Week in Review: Bitcoin slips below $40,000 as Ukraine passes the ‘On Virtual Assets’ law

The price of Bitcoin fell below $40,000; Ukraine passed the ‘On Virtual Assets’ law; the Russian Finance Ministry clarified the purchase limits for cryptocurrencies and outlined a preliminary framework for their taxation, and other events of the week.

Bitcoin slips below the $40,000 level

On Friday, February 18, the price of the leading cryptocurrency fell below the $40,000 mark. Senior OANDA analyst Edward Moya attributed the decline to ‘short-term geopolitical risks and potentially overly aggressive monetary policy tightening’ by the Fed.

Despite a prolonged correction, after another recalculation, Bitcoin mining difficulty reached a new all-time high of 26.97 trillion hashes.

At the time of writing, digital gold was trading around $38,400.

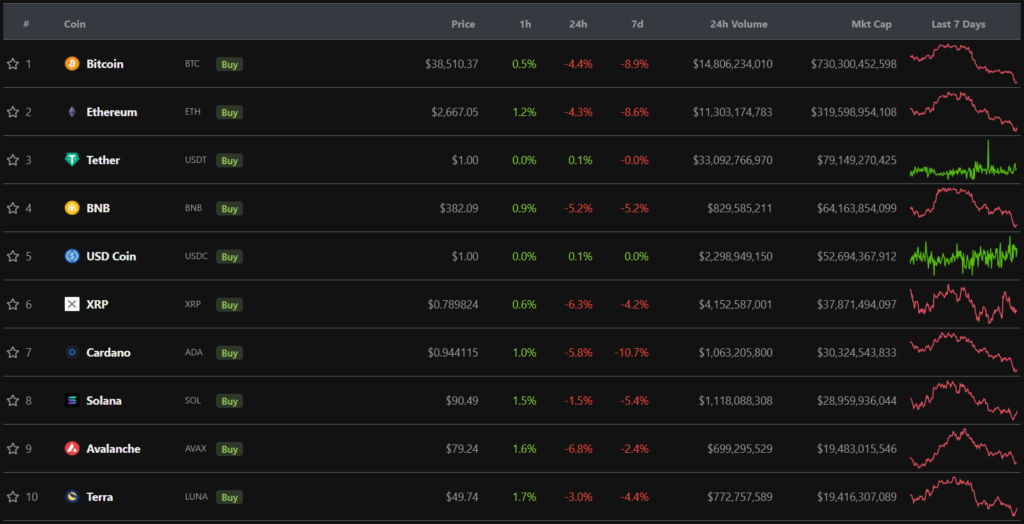

Traditionally, the flagship pulled the rest of the market lower. All top-10 cryptocurrencies by market capitalization ended the week in the red.

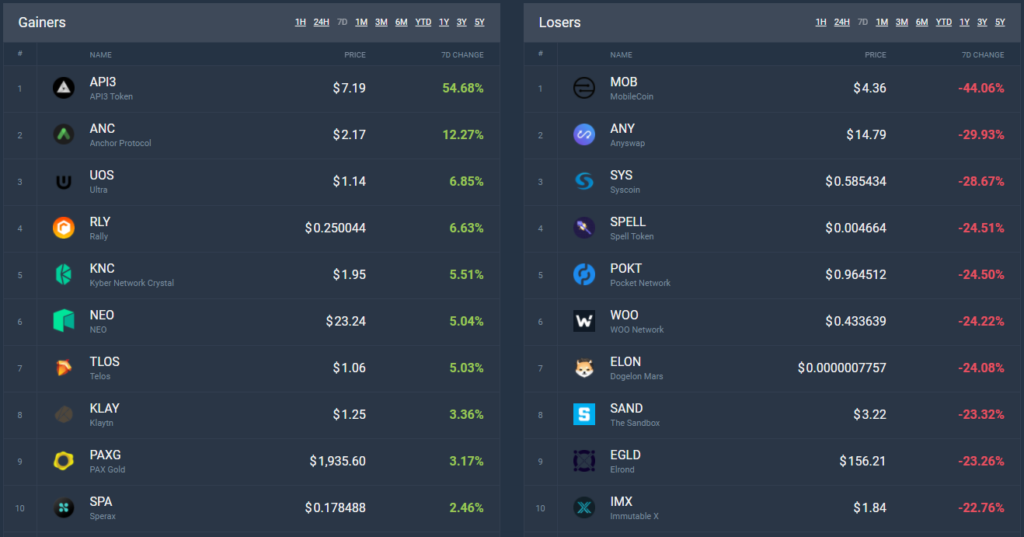

According to CoinCodex, for the week among mid-cap digital assets, the API3 DAO token rose the most. Its price increased by 54.68%.

Among the biggest decliners was MobileCoin. The MOB price fell by 44%.

The total market capitalization stood at $1.83 trillion. Bitcoin dominance fell to 39.88%.

Media: Bank of Russia prepares bills to ban Bitcoin and levy fines up to 1 million rubles

The Bank of Russia prepared bills to ban the issuance and circulation of ‘private digital currencies’ on the country’s territory, according to media reports.

The regulator proposed fines for individuals for issuing or circulating cryptocurrencies ranging from 300,000 to 500,000 rubles, and up to 1 million rubles for legal entities. For accepting payments — up to 50,000 rubles and up to 1 million rubles, respectively.

The Russian Ministry of Finance described a preliminary tax framework for cryptocurrencies and clarified the purchase limit

The Ministry of Finance opened up to March 18 public discussion of two bills regulating cryptocurrency turnover in Russia. Publication of the texts is planned at a later stage.

The first — ‘On Digital Currency’ — aims to create a regulatory framework for activities related to dealing in digital currencies and their issuance. The second introduces changes to certain acts.

Tax revenues to the budget from legalizing the cryptocurrency market were estimated by the Ministry of Finance at 10-15 billion rubles, with the bulk of payments expected from miners. Later the ministry said that they would temporarily forego the special taxation for miners in the first version of the bill due to difficulties in assessing their income.

For individual investors, personal income tax would be charged after selling digital assets at a rate of 13%.

At the same time, alongside developing the bill, the Ministry of Finance discussed restricting the cap on investments in cryptocurrencies for non-qualified investors at 50,000-100,000 rubles.

Meanwhile, Deputy Chairman of the State Duma Committee on Security and Anti-Corruption Andrey Lugovoy said that banning Bitcoin in Russia makes no sense. Finance Minister Anton Siluanov shared this view:

What else happened in Russia:

- Sberbank stated readiness of its banking infrastructure for the crypto market.

- The head of the Association of Russian Banks proposed financing the development of infrastructure to monitor the turnover of cryptocurrencies at the expense of users.

- The State Duma, in the second reading, allowed the seizure of digital assets from officials.

- Binance joined the Expert Council of the Association of Banks of Russia on cryptocurrencies.

Ukraine passed the ‘On Virtual Assets’ law

On February 17, the Verkhovna Rada of Ukraine, during a second reading, adopted the updated law ‘On Virtual Assets’, regulating cryptocurrency operations within the country. The document was supported by 272 deputies.

Under the updated law, the regulation of the virtual assets market within its powers will be carried out by the National Commission on Securities and Stock Market (NKCSFM) and the National Bank of Ukraine.

The Ministry of Digital Transformation of Ukraine commented ForkLog on its exclusion from supervisory bodies, and in the NKCSFM explained how they will regulate the virtual assets market.

Coinbase, FTX and Crypto.com showed ads at the Super Bowl

On February 13, the Super Bowl — the NFL championship game — saw crypto firms running ads. In 2022, a 30-second spot cost $6.5 million.

In Kazakhstan, a tenfold rise in mining tax discussed

The Ministry of National Economy of Kazakhstan proposed increasing the mining tax on cryptocurrencies tenfold—from 1 to 10 tenge per kWh. Officials also announced the creation of an interagency group to combat illegal miners.

Involvement of Bitfinex-Linked Assets Released on $3 Million Bail

The District of Columbia court released Heather Morgan on $3 million bail, accused of laundering assets stolen from the Bitfinex exchange. Her husband and co-defendant, Ilya Lichtenstein, remained in custody.

The judge found no substantial evidence against Morgan beyond the assertion she, ‘allegedly, received funds related to the case.’

Monero community concerned about 51% network attack risk

One of the pools in the network—MineXMR—concentrated 50% of the network’s computing power at one point, prompting concerns about a potential 51% attack. By week’s end, the situation had stabilised—the pool controls 38% of the hash rate.

Intel CEO criticized Bitcoin for its environmental impact

Intel CEO Pat Gelsinger criticized the first cryptocurrency for its environmental impact. He argued that a single transaction on the Bitcoin network ‘consumes enough energy to power a home for a day.’ He called the situation a ‘climate crisis’.

In 2012, lawyers told Ripple that XRP was not a security

In consultations provided by Ripple’s law firm Perkins Coie in 2012, it was asserted that the XRP token was not a security. However, experts noted a ‘small’ risk that the SEC could disagree with this assessment.

According to attorney James Filan, the documents were ‘generally favorable’ to Ripple. He noted that the company ‘acted very proactively’.

Vitalik Buterin: Canadian authorities’ actions illustrate why cryptocurrencies exist

Ethereum founder Vitalik Buterin did not endorse the protesters’ actions in Canada, but noted that the authorities’ measures vividly illustrate why cryptocurrencies exist. He called decentralized systems ‘a return to the rule of law’.

On February 19, non-custodial wallet Nunchuk also reported that the Ontario Superior Court issued a Mareva injunction ordering freezing and disclosure of assets of those involved in the protests.

Also on ForkLog:

- entered the ring against Max Holloway in the metaverse.

- compared cryptocurrencies to a ‘disease’. Elon Musk responded to the publication.

- initiated an investigation into user NFT theft.

- will add NFT support for monetising content and protecting copyrights.

What to read and watch next

Together with the experts involved in drafting the ‘On Virtual Assets’ law and other specialised professionals, ForkLog found out what awaits cryptocurrency holders in Ukraine.

In 2020, President Kassym-Jomart Tokayev urged attracting more companies and investments—by his words, by 2025 the amount of investments in mining should have risen to 500 billion tenge.

However, as sector players moved to the country, conditions began to change. We unpacked why Kazakhstan, which had just started turning into a mecca for mining, risks losing all this.

As part of a series on passive income from cryptocurrencies made an overview of Terra. In particular, we examined stablecoins and synthetic equities in the project’s ecosystem.

Some investors and analysts think the bear market has either already arrived or is on the way. JPMorgan strategists believe Bitcoin’s fair price is below $40,000.

We explained how to earn from stablecoins in a bear market using popular DeFi platforms and the Binance exchange.

In traditional digests, we gathered the week’s main events in cybersecurity and artificial intelligence.

The DeFi sector continues to draw heightened attention from crypto investors. ForkLog has compiled the most important events and news from recent weeks in a digest.

On Feb 14, ForkLog’s YouTube channel hosted an online conference “Why NFTs Bring in Millions?”. They discussed non-fungible tokens, growth prospects, use cases and regulation.

Read Bitcoin news from ForkLog on our Telegram — crypto news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!