Week in review: Bitcoin slips below $27,000 as US inflation slowdown stalls

Bitcoin fell through the $27,000 level, the slowdown in US inflation stalled, HTX hacker returned the 250 ETH bounty, Binance CEO ruled out an explosive Bitcoin rally immediately after the halving, and other events from the past week.

Bitcoin price falls below $27,000

On Monday, October 9, BTC slid below $28,000. On Wednesday, October 11, the asset breached the $27,000 level.

At the time of writing, Bitcoin was trading around $26,800.

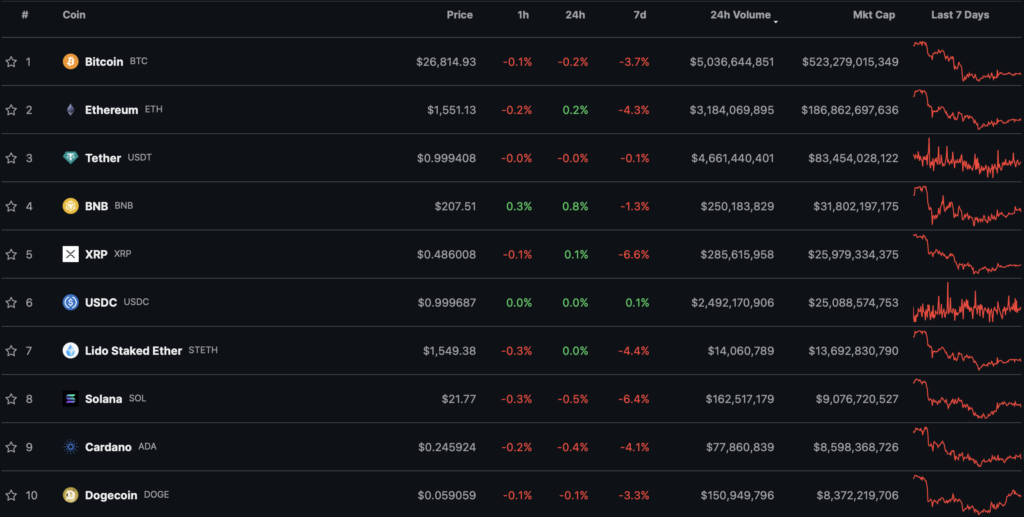

All top-10 cryptocurrencies by market cap ended the week in the red. The biggest losers were XRP (-6.6%) and Solana (-6.4%).

The total cryptocurrency market capitalization sits below $1.1 trillion. Bitcoin’s dominance index stands at 50.8%.

US inflation slowdown stalls

Year-over-year consumer prices in the United States for September stood at 3.7%, as in the previous month, exceeding economists’ forecast of 3.6%. On a monthly basis, prices rose 0.4% — below economists’ expectations of 0.3% and versus 0.6% in the prior month.

Core inflation, which excludes food and energy, rose 4.1% year over year and 0.3% month over month. The previous readings were 4.3% and 0.3%, respectively.

Analysts had penciled in readings of 4.1% YoY and 0.3% MoM.

CPI excluding shelter and energy rose by a year-to-date high 0.6% month over month. Previously, the Fed indicated that monetary authorities would be guided by price dynamics in the services sector.

What to discuss with friends?

- Bitcoin whale has emerged from a six-year ‘slumber’.

- Real USD has lost its peg. The stablecoin’s price collapsed by 50%.

- FTX used a random number to generate the insurance fund’s volume.

- The Gitcoin team lost $460,000 due to an erroneous transaction.

HTX hacker returns the 250 ETH bounty

The HTX crypto exchange (formerly Huobi) returned the 5,000 ETH stolen at the end of September (~$7.9 million at the time) in exchange for the hacker’s 250 ETH bounty (~$409,000).

The founder of Tron, Justin Sun, a member of HTX’s advisory board, said the hacker “made the right call.”

The white-hat in an on-chain message warned about the exploit’s nature. He said the breach was possible due to a leak of the exchange’s hot wallet keys. He advised changing the address and reducing its usage frequency.

Changpeng Zhao rules out explosive Bitcoin rally immediately after the halving

The price of Bitcoin will not double the day after the halving, but will begin to set a new ATH within a year. Stated by Binance CEO Changpeng Zhao, citing his experience.

He outlined a rough scenario for how events might unfold:

- In the months leading up to the halving there will be increasing chatter, news, anxiety, expectations, hype, and hopes.

- The day after the event, the price will not double. Users will wonder why it didn’t happen.

- A year after the halving, Bitcoin’s price will repeatedly set new ATHs. People will seek explanations. People have short memories.

According to the tracker on Binance’s homepage, more than 170 days remain until the halving at the time of writing.

Also on ForkLog:

- MEV bot earned $1.5 million from an attack valued at $4.

- An unknown exchanged $131,350 in USDR for $0 in USDC.

- Ex-Alameda head: Sam Bankman-Fried wanted to become President of the United States.

- Uniswap introduced a mobile wallet for Android.

Charles Munger forecasts collapse of most cryptocurrencies to zero

A large portion of investments in digital assets will be wiped out, stated Berkshire Hathaway vice-chairman Charles Munger.

“Don’t get me started on Bitcoin. It’s the stupidest investment I’ve ever seen,” exclaimed the 99-year-old investor.

Munger is a staunch opponent of cryptocurrencies and blockchain technology. In 2021 he compared Tesla and Bitcoin to ‘lice and fleas’, and questioned digital gold’s ability to ‘become a global means of payment’.

Edward Snowden warns of risks linked to Bitcoin ETFs

The former employee of the NSA and CIA Edward Snowden outlined potential risks stemming from traditional financial institutions entering the crypto market, including Bitcoin-based exchange-traded funds.

He advised investors focused on price to identify ‘real use cases for cryptocurrencies, rather than looking at charts and candles’.

Snowden said that capital inflows from traditional financial institutions could influence Bitcoin’s price. However, large volumes would give institutions ‘too much power’ over the asset, and ordinary users would no longer be able to influence decisions and actions regarding the coin, according to the former agent.

Snowden also noted that cryptocurrency ETFs, which are gaining popularity among financial firms, are actually ‘taming’ the crypto market.

Snowden also drew attention to Bitcoin’s ‘lack of real anonymity,’ which allows governments to easily track people behind certain transactions. As a comparison, he cited the 2013 incident when he leaked NSA documents, paying for servers with the first cryptocurrency.

The former intelligence officer criticised governments for attempts to regulate the crypto industry, imposing their own rules. He added that he ‘couldn’t care less’ about the views of SEC chair Gary Gensler.

Snowden urged developers and ordinary users to focus on greater anonymity of Bitcoin to realise Satoshi Nakamoto’s vision.

What else to read?

This week, ForkLog explained how to profit from retrodrops and what the Web3 social network Friend.Tech is for. It also looked at how startups are surviving in the venture winter.

In the new book ‘The End of the Individual’, French philosopher Gaspard Koenig contemplates the threats of AI, fictional and real.

Valeriy Usenko, head of private capital at the Dzengi.com crypto exchange, discussed the reasons for Currency.com’s rebranding.

The crypto industry is attracting more and more institutional players. This is reflected in new investments in infrastructure and the growing attention companies pay to Bitcoin as an asset class. The most important events of the past weeks are in ForkLog’s wrap-up.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!