Week in review: IMF goes after El Salvador and Pakistan over bitcoin; China hosts a robot bout

Blockchain pushes in El Salvador and Pakistan drew IMF scrutiny; Sber cast itself as the future market-maker for Russian crypto exchanges; China staged its first robot fight; and other events of the week.

Bitcoin moves into consolidation

After last week’s peak near $112,000, the leading cryptocurrency made another bid to break higher. But after testing $111,000 on 27 May, prices turned lower.

As the sell-off accelerated, the price briefly dipped below $104,000. The main drivers were negative headlines on US trade talks with its largest partners—China and the EU.

An additional drag was outflows from bitcoin ETFs after nine straight days of net inflows. On Friday, 30 May, investors pulled about $616m from the products.

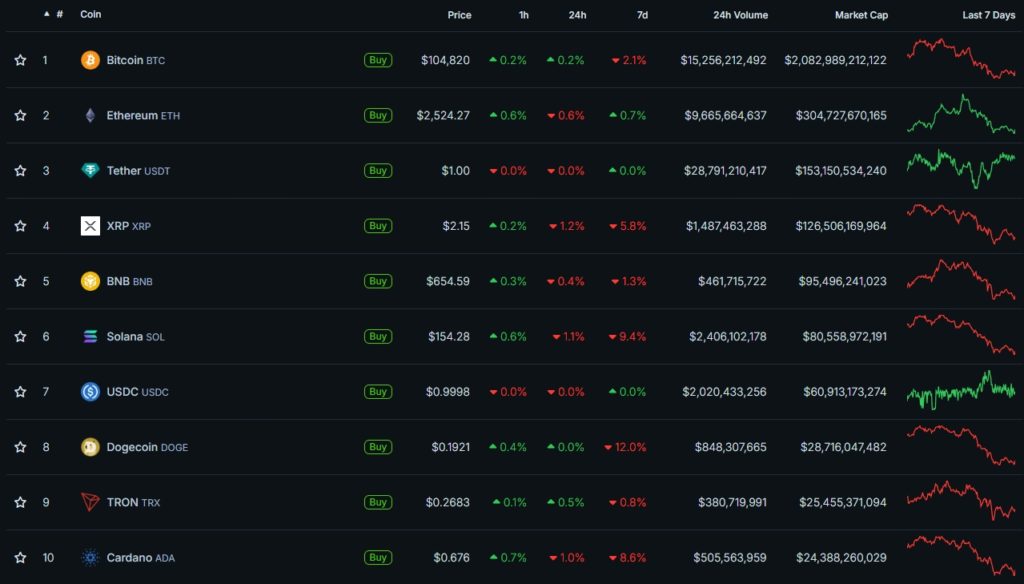

At the time of writing, bitcoin changes hands near $104,800, down roughly 2% on the week. Several top‑10 altcoins dropped more: Dogecoin fell 12%, Solana 9.4% and XRP 5.8%. Only Ethereum stayed in the green.

The crypto Fear & Greed Index slipped to 56 by week’s end—near neutral, yet still signalling upbeat investor sentiment.

Total crypto market capitalisation shrank to $3.4trn; bitcoin’s dominance was 61.4%, Ethereum’s nearly 9%.

IMF reacts to bitcoin initiatives in El Salvador and Pakistan

The International Monetary Fund (IMF) said it would spare no effort to limit the size of El Salvador’s bitcoin reserve.

The organisation reported a staff‑level agreement on extended financing for the country. In 2024 the sides struck a deal that capped El Salvador’s purchases of digital gold in exchange for a 40‑month, $1.4bn loan. With additional support from other international and regional bodies, the package could reach $3.5bn.

A prerequisite for approval was the adoption of amendments to the bitcoin law. They scrapped the mandatory acceptance of the coin by private entities and revoked its legal‑tender status.

Despite the formal ban, El Salvador continued to build its bitcoin position, taking it to 6,190 BTC. The latest purchase was recorded on 28 May.

The IMF also expressed concern over Pakistan’s cryptocurrency and artificial‑intelligence initiatives.

The authorities announced the allocation of 2 GW of surplus electricity for bitcoin mining and for data centres serving AI. The prime minister’s crypto adviser, Bilal bin Saqib, announced the creation of a national reserve in digital gold.

The plans drew a sharp reaction from the IMF, which demanded urgent clarification regarding the legal basis for the moves and the distribution of electricity amid chronic shortages.

Officials confirmed they had not notified the Fund, even as they negotiate financial support with it. They conceded the initiatives could complicate a deal already facing “difficult questions”.

Sber to become market‑maker for Russian bitcoin exchanges and launch ETFs

Sber will act as a liquidity provider and market‑maker on Russian cryptocurrency platforms, said Alexander Zozulya, head of Sberbank’s global markets department.

Exchanges will appear within a regulatory sandbox, with operations permitted for super‑qualified investors. Crypto products will be available to them without direct ownership, akin to ETFs.

“In Russia these could be structured products, ЦФА or ПИФы, giving exposure to bitcoin, Ethereum or a basket of cryptocurrencies, but without direct ownership of them or the possibility to receive them “in hand”,” Zozulya said.

A full launch will require changes to the Civil and Tax Codes and to the Central Bank’s own rules.

What to discuss with friends?

- Weld Money crypto cards will cease operating in Ukraine.

- Ethereum validators backed raising the gas limit to 60m.

- Luke Smith: “The Michael Saylors do not want bitcoin to threaten the existing system.”

- Vitalik Buterin noted Ethereum’s usefulness amid Sweden’s decision to “bring back” cash.

Real Steel: China hosted its first robot fight

On 25 May, the Chinese city of Hangzhou hosted the first Muay Thai‑style combat tournament among Unitree Robotics’ G1 humanoid robots.

At the Unitree Iron Fist King: Awakening event, four bots fought one another in a knockout system. They were remotely controlled but had pre‑programmed behaviours such as punches, kicks and evasions.

Equipped with sensors and depth cameras, the robots demonstrated strikes, combinations and the ability to keep balance. Engineering teams operated the machines via controllers or voice commands.

A new bout is planned for December, taking into account lessons from the opening fights.

Also on ForkLog:

- Jack Dorsey’s Block will integrate bitcoin payments into Square.

- Circle blocked LIBRA‑linked stablecoins worth $58m.

- The head of MARA urged US authorities to mine bitcoin to build a bitcoin reserve.

- Media learned of Telegram’s plans to raise $1.5bn via bonds.

Bitmain unveils bitcoin miner with energy efficiency of 9.5 J/TH

Bitmain presented the first bitcoin miner with an energy‑cost ratio below 10 J/TH. The headline figure for the latest Antminer S23 Hydro series is 9.5 J/TH.

The hydro‑cooled device delivers 580 TH/s at a power draw of 5.51 kW.

Analysts noted the manufacturer is bringing the miner to market amid stagnant demand. The firm is offering flexible instalment plans with a 40% down payment and the option to pledge bitcoins as collateral.

Rival Bitdeer expects to come close to Bitmain’s flagship with the SEALMINER A3 launching in the fourth quarter. Rigs based on the SEAL03 chip are expected to deliver energy efficiency of 11 J/TH.

What else to read?

We teamed up with the bitcoin mixer Mixer.Money to examine the technical aspects of the intensifying dispute over lifting the data limit in OP_RETURN.

We looked at how account abstraction introduced by Ethereum’s Pectra upgrade has made life easier for hackers—and how to protect your funds.

We told the story of the mountain kingdom of Bhutan, long outside global trends and now building a digital future with bitcoin.

In our regular digest, we rounded up the week’s key events in cybersecurity.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!