Week in Review: New York financial regulator bans BUSD issuance, and the SEC files charges against Do Kwon

The New York State Department of Financial Services banned Paxos from issuing Binance USD, the SEC charged Terraform Labs founder Do Kwon, and Bitcoin’s price tested the $25,000 level, among other events of the week.

Bitcoin price tested the $25,000 level

In the evening of 16 February, the quotes of the first cryptocurrency surpassed the $25,000 mark, updating the high last seen in June 2022. At the time of writing Bitcoin was trading near $25,060.

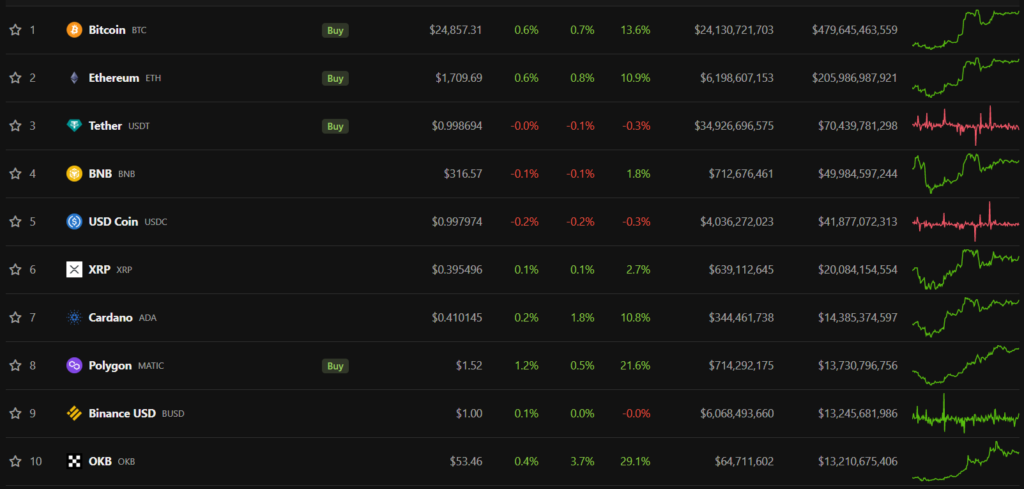

Practically all top-10 capitalized digital assets closed the week in the green. The best-performing asset was OKX’s exchange token OKB, whose price rose by almost 30%.

The total market capitalization of the cryptocurrency market stood at $1.18 trillion. Bitcoin’s dominance index rose to 40.5%.

New York financial regulator bars the BUSD issuer from issuing the stablecoin. A timeline

The New York Department of Financial Services (NYDFS) initiated an investigation into Paxos, the issuer of Pax Dollar (USDP) and Binance USD (BUSD).

The regulator ordered Paxos to stop issuing the latter. As a result Paxos said it would halt BUSD issuance in accordance with the regulator’s directives from February 21, but will continue supporting buyback and conversion operations at least until February 2024.

NYDFS explained that Paxos breached its obligation to conduct individual periodic risk assessments and update due diligence on Binance’s customers and the issued BUSD to prevent misuse of the platform by malefactors.

Simultaneously, media reports suggested that the U.S. Securities and Exchange Commission planned to file a lawsuit against Paxos. The regulator contends that BUSD is an unregistered security.

The negative news weighed on Binance Coin (BNB) — at one point the token’s price tumbled more than 10%, to below $300. In response to Paxos’ claims, media reported that PayPal was suspending development of its own stablecoin. The Aave lending protocol community will consider a proposal to freeze the use of Binance USD.

There were reports that Circle had filed the complaint with NYDFS; however Binance’s Changpeng Zhao expressed doubts. He noted that such a move by a competitor would also harm USD Coin (USDC), which the company co-issues. Zhao also said that recognizing BUSD as a security would have a strong impact on the entire sector, given that many jurisdictions look to the United States. He confirmed that Paxos must comply with the regulator’s requirements as it is regulated by NYDFS. He added that in the future the BUSD offering will shrink, and more stablecoins will appear on exchanges, including those pegged to alternative U.S. dollar currencies.

During an AMA session Zhao said the exchange would abandon using BUSD as the main trading pair, and predicted the fate of U.S.-based companies under regulatory pressure. Among countries with a favourable regulatory environment, he named the UAE, Bahrain and France.

At the end of the week, Binance’s Chief Strategy Officer Patrick Hillmann stated that the company expects to pay fines to settle claims in the United States.

Bloomberg also reported that Binance Holdings is considering ending ties with U.S. business partners amid intensifying regulatory scrutiny.

SEC files charges against Do Kwon

The U.S. Securities and Exchange Commission filed charges against Terraform Labs and its CEO Do Kwon for orchestrating a multi-billion-dollar fraud. The agency contends that the company sold a linked bundle of crypto asset securities—the algorithmic stablecoin TerraUSD (UST) and the token LUNA.

The regulator added that the Singapore-based company, together with its chief, misled investors by promising price appreciation and assuring their stability.

What about FTX and Sam Bankman-Fried?

The court uncovered the names of two guarantors for SBF’s $250 million bail. They were the former dean of the law school Larry Kramer, who signed obligations for $500,000, and senior research fellow Andreas Pepke ($200,000). The other two guarantors were SBF’s parents.

This week, Judge Lewis Kaplan prohibited Bankman-Fried from using a VPN after the former FTX chief admitted that he watched the Super Bowl via a private network while under house arrest. Kaplan also did not rule out the return of SBF to prison, given there are “reasonable grounds” to believe the former exchange chief attempted to pressure witnesses.

The court suspended consideration of two civil suits by the SEC and the CFTC against Bankman-Fried until the conclusion of the criminal case against him in the U.S. Department of Justice.

The liquidators of FTX’s Bahamas arm stated that the exchange’s unit commingled its own and customer funds, and kept a “limited” accounting. CEO John Ray pointed to the failure of corporate controls and the absence of reliable financial information in the past.

On February 14, the Delaware bankruptcy court authorized the sale of certain FTX assets categorized as De Minimis. The approval covers investments without encumbrances valued up to $1 million with initial investments not exceeding $5 million.

Additionally, FTX investors filed a lawsuit against venture capital and private investment firms, including Sequoia Capital, Thoma Bravo and Paradigm. Court documents indicate that in 2021 these firms promoted hundreds of millions of dollars in investments in FTX-related entities, creating an aura of legitimacy around them.

Glassnode links Bitcoin network overload to NFT appearance

Analysts at Glassnode stated that on-chain activity in the top cryptocurrency has risen in recent weeks. They linked this to the late January launch of the Ordinals protocol — NFTs on the Bitcoin blockchain, described by supporters of Bitcoin as an “attack on the network”.

Ordinals allow inscribing data into a Bitcoin block up to 4 MB. In anticipation of a new trend, supported by Bitcoin’s decentralization, users began flooding the blockchain with copies of Ethereum projects such as pixelated CryptoPunks and Rocks, audio files, various images and so on.

By mid-February, the number of NFTs on the Bitcoin blockchain issued via the Ordinals protocol surpassed 116,000 units.

Network activity led to mempool congestion and higher fees, and the average block size increased from a steady 1.5–2 MB to 3–3.5 MB. At the same time, miners’ revenue rose as a result.

What to discuss with friends?

- Elon Musk posted a photo of his dog Floki as the “new CEO of Twitter,” triggering a meme-cryptocurrency pump.

- Robert Kiyosaki predicted Bitcoin to reach $500,000 by 2025.

- Keanu Reeves called cryptocurrencies remarkable tools.

- Valentine’s Day poll: Binance customers described their appetite for cryptocurrencies as an attractive trait.

Blur vs. OpenSea

On 15 February, known in the community as Pacman, the head of Blur, urged NFT creators to ignore OpenSea and post collections on Blur’s curated NFT marketplace.

He noted that NFT creators cannot receive royalties on two platforms simultaneously — OpenSea’s policy blocks this. In response, Blur proposed several options:

- use both marketplaces. This would allow earning a minimal royalty (0.5%) on Blur, but would hinder earning royalties on the competitor’s platform;

- do away with auctions on Blur. The marketplace would pay creators a minimal 0.5%, while OpenSea would pay full royalties;

- opt out of OpenSea and use Blur. In this case the latter would also offer a full royalty model.

OpenSea called the initiative a “false choice” proposed to the community. The company migrated its platform to a model of optional royalties and temporarily waived fees. It also allowed content creators to list collections on alternative platforms.

Earlier Blur conducted an airdrop of the BLUR token, after which several leading exchanges including Coinbase, Huobi, Gate, KuCoin, Bybit and OKX confirmed listing.

The marketplace has been operating since October 2022. According to reports, Blur is in talks to raise funding that could propel it to unicorn status (a USD 1 billion valuation).

Bitzlato sets date to resume withdrawals

The Bitzlato platform, whose infrastructure was seized by the French prosecutor, conducted a technical audit as part of the announced resumption of operations.

By February 24, the service will revalue altcoin balances into Bitcoin at the rate on the day the service was halted (January 18). This step, as explained, is taken due to the technical impossibility of launching an exchange with multiple cryptocurrencies.

On March 1, Bitzlato will add the ability to withdraw up to 50% of deposits in digital gold. From March 14, users will be able to use the P2P service as a wallet for storing funds in Telegram. From April 2, the team will open the P2P service for cryptocurrency trading.

Journalists report on the murder of OneCoin founder Ruja Ignatova

The founder of the OneCoin crypto pyramid, Ruja Ignatova, was reportedly killed in November 2018 on a yacht in the Ionian Sea, the BIRD project said, citing police documents from Bulgaria.

According to the publication, within an unrelated to OneCoin murder investigation, police informants’ reports were obtained. Journalists obtained access to these documents. In a conversation with BIRD, Sofia deputy prosecutor Hristo Krasttev confirmed that the documents were indeed seized, but noted that his office does not regard them as evidence.

According to the released report, Ignatova was killed on orders of a certain Christoforos Amanatidis, whom BIRD calls a “drug lord.” The informant reportedly told the police.

BIRD suggests the crime was committed to conceal ties between Amanatidis and Ignatova.

Media: Mt. Gox top creditor chooses Bitcoin-based payout

According to Bloomberg, Mt Gox Investment Fund decided not to wait for the platform’s legal proceedings — which could last up to nine years. The choice to payout in cryptocurrency reduces the risk of forced selling and price pressure.

CoinDesk reports that a similar payout form was chosen by the now-defunct New Zealand crypto exchange Bitcoinica. Journalist Colin Wu calculated that this represents a fifth of all claims against the platform, or 28,000 BTC.

Also on ForkLog:

- Charles Munger criticised U.S. authorities for not banning cryptocurrencies.

- Mike Novogratz predicted Bitcoin at $30,000 by the end of March.

- Binance analysts calculated the share of “profitable” Ethereum stakers.

- Keanu Reeves called cryptocurrencies remarkable tools.

What else to read?

Forecasts for March 2023 point to a major Ethereum upgrade — Shanghai. ForkLog investigated how it could affect the price and prospects of the cryptocurrency, and whether investor concerns are warranted.

GMT Legal lawyers told ForkLog about the advantages and drawbacks of the popular among crypto companies Chapter 11 bankruptcy procedure in the United States.

The ForkLog AI team released a piece on the buzzworthy AI algorithm ChatGPT. They looked at what the service is, its strengths and weaknesses, and identified potential use cases.

In traditional digests, we gathered the week’s main events in cybersecurity and artificial intelligence and.

The cryptocurrency industry is attracting an increasing number of institutional players. This is reflected in new investments in infrastructure and the growing attention that companies are paying to Bitcoin as an asset class. The most important events of the last weeks are in ForkLog’s overview .

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!