Week in Review: Sam Bankman-Fried apologised for the FTX collapse, Finiko co-founder detained in the UAE

Sam Bankman-Fried apologised for the FTX collapse, Finiko co-founder detained in the UAE, Changpeng Zhao outlined the key requirements for crypto exchanges and other events of the week.

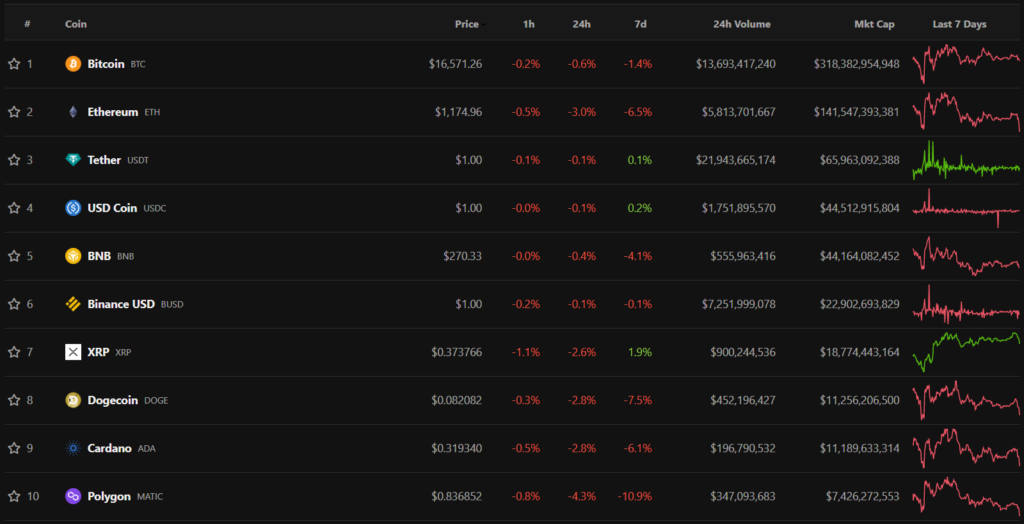

Bitcoin holds above $16,000

Over the period, Bitcoin prices returned to levels above $16,000. As of writing, the leading cryptocurrency was trading near $16,570.

During the period, almost all top-10 assets by market capitalization were in the red. The exception was XRP, whose price rose 1.9%.

Total cryptocurrency market capitalization fell to $858 billion. Bitcoin’s dominance rose to 37.1%.

FTX collapse — events of the week

At the start of the week, Glassnode analysts pointed to a record outflow of bitcoins from exchange balances to cold wallets in the wake of the FTX collapse. According to their calculations, the monthly pace reached 106,000 BTC. Such dynamics were characteristic of April and November 2020, as well as June-July 2022.

According to Crypto Fund Research, losses of crypto funds due to FTX bankruptcy may amount to up to $5 billion. The crisis affected 25-40% of sector investment structures that had invested in Bitcoin exchanges or their utility token FTT.

According to Nansen, about 86% of tokens were originally controlled by FTX and Alameda Research.

Paradigm reportedly wrote off its investment in the company, bringing the stake to zero. Temasek Holdings of Singapore and the Canadian pension plan Ontario Teachers’ Pension Plan did likewise. According to Circle, its investments in FTX Group equity amount to about $10.6 million.

In court filings, the operator of FTX reported having more than one million creditors. In Bloomberg they called returns to customers unlikely. Later, Bankman-Fried apologised for what happened and acknowledged that events could have unfolded more dramatically. He also disclosed information on the value of assets of the exchange and Alameda Research.

Lawyers interviewed by the press expressed pessimism about Bankman-Fried’s prospects and the fate of the ex-CEO. They say the US Department of Justice has what it takes to bring criminal charges against Bankman-Fried and other executives. A class-action lawsuit has already been filed against him.

Hack VC managing partner Alexander Pak, in turn, said of the ex-CEO’s “catastrophic” risk appetite. He said serious concerns about the founder’s methods were present even before the platform’s emergence.

Meanwhile, acting FTX CEO John Ray accused the former leadership of concealing improper use of customer funds and a “secret freeing of Alameda Research from certain aspects of the auto-liquidation protocol” on the platform.

According to the document, Euclid Way Ltd., controlled by Alameda Research, lent $2.3 billion to Paper Bird Inc., owned by Bankman-Fried. The venture firm also lent:

- $1 billion — to the head of the group;

- $543 million — to co-founder Nishad Singh;

- $55 million — to co-CEO Ryan Salame.

Additionally, Ray stated that the fair value of the digital assets of FTX Trading Ltd, which includes the global exchange FTX and other trading platforms registered outside the United States, stands at $659,000.

According to him, the FTX Group violated accounting rules. In particular, the exchange platform did not include client liabilities in its financial statements.

Amid the crisis, several industry participants pledged support for those affected by the FTX collapse. Funds were announced by Binance <\/span>, Bitget and OKX.

Meanwhile, Binance.US may bid for Voyager Digital assets in an auction. Previously, a creditor reached a preliminary agreement with FTX US.

Binance’s activity drew the attention of authorities. In Congress, lawmakers questioned Binance’s role in the FTX collapse. Later, the exchange confirmed receiving similar inquiries from regulators in several countries.

During the week, Kraken and Paxos reported freezes on FTX-linked assets.

On 15 November, the Bahamian Supreme Court granted the Securities Commission’s petition to appoint temporary liquidators for local FTX Digital Markets (FDM). In the same day, the company filed for bankruptcy protection in the Southern District of New York.

Subsequently, it emerged that the Bahamian regulator transferred all FDM assets to a wallet under its control.

Changpeng Zhao outlined the six key requirements for centralized exchanges and announced collaboration between giants of the industry and regulators

The head of Binance Changpeng Zhao named six key, in his view, requirements for centralized exchanges:

- do not put user funds at risk;

- never use native tokens as collateral;

- disclose asset information;

- maintain substantial reserves;

- avoid excessive leverage;

- strengthen and implement security protocols.

The head of Binance also stated that he plans to unite the industry’s major players to work with policymakers and regulators. The governance of the organisation would be entrusted to “a third party that has done this before in different areas”.

What else is happening around FTX?

- Coinbase forecasted a prolonged crypto winter due to the FTX collapse.

- The hacker who breached FTX entered the list of Ethereum whales.

- New FTX CEO urged not to rely on Bankman-Fried’s statements.

- The FTX collapse led to record hardware-wallet sales.

Auditors confirmed use of the LFG fund of $2.8 billion to rescue UST

The technical audit by JS Held showed that Luna Foundation Guard (LFG) spent about $2.8 billion of its reserve fund solely to defend the peg of the algorithmic stablecoin TerraUSD (UST).

Following the audit, experts arrived at the following conclusions:

- LFG spent 80,081 BTC and $49.8 million in stablecoins (~$2.8 billion) to defend the UST peg, in line with May 16 reports;

- Terraform Labs (TFL) similarly directed $613 million of its own capital to rescue the stablecoin.

On November 16, media reported searches at Chai Corporation, founded by Terraform Labs co-founder Daniel Shin. The charges allegedly relate to use of customers’ personal data without consent when launching a service based on Terra-linked stablecoin KRT.

1inch Network launched the fifth version of the liquidity-aggregating protocol with DEX

DeFi project 1inch Network launched the fifth version of the liquidity-aggregator protocol with DEX. Unlike 1inch Router v4, transactions will cost around 5% cheaper.

The new version applies a new interaction logic, and adds pre- and post-interactions.

Tim Draper maintains forecast of Bitcoin at $250,000

Venture investor and billionaire Tim Draper confirmed his forecast that Bitcoin would reach $250,000 by early 2023, despite the FTX crisis.

According to him, the collapse of Sam Bankman-Fried’s exchange “has nothing to do” with the success of the first cryptocurrency, because it is decentralised, and FTX is not.

What to discuss with friends?

- Prime Minister of Saint Kitts and Nevis allowed the legalisation of Bitcoin Cash.

- In China the hacker was sentenced to 10.5 years in prison for stealing 383 ETH.

- DeFi project Flare on BNB Chain was hacked for $17.9 million.

- CertiK experts uncovered the black market for KYC checks.

Genesis Global Capital suspended crypto-lending operations

The Genesis Global Capital crypto OTC platform froze withdrawals and new lending. This followed heightened client inquiries after the FTX collapse.

News that a rival, B2C2, made an offer to acquire Genesis’s loan portfolio, worth around $2.8 billion. The platform’s founder Max Boonen noted that the decision was made “not out of altruism”.

Report: Ukrainian Web3 startups raised $1bn over four years

Since 2017, Ukraine has launched more than 80 Web3 startups, which have collectively attracted around $1 billion in investments over the past four years, according to a Hypra venture fund report.

Leaders by funding are the Solana team and NEAR Protocol developers — they received $315.8 million and $524 million respectively.

On 14 November, the cross-faction group Blockchain4Ukraine and the public association “Virtual Assets of Ukraine” signed a roadmap for applying blockchain and Web3 technologies in the country.

Vitalik Buterin proposed using zk-SNARKs to verify exchange balances

Ethereum founder Vitalik Buterin proposed to use zk-SNARKs to verify reserve-data of crypto exchanges. In his view, the technology would make the Proof-of-Reserve (PoR) process more efficient.

In his view, ideally there should be a system that would prevent an exchange from moving client funds without their consent. He stressed that the zk-SNARKs technology could help achieve this goal.

The Ethereum founder called the Merkle Tree Proof-of-Reserves “as good as it can be” a scheme for proving liabilities. He also noted that the model has privacy-related issues.

Co-founder of Finiko detained in the UAE

Finiko co-founder Zygmunt Zygmuntovich was detained in the United Arab Emirates on 6 September. The information was also confirmed by the Russian Prosecutor-General’s Office. The agency has already issued a request for his extradition.

He is accused of fraud and involvement in a criminal group.

Also on ForkLog:

- Grayscale GBTC discount reached a record 42%.

- Analysts pointed to hodlers’ resilience and miner stress amid the FTX collapse.

- WSJ: the crypto-lending platform BlockFi will file for bankruptcy.

- Top executives of Bitcoin companies gave forecasts for the market after the FTX collapse.

What else to read?

In an exclusive piece, we explored how a trader can avoid one of the psychological traps, recognise destructive behaviour and protect themselves from impulsive actions.

In traditional digests, we gathered the week’s main events in cybersecurity and artificial intelligence.

The DeFi sector continues to attract heightened attention from crypto investors. ForkLog has compiled the most important events and news of the recent weeks in the digest.

Read ForkLog’s bitcoin news in our Telegram — cryptocurrency news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!