Week in Review: Bitcoin tops $30,000 as Fed chair calls stablecoins money

The price of the leading cryptocurrency rose above $30,000, and the Fed Chair Jerome Powell said that stablecoins are money and signalled a rate hike; WisdomTree, Invesco and Valkyrie filed applications to launch Bitcoin-ETF and other events of the closing week.

Bitcoin tests the $31,000 level

On June 21, the price of the leading cryptocurrency surpassed $29,000. By the end of the day, Bitcoin’s price had broken the $30,000 mark.

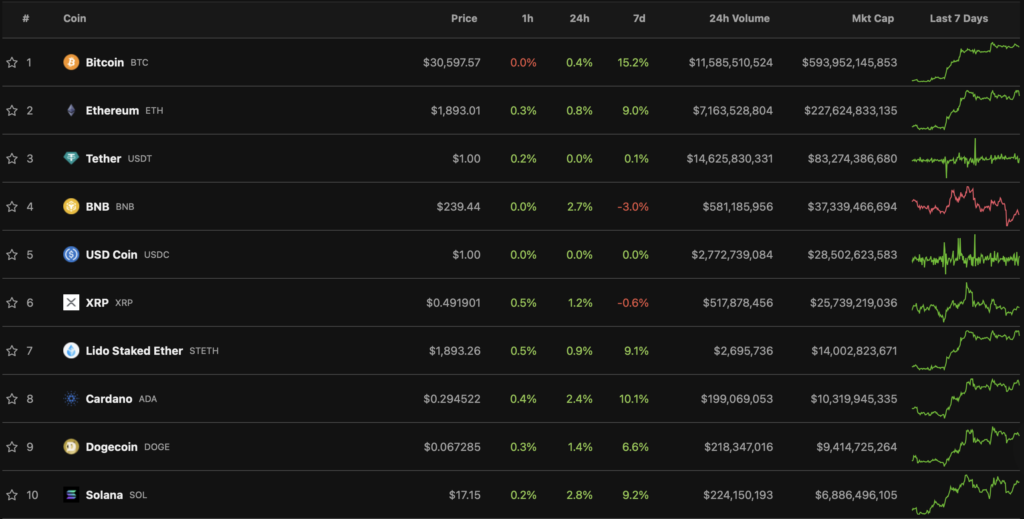

On June 23, digital gold rose above $31,000, but could not hold that threshold. At the time of writing, the asset was trading at around $30,600. Over the past week, Bitcoin rose 15.2%.

Most digital assets in the top-10 by market cap finished the week in the green. The biggest movers were Cardano (+10.1%) and Solana (+9.2%).

Total crypto market capitalization surpassed $1.2 trillion. Bitcoin’s dominance index stood at 51.6%.

What’s happening with Binance?

Earlier in the week, Binance termed Binance Nigeria Limited a fraudulent entity and disavowed any link with the organisation after Nigeria’s Securities and Exchange Commission flagged illicit activity at the local arm of the exchange.

The UK subsidiary, Binance Markets Limited, cancelled registration with the Financial Conduct Authority. The company will not be able to provide any services in the United Kingdom.

On June 21, Binance launched a local trading platform in Kazakhstan. By the end of the year the exchange plans to broaden its product range and increase the number of available digital assets to at least 100.

On June 22, the U.S. arm of Binance unfroze withdrawals. The company warned that the situation could change in the near future.

By the end of the week, the Belgium Financial Services and Markets Authority ordered Binance to immediately cease providing crypto-related services in the country.

Fed chair says stablecoins are money and signals rate hikes

The Fed should be involved in regulating stablecoins. This was stated by Fed Chair Jerome Powell during a speech before the House Financial Services Committee.

«We view payment stablecoins as money. We believe it is prudent to obtain a sufficiently strong federal role in what is going on around stablecoins in the future», — he said.

Powell also allowed for rate hikes in the coming months. The Fed will do so at a slower pace than before, he added.

WisdomTree, Invesco and Valkyrie file for Bitcoin ETFs

Asset managers WisdomTree, Invesco and Valkyrie, following BlackRock, filed applications with the U.S. Securities and Exchange Commission (SEC) to launch spot exchange-traded funds built on the first cryptocurrency.

To date the SEC has rejected all applications for approval of spot Bitcoin ETFs. An exception was made for ProShares and Valkyrie, which are based on Bitcoin futures on the Chicago Mercantile Exchange (CME).

What to discuss with friends?

- Bitcoin enthusiasts burned a CryptoPunk valued at $94 000.

- The meme token BOB fell after Elon Musk warned of a scam.

- A Brooklyn bathhouse told of using heat from Bitcoin mining.

- The CEO of Animoca Brands predicted the launch of AAA-class Web3 games in 2024.

Berenberg names the SEC’s next victims

Analysts at the investment bank Berenberg believe the SEC’s next targets in its crackdown on the crypto industry will be stablecoins and the DeFi sector.

They argue the regulator will focus on the regulatory compliance of the two largest market-cap stablecoins — Tether (USDT) and USD Coin (USDC).

According to the report, if the agency targets stablecoins, this would significantly weaken the DeFi ecosystem. In particular, forced regulation of USDC would negatively affect Coinbase’s finances.

Major investors withdrew $150 million in Ethereum from Binance and Kraken

Lookonchain analysts recorded three large withdrawals from crypto exchanges Binance and Kraken totalling 86 520 ETH (~$150 million):

- The first whale transferred 35 860 ETH worth more than $64 million from a Binance address;

- The second withdrew 27 000 ETH worth $48 million from the largest-volume exchange across four transfers;

- The third wallet withdrew 23 660 ETH worth more than $42 million across five transactions.

Do Kwon found guilty of forging documents

A court in Podgorica found guilty of forging documents in an attempt to leave Montenegro the Terraform Labs founder Do Kwon.

He was sentenced to four months in prison. A similar term was given to former chief financial officer Han Chang-joon. Time served will be credited.

Also on ForkLog:

- In Ukraine authorities liquidated an illegal mining farm.

- The number of new Litecoin addresses rose by 55% ahead of the halving.

- Wyre announced it is ceasing operations.

Nansen lays out conditions for Bitcoin’s bullish rally

For a revival of Bitcoin’s bull market, clear regulatory clarity in the United States and a sustained decline in core inflation are required. This is the conclusion reached by the analytics firm Nansen.

Researcher Orli Barter noted in the report that central-bank and market narratives are shifting: the recession scenario is pushed back, and a stubborn inflation comes to the fore.

IMF questions the need for crypto bans

IMF experts concluded that banning cryptocurrencies may not be the best way to curb related risks.

They recommended that countries focus on removing factors that stimulate demand for this asset class, meeting needs for digital payments and increasing transparency through including crypto transactions in national statistics.

What else to read?

This week we discussed the features, advantages and drawbacks of automated asset management in DeFi, as well as the conclusions of PMEF-2023.

ForkLog spoke with PirateCash founder, CEO and CTO Dmitry Korniyuchuk about scenarios of total regulation of cryptocurrencies, conditions for mass Web3 adoption and ways of moderating decentralized content.

In the cards, we discuss explainable artificial intelligence. In the standard digest we collect the week’s main cybersecurity events in cybersecurity.

The crypto industry is attracting more and more institutional players. This is reflected in new investments in infrastructure, and the growing attention that companies pay to Bitcoin as an asset class. The most important developments of the past weeks are in ForkLog’s review.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!