the Ethereum Shapella hard fork activation.

What to discuss with friends?

- A participant in an Ethereum ICO moved coins for the first time in almost eight years, and a Bitcoin whale distributed 400 BTC after 12 years of “sleep.”

- Dogecoin co-founder compared cryptocurrency enthusiasm to an obsession.

- An expert discovered an address that created 114 “fraudulent” meme tokens.

- A Bitcoin enthusiast picked a seed phrase from famous words in half an hour.

SМI report on raid at former FTX executive’s home

The FBI allegedly conducted a search at the home of former FTX chief executive and Bahamian unit CEO Ryan Salame.

According to The New York Times, the residence is in Potomac, Maryland. The official reason for the investigation was not disclosed. However, sources noted Salame had been under close scrutiny by law enforcement due to a $24 million contribution to Republican causes.

It also emerged that US authorities will install a tracker on the phone of Sam Bankman-Fried.

Brian Armstrong impressed by Gary Gensler’s old remark

In 2018, then-SEC chair Gary Gensler named three-quarters of the crypto market “not securities.” Coinbase CEO Brian Armstrong commented on the old clip with a single word — “wow.”

The official stated that, under the law, cryptocurrencies are investment contracts, and those offering them must register with the SEC.

Uniswap unveils solutions to reduce protocol costs

The Uniswap team developed a new mechanism called Permit2, enabling smart contracts to move tokens on behalf of users.

Permit2 will allow network participants to set their own permissions and approve token transfers with a single signature. The development also substantially reduces gas fees.

Avalanche developers implement Cortina hard fork

On April 25 the Avalanche team activated the Cortina hard fork on the project’s mainnet.

The update included migrating one of the three main blockchains—X-Chain—onto the Snowman++ consensus mechanism. This enables the Avalanche Warp Messaging service, supports more complex transactions and broadens exchange support.

South Korea charges Terraform Labs co-founder

South Korea’s prosecutors filed charges against Terraform Labs co-founder Daniel Shin and nine other employees, including for fraud and violations of the Capital Markets Act.

Authorities say the defendants knew that the price-stabilisation mechanism for the algorithmic stablecoin TerraUSD (UST) using the LUNA token did not work.

Meanwhile, Terraform Labs chief Do Kwon’s lawyers sent a request to the US courts asking to nullify the charges brought by the SEC. They argued the regulator could not prove jurisdiction in the United States; the products cited were “available to the whole world and intended not only for Americans.”

In the appeal it is also stated that UST does not fall under the regulator’s jurisdiction as it is a currency, not a security.

Circle launches cross-chain USDC transfers between Ethereum and Avalanche

Circle, co‑emitter of USD Coin (USDC), launched the mainnet version of the CCTP protocol for moving the stablecoin between blockchains. Initially implemented for Ethereum and Avalanche.

When a CCTP transfer is requested, it burns the user‑specified amount of USDC on the source chain and mints an equivalent amount of tokens for the destination chain.

Hong Kong to publish new crypto exchange licensing rules

The Hong Kong Securities and Futures Commission will publish licensing guidelines for platforms trading digital assets, the regulator head Julia Leung said in May.

Also on ForkLog:

- Gemini will launch a crypto derivatives platform outside the United States.

- Arbitrum initiated a token distribution among the DAO.

- Ray Dalio said holders of Bitcoin should be prepared for its fall by 80%.

- In Uzbekistan, the first NFT issuer was registered.

What else to read?

On 13 April, in Tokyo, the DAO Tokyo conference discussed topics related to the technology underpinning decentralized autonomous organizations.

Web3 journalist Tamara Soykina prepared a report from the event for ForkLog.

Experts from the law firm DRC told ForkLog whether buying a non-fungible token can be considered an investment.

In traditional digests, ForkLog highlighted the week’s key events in cybersecurity and and artificial intelligence.

At the end of April, ForkLog produced its customary calendar of important events for the coming month.

The cryptocurrency industry is drawing an increasing number of institutional players. This is evident from new investments in infrastructure and from the growing attention companies devote to Bitcoin as an asset class. The most notable recent events are captured in ForkLog’s overview.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!