Week in review: Bitcoin tops $51,000 as OpenSea’s August trading volume surpasses $3 billion

Trading volume of the NFT-marketplace OpenSea in August surpassed $3 billion, Vitalik Buterin called the choice of Ethereum co-founders mistaken, the founders of the Finiko pyramid were issued with an international arrest warrant and other events of the week.

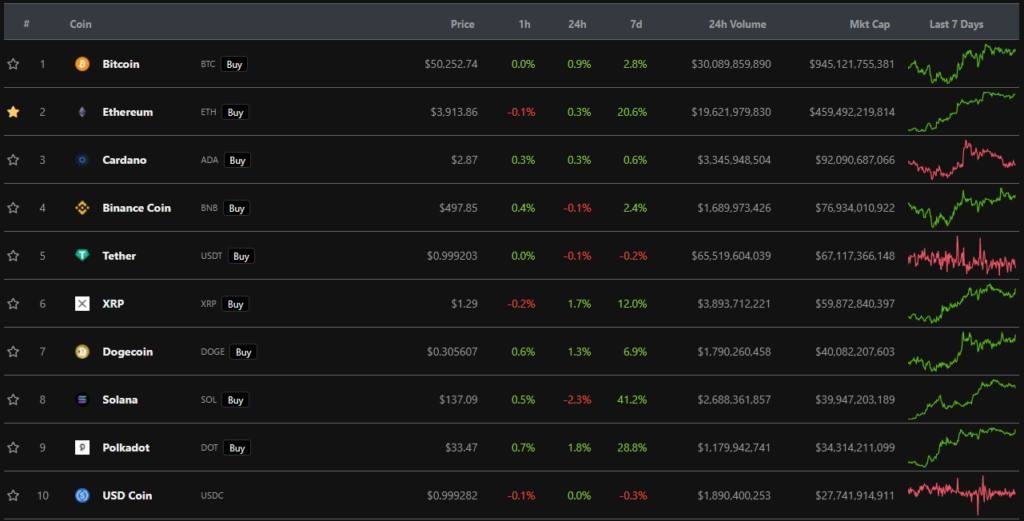

Bitcoin tops $50,000, Ethereum at $4,000

On September 1, Ethereum surpassed the $3,500 level for the first time since May’s drop. By the end of the week, the second-largest cryptocurrency breached the $4,000 mark.

A former Goldman Sachs executive and macro investor Raoul Pal forecasted Ethereum to reach $20,000, based on comparisons of current charts with those from 2017.

At the time of writing, the cryptocurrency was trading near $3,910.

Bitcoin also set a local high — its price rose above $51,000 on Friday. The move was accompanied by notable activity in the futures market — open interest dostig $18 bn with повышении of funding rates.

Yuriy Mazur, head of data analytics at CEX.IO Broker, in conversation with ForkLog noted that the price of the first cryptocurrency is likely to cap near the $58,000 level.

At the time of writing, Bitcoin’s price stands around $50,300.

By week’s end, all top-10 assets by market cap remained in the green. Solana’s native token rose above $140. Cardano flirted with a new high above $3, and developers deployed Plutus smart contracts on its testnet.

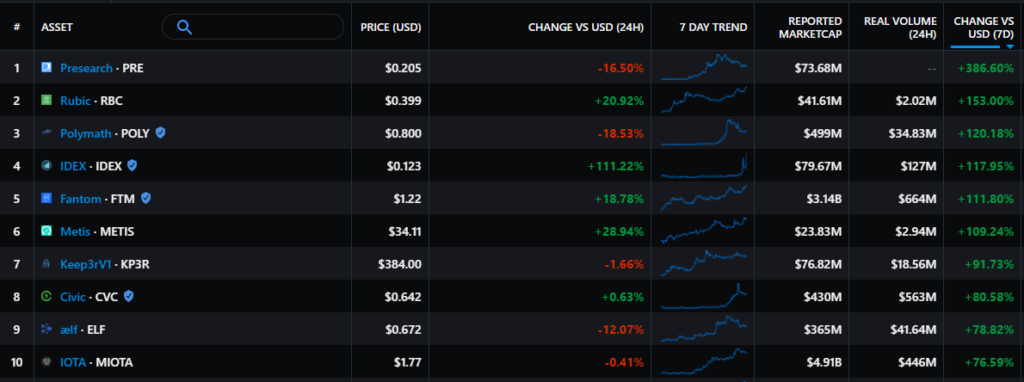

According to Messari, among digital assets over the past week the strongest gainer was Presearch, the token of the decentralized search engine. PRE rose 386%, with a market cap of $73.68 million.

The biggest loser among in-game currencies was Chain Guardians, down almost 44%, with market cap dropping to $36.63 million.

The crypto market cap stood at $2.38 trillion. Bitcoin’s dominance index slipped to 39.6%.

OpenSea NFT marketplace trading volume in August surpasses $3 billion

Over 30 days, OpenSea’s NFT-focused platform reached $3.11 billion in trading volume. The marketplace was used by more than 195,000 unique users who conducted 2.22 million transactions.

In this context, product manager Nate Chastain said there is a staff shortage. The company currently employs only 37 people. He pledged to send 1 ETH to anyone who refers an engineer or designer the company hires.

What else is happening in the NFT space?

Collector Pranksy paid 100 ETH (~$335,000 at the time) for an NFT allegedly belonging to the anonymous artist Banksy. Questions were raised about its authenticity, as the address involved in the token’s issuance has been linked to numerous suspicious transactions.

On September 4, Pranksy made another purchase — acquired a zombie punk from the CryptoPunks collection for $3.9 million. On the same day he sold an NFT for $5.12 million.

OKEx launched its own NFT marketplace with royalties to authors, and Binance introduced additional settings on its platform for selling non-fungible tokens after a user lost $200,000.

ForkLog wrapped up an auction for the magazine’s seventh anniversary! Seven NFTs featuring figures from the crypto industry were sold for 6.74 ETH.

- Hermitage announced the start of tokenised artworks sales on Binance’s marketplace.

- A user spent 0.1 ETH on an NFT and earned 290x.

- A phishing attack on the NFT project brought the hacker more than $1 million.

Media: Twitter tests Bitcoin donations to content creators

The social network Twitter is testing the ability to send donations in the first cryptocurrency to content creators via the Tip Jar feature, MacRumors reports.

Later, developer Alessandro Paluzzi showed the interface through which Bitcoin and Ether could be accepted on Twitter. No official confirmation yet.

Analysts detect signs of manipulation in EOS ICO worth $4.2 billion

According to Integra, a significant share of EOS token purchases during the 2017–2018 ICO was provided by a group of addresses affiliated with one another. This suggests possible wash trading to inflate turnover.

Changpeng Zhao: Binance.US to pursue IPO within three years

In the next three years, Binance’s U.S. unit could pursue a public listing on the U.S. stock market, said CEO Changpeng Zhao.

He added that in the next two months the unit would close a major private financing round. The deal would reduce the CEO’s control over the board.

This week the exchange’s main domain binance.com was placed on the Monetary Authority of Singapore’s Investor Warning List. Later, a similar warning was issued by the South African Financial Sector Conduct Authority.

On Sunday Binance stated that it would ban customers from using the Singapore dollar on the platform and remove apps from regional App Stores and Google Play.

Media: SEC investigates several DeFi sector firms

Uniswap Labs, operator of the largest decentralized platform Uniswap, is the subject of a Securities and Exchange Commission (SEC) inquiry, WSJ reports citing sources. said the publication.

According to the report, the regulator is reviewing information about Uniswap and how investors interact with it. The article suggests the probe is in early stages and no charges have been brought yet.

The Uniswap review may be part of a broader effort aimed at the DeFi sector. Projects in the space have reportedly been receiving letters from the SEC and inquiries from other regulators for months. have been receiving such inquiries.

Vitalik Buterin says selecting eight co-founders was a mistake

Vitalik Buterin hosted an AMA with his Twitter followers. When asked what he regrets most about Ethereum’s development, Buterin replied that choosing eight people as co-founders due to coordination difficulties was a mistake.

The Ethereum co-founder also called it a mistake to make the EVM 256-bit, and expressed hope that the meme cryptocurrency Dogecoin would move to the consensus mechanism Proof-of-Stake, using Ethereum’s codebase.

Poll: 77% of Russian investors deem Bitcoin more promising than “traditional currencies” and gold

Nearly 77% of Russian investors see buying cryptocurrencies as more promising than holding traditional national currencies and gold, according to a survey by the Association of Forex Dealers in August.

17% of respondents trade digital currencies at least monthly, 25% less than monthly, 35% more often. 23% have never worked with such instruments, yet the vast majority of that group plan to acquire digital assets in the near future.

Issuer of Tether sought to block disclosure of USDT reserves data

The parent company of the Bitfinex exchange and the issuer of the stablecoin Tether — iFinex — has petitioned New York’s Supreme Court to bar media and others from requesting data on the state and structure of USDT reserves over the past few years.

According to the filing, disclosure would create an unfair competitive environment for Tether.

Ripple documents SEC ruling: Court requires access to staff Slack messages

Judge Sarah Netburn ruled that the SEC must provide Ripple with the requested documents for in-camera review.

The term review in camera means the defendants will not have access to the SEC materials at this stage. If the judge deems them material to the case, they may be made public at a later open hearing.

Later Netburn ordered Ripple to provide the SEC access to staff Slack messages. The agency maintains that the messages could prove XRP price manipulation and bear on the business of the defendant.

Media: Co-founders of the Finiko pyramid declared wanted internationally

The Kazan Vakhitovsky District Court granted petitions for arrest in absentia of three Finiko founders — Marat and Edvard Sabirov, and Zygmunt Zygmuntovich.

Official losses from the pyramid’s activities amount to 250 million rubles, according to the Russian interior ministry for Tatarstan. Chainalysis notes Finiko gathered over $1.5 billion in Bitcoin from Eastern European investors — the scheme took 800,000 deposits between December 2019 and August 2021.

Over the past year Eastern Europe has emerged as a leader in illicit crypto transactions, according to Chainalysis.

Hackers withdrew more than $18 million from the Cream Finance DeFi protocol

On August 30, the Cream Finance DeFi protocol came under attack via a flash loan exploit. The attackers withdrew more than $18 million (418,311,571 AMP and 1,308 ETH) exploiting a reentrancy vulnerability in the AMP token contract.

Cream Finance said it would reimburse victims; the project will allocate 20% of fees toward repayment until the full amount is repaid.

The DeFi project xToken reported a second hack of the year, with user losses estimated at $4.5 million. The team is developing a compensation plan based on its own token, XTK.

Protests erupt in El Salvador against Bitcoin legalization as parliament funds a $150 million program

Residents of El Salvador took to the streets to protest Bitcoin’s legalization amid fears of rising corruption. A poll showed 70% of citizens oppose the initiative.

Meanwhile, the Legislative Assembly’s Finance Committee agreed to establish a $150 million fund to back the Bitcoin-dollar exchange.

Also on ForkLog:

- The State Duma allowed discussion of cryptocurrency taxation in the autumn session.

- The promoter of BitConnect’s fraudulent scheme will return $24 million to investors.

- Tron founder Justin Sun announced BitTorrent Chain — a cross-chain second-layer solution for blockchain scalability.

What else to read and watch

NFT and GameFi segments surged, Solana breached the $100 mark, and Ethereum endured two hard forks — planned and unwanted.

That and more in the August industry review. All the key crypto-market news of the month in one piece.

The rise of gaming tokens has been among the summer’s most notable events in crypto. ForkLog analyzed what is happening in blockchain-based gaming and its prospects.

In traditional digests we’ve collected the week’s main events in cybersecurity and and artificial intelligence.

The most significant DeFi news of late from ForkLog’s DeFi Bulletin we invite you to revisit.

On August 30, ForkLog hosted a live session with guests discussing uses of cryptocurrency in games and NFT. It featured charts and forecasts and answered followers’ questions with Crypto Gamers co-founder Petrukha, trader and ForkLog resident Ton Vais, and defi.dao.vc founder Georgiy Galyan.

Follow ForkLog’s bitcoin news on our Telegram — cryptocurrency news, prices and analytics.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!