Week in Review: murmurs of trouble at DCG, and Binance allocates $1 billion for industry recovery fund

Whispers about trouble at Digital Currency Group surfaced in the community as Binance earmarked $1 billion for a Web3 industry recovery fund, a court extended the detention of the Tornado Cash developer, and other events of the week.

Bitcoin price has risen above $16,500

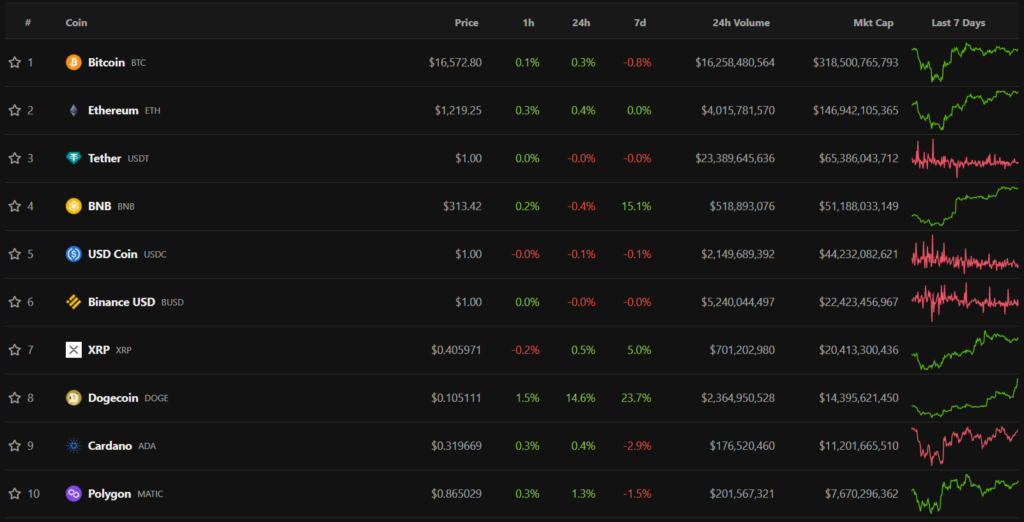

Since November 21, Bitcoin has traded in a narrow range of $15,470-$16,800. At the time of writing, the top cryptocurrency is trading near $16,570.

During the period under review, most top-10 by market capitalisation were in the red. However, some posted gains: Dogecoin rose nearly 24%, BNB Coin added 15%, XRP up 5%.

The combined market capitalisation rose to $880 billion. The Bitcoin dominance index fell to 36.2%.

What about FTX?

FTX owed $3.1 billion to its 50 largest creditors, according to court filings. Their names were not disclosed, though the largest claim stood at $226 million.

Japanese crypto exchange Liquid paused trading five days after withdrawals were halted amid an ongoing investigation into FTX’s activities. The latter had acquired Liquid and related entities in February of this year.

On November 24, Changpeng Zhao allowed the possibility of purchasing assets from Sam Bankman-Fried’s exchange. In his view, some of them may still be salvaged.

Reuters learned that his parents, he himself and top managers of organisations became owners of at least 19 premium real estate properties worth $121 million.

Against Bankman-Fried and the NBA’s Golden State Warriors filed a suit charging false advertising. At the end of the week Turkish authorities began an investigation into the founder of FTX on suspicion of fraud.

Whispers about DCG troubles surface amid FTX collapse

The Grayscale Investments management’s decision not to disclose reserves and Genesis Global Capital’s halt of OTC crypto-lending operations raised concerns about the resilience of the entire Digital Currency Group (DCG) group.

DCG, valued at about $10 billion, also includes the CoinDesk publication, the crypto exchange Luno acquired in September 2020, and the mining company Foundry. Foundry’s Bitcoin pool today remains leading and mines a quarter of the blocks in the Bitcoin network.

Grayscale had refused to disclose reserves, citing that assets were stored with custodian Coinbase. After several days, it went ahead with this step; however, parties have not provided detailed information for security reasons.

By the end of the week, media reported that a financially troubled crypto lender Genesis Global Capital had hired Moelis & Company to explore options, including bankruptcy. According to sources, a final decision has yet to be made, and the firm still has a chance to avoid insolvency filing.

Earlier, Binance reportedly refused to rescue Genesis Global Capital. A Wall Street Journal source said a potential conflict of interest between the exchange and the business model of the DCG subsidiary existed.

Binance allocated $1 billion for industry recovery fund

The cryptocurrency exchange Binance launched an Industry Recovery Initiative (IRI) aimed at

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!