Week in review: Bitcoin price tops $55,000 as Volodymyr Zelensky vetoes the virtual-asset law

Bitcoin price surpassed the $55,000 mark, Vitalik Buterin called the legalization of digital gold in El Salvador “foolhardy”, Volodymyr Zelensky vetoed the virtual-asset law and other events of the past week.

Bitcoin price tested the $56,000 level

On Wednesday, October 6, the price of the leading cryptocurrency reached $55,000, and by Friday tested the $56,000 level. On October 10 the situation repeated itself, but the prices could not sustain above this threshold.

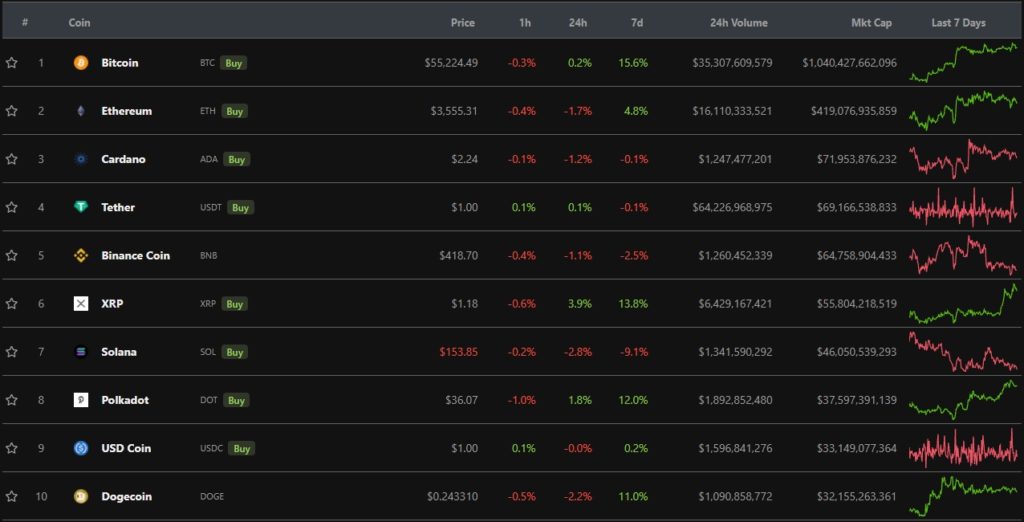

Over the week Bitcoin rose by 15.6%. At the time of writing the asset was trading near $55,200.

According to analysts at JPMorgan, the local rally in Bitcoin this week was aided by institutional interest, the growing use of the Lightning Network for micropayments, and assurances by U.S. authorities that they have no intention of banning cryptocurrencies.

For the week, most of the top-10 assets by market cap were in the green. The exceptions were Solana (-9.1%), Binance Coin (-2.5%) and Cardano (-0.1%). The XRP token rose almost 14%, Polkadot — 12%.

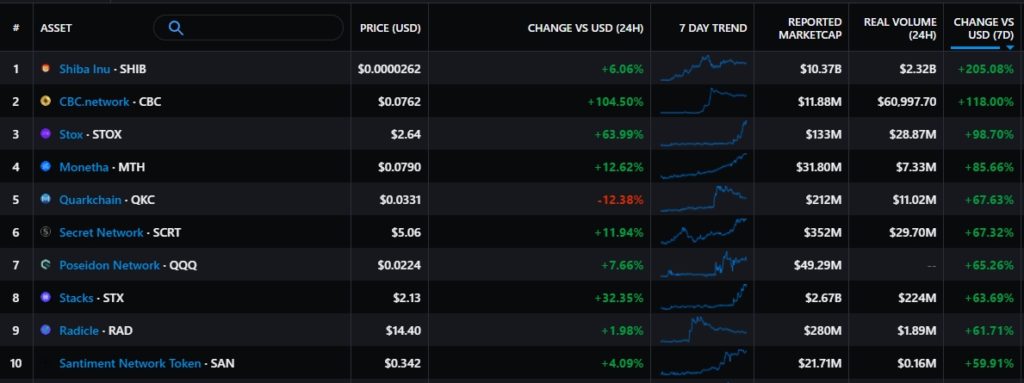

According to Messari, among digital assets over the past week the biggest gainer was the cryptocurrency Shiba Inu. Its price rose by more than 200%, and its market cap surpassed $10 billion.

The biggest drop was the Ethereum 2.0 staking service CDT. Its price fell by nearly 19%, and its market cap dropped to $94.6 million.

The market capitalisation of the crypto market stood at $2.4 trillion. Bitcoin’s dominance index rose to 43.2%.

Zelensky vetoed the virtual-asset law

President Volodymyr Zelensky sent back the draft law “On Virtual Assets” to the Verkhovna Rada for reconsideration with his proposals.

The head of state proposed to attribute regulation of the virtual-asset market to the remit of the National Securities and Stock Market Commission (NSSMC). Some lawyers say this would meet the requirements of the EU regulation.

In the vetoed version the main regulators were the Ministry of Digital Transformation and a specially created service, while NSSMC was tasked only with virtual assets backed by financial instruments. Zelensky proposed excluding the Ministry of Digital Transformation from the process entirely.

The Ministry of Digital Transformation declined to comment, while the NSSMC backed the changes.

Edward Snowden called CBDCs “an evil twin” of Bitcoin

Central bank digital currencies (CBDCs) are “the latest danger hanging over society.” According to former National Security Agency (NSA) and Central Intelligence Agency (CIA) employee Edward Snowden, these tools “distort” the very nature of cryptocurrencies.

He says CBDCs are “clearly intended to strip users of ownership of their money.” He notes that their rollout is not tied to government support for cryptocurrencies or digitalisation of finance, as “most dollars are already digital.”

SEC approved ETF based on Bitcoin companies and pledged not to ban cryptocurrencies

The U.S. Securities and Exchange Commission approved Volt Equity’s application to launch an exchange-traded fund (ETF) based on a basket of companies, “driving a revolution in the Bitcoin industry”.

The ETF will include around 30 companies, including Tesla, Twitter, Square, Coinbase and PayPal.

The SEC also stressed that they do not intend to ban cryptocurrencies, as that is a prerogative of Congress. The agency’s chair, Gary Gensler, said the objective is to bring the industry within existing investor-protection rules.

In his view, stablecoins pose a threat to financial stability, and if growth continues by tens of times, the sector could pose systemic risks to the economy.

Vitalik Buterin called the legalization of Bitcoin in El Salvador “foolhardy”

Vitalik Buterin criticised El Salvador’s decision to recognise Bitcoin as an official currency. The Ethereum founder stressed that the forced integration of digital assets into the financial system “runs against the ideals of freedom”.

“{“Shame on everyone (well, I’ll name the main culprits: shame on the Bitcoin maximalists) who praise him [President Nayib Bukele] without any scrutiny,”} wrote Buterin.

SEC demanded Ripple records of court proceedings discussions

The SEC plans to obtain audio and video recordings of meetings where the ongoing Ripple case was discussed. According to Ripple’s lawyer James Filan, these were events in which CEO Brad Garlinghouse and co-founder Chris Larsen, as well as other senior executives, discussed topics related to the suit.

On October 4, the Southern District of New York denied XRP holders’ request to participate in the Ripple case as defendants. However, Judge Analisa Torres allowed them to appear as amici curiae.

According to Judge Analisa Torres, the status of defendants would “compel the SEC to take coercive measures against investors.” It would also delay the proceedings, the ruling states.

Russia considers limits for retail crypto investors

Chairman of the Financial Markets Committee Anatoly Aksakov stated that the State Duma will consider legislatively restricting investments in crypto assets for non-qualified investors.

“We must, of course, spell out in law norms that protect non-qualified investors from imprudent investments in digital currencies,” — said Aksakov.

Seventeen bitcoin exchanges face blocking due to a Russian court ruling

On September 2, the Kushnarenkovsky district court in Bashkortostan ruled that information disseminated on the sites of several cryptocurrency exchanges is prohibited within the Russian Federation. If the pages are not removed, Roskomnadzor may block them.

The case is brought by the district prosecutor of Kushnarenkovsky district, Bashkortostan; Roskomnadzor’s regional administration is listed as a interested party.

A crypto-enforcement group to be formed in the United States

A new body under the U.S. Department of Justice will include anti-money-laundering and cyber-security specialists. Its main task is to prevent cybercrime, in particular ransomware.

Earlier President Joe Biden announced a meeting with representatives from 30 countries to discuss joint efforts against cybercrime and illicit use of cryptocurrencies.

This week Senator Elizabeth Warren and Congresswoman Debora Ross proposed to legislatively require American companies to report the size of ransoms paid to hackers.

Also in the Fed’s view, there were signals that cryptocurrencies pose a threat to global dollar dominance “seen” in cryptocurrencies.

There was also reporting that President Biden’s administration planned to issue an order for federal agencies to study the crypto industry and present recommendations for supervision.

Negative coverage of Tether returns to the press

Bloomberg once again attempted to locate Tether’s reserves and discovered previously unknown facts.

- In the reserves backing the stablecoin USDT there are short-term debt securities of large Chinese companies. Tether denies holding Evergrande papers, but does not comment on other Chinese firms. Overall the issuer maintains that all papers in the reserves have a credit rating no lower than A2.

- Some loans that Tether extends are collateralised by Bitcoin. For example, Celsius Network Ltd. received $1 billion at 5-6% per year — confirmed by founder Alex Mashinsky.

- A former banking partner accused Tether’s management of risky investments that imperilled the reserves. The issuer hinted that this man cannot be trusted.

- Deltec Bank in the Bahamas stores only $15 billion. The rest are in other lending institutions, but which ones remains unclear.

- Top executives at Tether are named in a U.S. bank-fraud investigation led by the FBI.

Also this week it emerged that the SEC initiated an investigation into the Circle consortium behind the USD Coin (USDC).

Also on ForkLog:

- Critical vulnerability discovered in Ethereum 2.0 staking protocols.

- The Bank of Russia added a pyramid scheme targeting Chia miners to the blacklist.

- Divergence Ventures analyst earned $2.4 million through a Ribbon airdrop exploit.

What else to read and watch

In the decentralised finance (DeFi) segment, Ethereum layer-2 solutions like Arbitrum are gaining traction, the decentralised derivatives platform dYdX surpassed centralised exchanges in trading volume, and the Lightning Network has gained a new lease of life amid donations on Twitter and payments in El Salvador.

All this and more in the September industry overview. The month’s most important crypto-market happenings in one piece.

In ForkLog’s educational cards we explain what cross-chain bridges are.

In our traditional digests we have gathered the key weekly news in cybersecurity and artificial intelligence and.

For the most significant news in the decentralised-finance space, check out our “Defi Chronicle”.

On 4 October we spoke live about the latest industry developments, discussed the problems and benefits of the Lightning Network, and explained under what conditions the SEC would approve Bitcoin. Guests were the host of the podcast “Base Block” Sergey Tikhomirov and ForkLog resident trader Ton Vays.

Read ForkLog’s Bitcoin news on our Telegram — crypto news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!