Week in Review: El Salvador legalises Bitcoin, and Ukraine passes a virtual assets law

El Salvador legalised Bitcoin, Ukraine passes a virtual assets law, SEC warned Coinbase of a lawsuit and other events of the week.

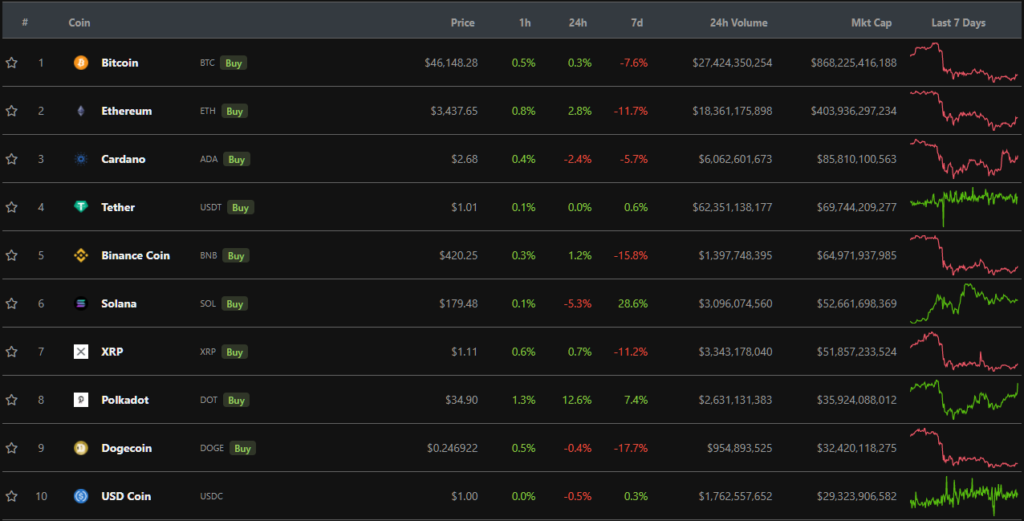

Bitcoin price tops $52,000 but fails to hold above that level

On September 6, the price of the first cryptocurrency reached a local high, surpassing $52 000. By the next day, quotes began to fall, slipping intraday to $43 000.

As of writing, digital gold was trading near $46 000.

In the wake of the correction, open interest on the futures market shrunk by $4.2 bln (to $15.1 bln), indicating that the main driver of the decline was a cascade of liquidations totaling $3.7 bln.

Elias Simos, a Coinbase developer, noted that the DeFi DeFi, which surpassed $200 bln in value locked, is better able to withstand market volatility.

Long-term targets are quite optimistic: Bloomberg strategist Mike McGlone predicted Bitcoin to rise to $100 000, and Standard Chartered expect the first cryptocurrency in the $50 000-$175 000 range, and Ethereum at $35 000.

BlackRock investment chief Rick Rieder, in a CNBC interview, called Bitcoin an alternative currency whose value depends on its adoption.

Over the past seven days Bitcoin fell nearly 8%, Ethereum fell almost 12%. Solana rose 28% — the cryptocurrency posted the best performance among the top-10 by market cap.

According to Messari, among digital assets last week the IDEX token, the native token of the decentralised exchange IDEX, rose the most, by 367%, and its market capitalization rose to $370 mln.

The biggest loser was the BAO token from the DeFi project BAO Finance. Its price fell almost 48%, and its market cap dropped to $15.3 mln.

The cryptocurrency market capitalization stood at $2.2 trillion, with Bitcoin’s dominance index down to 39.1%.

El Salvador legalised Bitcoin. Government purchases 550 BTC

On September 7 in El Salvador the took effect law recognising Bitcoin as a legal means of payment. The day before a Reddit user urged everyone to buy $30 of digital gold in solidarity with the country.

The initiative was supported by MicroStrategy CEO Michael Saylor, but some community members did not share his optimism. The Twitter account of the Cipherpunks conference in Prague noted that mandating Bitcoin into the financial system “contradicts the core values” of cryptocurrencies.

President Nayib Bukele said that the government had purchased 550 BTC. The purchase was made by a government fund of $150 million, established by authorities to ensure the exchange of Bitcoin and the dollar. The latest tranche of 150 BTC was bought during the price decline. Bukele described it as the “buyback of the day”.

McDonald’s, Pizza Hut and Starbucks fast-food chains in El Salvador immediately began accepting Bitcoin as payment.

Transactions with digital gold are available in the Chivo wallet. At launch there were technical problems, but it quickly returned to operation. According to former Liquid product director and founder of PowerTrade Mario Gomez Losada, payment systems and companies could lose up to $1 bln a year due to the integration of Chivo into the financial system.

Charles Hoskinson predicted recognition of Bitcoin by other countries following El Salvador.

Ukraine passes a virtual assets law

On 8 September the Verkhovna Rada of Ukraine passed the law “On Virtual Assets,” regulating cryptocurrency operations within the country. The document was supported by 276 deputies.

The law will come into force after amendments to the Tax Code concerning taxation of virtual assets (VAs) are adopted. This document has not yet been adopted.

Under the law, VAs are recognised as intangible property. They are divided into secured and unsecured. VAs are not a means of payment in Ukraine and cannot be exchanged for property or services.

Market participants gain the right to legal protection of VA rights, to open bank accounts for settlements on VA transactions, and to independently determine and set the value of VA in the course of operations.

ForkLog prepared a detailed analysis of the law.

SEC threatens Coinbase with a lawsuit over crypto-savings accounts

The U.S. Securities and Exchange Commission warned Coinbase of potential legal action in the event of launching crypto-savings accounts based on USD Coin (USDC) at 4% annually, due to their treatment as “securities”.

Ripple CEO Brad Garlinghouse stated that the warning from the SEC places Coinbase in a situation similar to his own company. He stressed that the regulator “continues the war against cryptocurrencies,” and hinted at possible cooperation between the two organisations.

Later on Twitter there were reports of XRP being relisted on Coinbase Pro. The latter denied these rumours, stating that due to a technical glitch some customers could see the asset in the mobile app.

Solana price tops $200

On September 7 the Solana (SOL) surpassed the $190 mark, and on September 9 the price hit a new high above $200.

With a market cap of $61 bln the project ranked sixth on CoinMarketCap, ahead of Dogecoin, Polkadot and even XRP.

Solana founder Anatoly Yakovenko gave his assessment of the crypto market:

Binance announces support for Cardano hard fork

The Bitcoin exchange Binance said it would support the scheduled Cardano network hard fork on the night of Sept. 12-13 (ADA). Half an hour before the activation of the upgrade, the platform will suspend deposits and withdrawals of ADA, but users will still be able to exchange the cryptocurrency within trading operations.

Three Finiko pyramid leaders detained in Kazan

On Tuesday, police in Tatarstan detained the vice president of the Finiko financial pyramid Ilgiz Shakirov. The court sent him to pre-trial detention until September 28.

On September 8, police detained two more participants of Finiko — the “vice-president” Dina Gabdullina and Lilia Nurieva.

Peskov: Russia is not ready to recognise Bitcoin as a means of payment

Recognising Bitcoin as a means of payment in Russia would only harm the financial system, said Kremlin spokesperson Dmitry Peskov. He called digital gold a “quasi-currency” and said there is not the slightest reason to take such steps.

Bitfinex launches Kazakhstan-registered platform for trading tokenized stocks

The cryptocurrency exchange Bitfinex launched the Bitfinex Securities platform for trading tokenized shares and bonds. It is registered in Kazakhstan at the Astana International Financial Centre.

Bitfinex Securities will allow companies to issue tokenized securities, and users will be able to invest in and trade them. The platform targets companies seeking public status via token offerings.

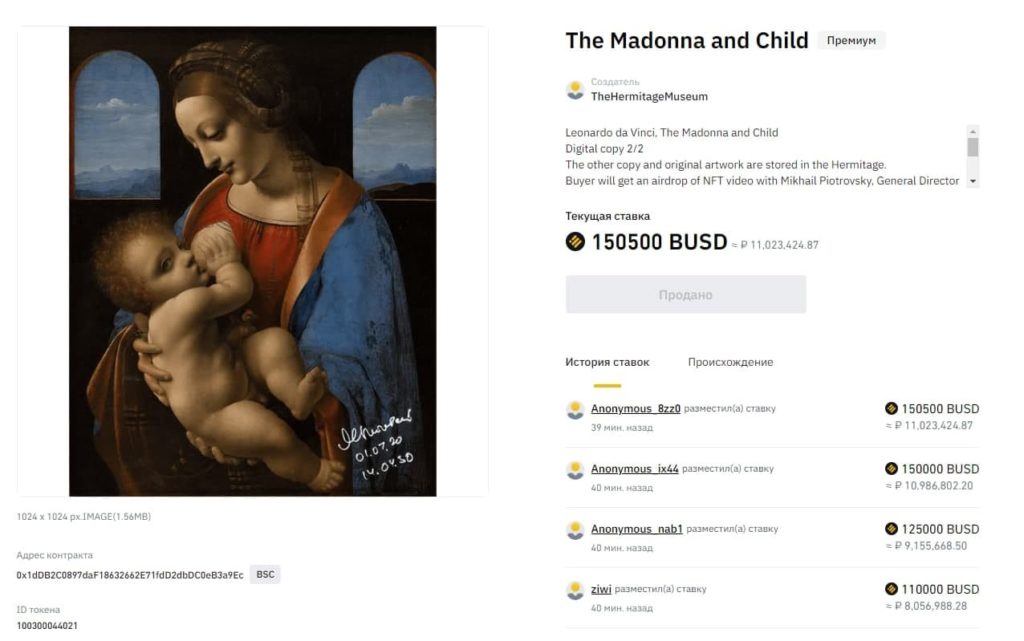

Hermitage sells NFT collection on Binance and resolves conflict with Rammstein vocalist

Hermitage completed the auction of tokenised artworks from a limited digital collection on the NFT marketplace Binance:

- “Madonna Litтa” by Leonardo da Vinci — $150 500;

- “Composition VI” by Wassily Kandinsky — $80 000;

- “Lilac Bush” by Vincent van Gogh — $75 000;

- “The Corner of a Garden in Mongezrone” by Claude Monet — $74 000;

- “Judith” by Giorgione — $65 000.

The museum also allowed using images of its interiors in the NFT collection of German musician Till Lindemann. Hermitage held talks with the Twelve X Twelve marketplace where the tokens are hosted. The parties signed an agreement taking into account each other’s interests.

Vitalik Buterin proposed moving Ethereum NFTs to the L2 ecosystem

Vitalik Buterin proposed moving Ethereum-issued NFTs to the Layer 2 (L2) ecosystem. This, he argues, would reduce gas consumption on the main network.

Buterin stressed that the NFT segment needs low fees “due to the non-financial character of a significant portion of it.”

State media warn of NFT bubble

The state-controlled Chinese outlets Securities Times and People’s Daily warned citizens about NFTs due to a potential bubble in the segment.

The statement notes that most NFT buyers focus on financial speculation rather than the visual qualities of the token.

What else happened in the NFT space?

- FTX launched an NFT minting feature. A test non-fungible token minted by the exchange’s founder Sam Bankman-Fried sold for $270 000.

- A set of 107 NFT Bored Ape Yacht Club from Yuga Labs went under the hammer at Sotheby’s for $24.4 mln.

- OpenSea led to the destruction of 42 NFTs worth $100 000.

- Moonrock Capital purchased a Solana-based NFT for $1.1 mln.

DeFi-protocol Cover Protocol closes, while Cream Finance hacker returns $17.6 mln

The developer going by the pseudonym DeFi Ted announced the shutdown of the peer-to-peer insurance market Cover Protocol and its associated lending service Ruler. He urged users to withdraw assets as quickly as possible. In response, the COVER token fell 40%, RULER — more than 95%.

The Cream Finance hacker reimbursed most of the funds stolen in the recent attack, amounting to 5 152.6 ETH ($17.6 mln at the time of writing), according to PeckShield analysts.

US Treasury names tax guidance on cryptocurrency taxation a priority

The U.S. Treasury confirmed its plan to publish guidance on cryptocurrency taxation. The relevant paragraph is in the “Tax Administration” section of the department’s priority directions plan for 2021–2022.

Earlier Bloomberg reported plans to clarify tax-reporting requirements for crypto companies, but there was no official confirmation.

Also on ForkLog:

- The court dismissed a suit against BitMEX for market manipulation.

- Billionaire Leon Cooperman urged caution when investing in Bitcoin.

- Mastercard announced the acquisition of blockchain-analytics firm CipherTrace.

What else to read and watch

The path into the rapidly evolving DeFi space begins with mastering decentralised exchanges that use automated market maker algorithms. For beginners, ForkLog has prepared a detailed guide.

In an exclusive ForkLog interview, the CEO of the Palladium Fund at Norilsk Nickel, Alexander Stoyanov told about tokenisation of precious and coloured metals, attitudes toward current regulation of digital assets in the Russian Federation, and the role of blockchain in increasing transparency in heavy industry.

In traditional digests we have aggregated the week’s main events in the fields of cybersecurity and artificial intelligence.

Blockchain technology remains one of the hottest trends among financial, government and corporate organisations worldwide. ForkLog has prepared a survey of the most interesting recent initiatives.

On 6 September in a live ForkLog broadcast we spoke with Crypto Gamers co-founder Petrukha and Tony ฿, founder of the educational project Bitcoin Translated, about crypto games.

Read Bitcoin news from ForkLog in our Telegram — cryptocurrency news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!