Week in Review: Tesla Begins Selling Merch for DOGE, and Russia Proposes Identifying Crypto Holders

Tesla began accepting Dogecoin in its online store, two solo miners mined blocks on the Bitcoin blockchain, and Alexander Bastrykin, head of Russia’s Investigative Committee, proposed identifying cryptocurrency holders, among other developments of the past week.

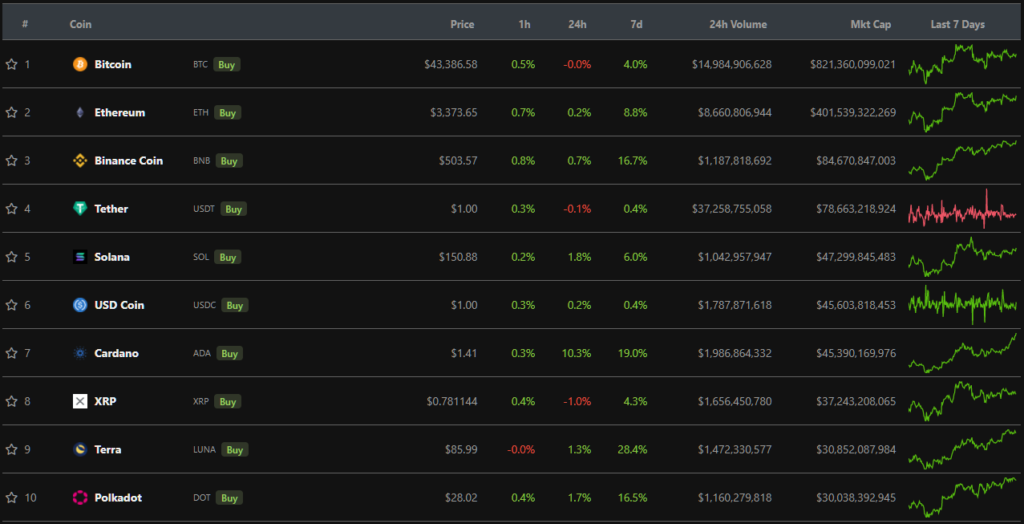

Bitcoin price dipped below $40,000

On January 10, the price of Bitcoin dipped to $39 650 (on Binance). The ensuing rebound allowed the quote to rise above $44 000. However, Bitcoin could not sustain above this level.

As of writing, the primary cryptocurrency was trading around $43 400.

Against the backdrop of a partial recovery in Bitcoin quotes, all top-10 assets by market cap closed the week in the green. Terra led the gains (+28%), followed by Cardano (+19%), Binance Coin (+16%) and Polkadot (+16%).

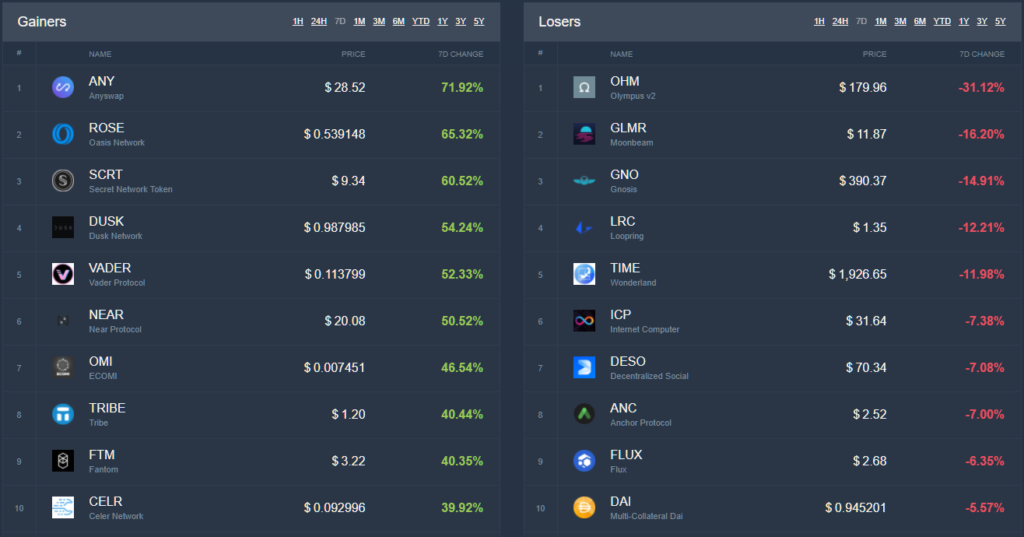

According to CoinCodex, over the week the biggest gainer among digital assets was the cross-chain protocol Multichain (formerly Anyswap) ANY. Its price rose 71%. The project no longer supports the asset, but holders can convert it into the new native token MULTI.

The OHM token, Olympus v2’s algorithmic token, fell the most, down 31%.

The total cryptocurrency market capitalization stood at $2.2 trillion. Bitcoin’s dominance fell to 37.1%.

The first Bitcoin transaction turns 13 years old

On January 12, 2009, the creator of Bitcoin, under the pseudonym Satoshi Nakamoto, made the first transaction in the cryptocurrency, sending 10 BTC to cryptographer Hal Finney.

Elon Musk says Tesla has begun selling merch for Dogecoin

Tesla began selling certain goods for Dogecoin (DOGE). Some products on the automaker’s website can be purchased only with cryptocurrency. At this stage, buyers do not have the option to choose the form of payment.

The support page notes that the company accepts payment exclusively in DOGE. Tesla does not support other digital assets and warns that senders of incorrect transfers will lose their money.

Against this backdrop, Dogecoin rose about 30%, to $0.214. In the 24 hours before the announcement, an unknown user purchased 8 million DOGE for $1.4 million.

Solo miners earned 6.25 BTC for finding a block

On January 11, an anonymous Bitcoin miner with a hashing power of 126 TH/s mined block 718 124 on the Bitcoin blockchain. The CKPool administrator, to which the devices are connected, reported. The probability of finding a block at the current hash rate was 0.000073%.

January 13 saw the story repeat with another CKPool user. He mined block 718 379 on the Bitcoin blockchain with a hashing power of 116 TH/s. Notably, the miner used the service for only two days.

Russia’s Investigative Committee calls for mandatory identification of cryptocurrency holders

Cryptocurrency holders should not remain anonymous due to the risks of such assets being used for criminal purposes. This was stated by Alexander Bastrykin, head of Russia’s Investigative Committee.

Meanwhile, the National Financial Association advocated reconsidering the question of a blanket ban on Russians’ investments in digital assets.

Tether blocked three Ethereum addresses with assets of more than $160 million

Tether added three Ethereum addresses to the blacklist at the request of law enforcement authorities. The total value of assets in USDT on those addresses exceeded $160 million — transfers from these wallets are blocked.

Dozens of thousands of Bitcoins moved from BTC-e to Coinbase on Vinnyk’s arrest day

Unknown actor withdrew 66 143 BTC from the hot wallet of the BTC-e exchange to Coinbase. This was reported by Indefibank CEO Sergei Mendeleev. The transaction took place on July 25, 2017, the day of the arrest of BTC-e’s alleged co-owner Alexander Vinnyk. According to Mendeleev’s investigation, from the Coinbase wallet, using a pre-written script, the funds were dispersed in small parts to thousands of wallets.

NEAR Protocol and SEBA Bank attracted financing in new rounds

On January 13, the native NEAR Protocol (NEAR) token hit a historic maximum amid the announcement of a new funding round of $150 million led by Three Arrow Capital. The project was also supported by Andreessen Horowitz, Alameda Research, Dragonfly Capital and other investors.

Also this week SEBA, the licensed cryptocurrency bank from Switzerland, announced raising $120 million in a Series C round.

Jack Dorsey’s company will form a team to develop a Bitcoin miner

Block (formerly Square) by Jack Dorsey opened vacancies in teams to develop a next-generation ASIC miner and hardware wallet for the next 100 million Bitcoin users.

This week Dorsey also announced the creation of a fund to defend Bitcoin developers in court. The organisation is prepared to provide lawyers, develop defense strategies and cover legal costs so they can continue their work.

Group of US banks forms consortium to issue a stablecoin

The group of FDIC-insured financial institutions in the US USDF Consortium announced plans to create a network of banks to promote the stablecoin USDF issued by its members.

The consortium aims to address opacity of reserves of non-banking structures like Tether. The implementation of a banking alternative will use the Provenance blockchain.

Visa says it is ready for small businesses to integrate crypto payments

In 2022, nearly a quarter of small businesses in nine countries plan to accept digital currencies as a form of payment. This follows Visa’s survey of 2,250 small business owners in Brazil, Canada, Germany, Hong Kong, Ireland, Russia, Singapore, the United Arab Emirates and the United States.

At the same time, Visa is working with ConsenSys on infrastructure to help central banks and financial institutions create user-friendly services on top of CBDC networks.

Vitalik Buterin asks followers about Ethereum alternative

Vitalik Buterin conducted a poll on his Twitter, asking what the most popular currency in 2035 will be, excluding Ethereum.

“You wake up in 2035, and 80% of the world’s transactions and savings are conducted in one currency, and it is not ETH. What do you think that currency will be?”, — he wrote.

The winner of the poll was Cardano. The company behind Cardano’s development, IOHK, also said it plans to develop the project in 2022.

Also on ForkLog:

- Morgenshtern invested in Toncoin 10 million rubles and mentioned the Open Network project in a new clip.

- Bloomberg valued the head of Binance, Changpeng Zhao, at $96 billion.

- FSB reported the dissolution of the REvil hacker group.

- The USDC on Ethereum surpassed USDT for the first time.

What else to read and watch

In 2021, Bitcoin and Ethereum reached new all-time highs, total market capitalization exceeded $3 trillion, alternative L1 networks strengthened, and liquidity in the DeFi sector grew 13-fold to $245 billion.

Presenting ForkLog’s annual report on key changes in industry segments.

Sponsored by the “Bitcoin industry in numbers” — the global blockchain ecosystem Binance.

We reviewed the most notable airdrops of 2021. We found out which tokens yielded the greatest profits for holders, and looked at whether to stick with the HODL strategy after airdrops.

In traditional digests we collected the main weekly events in cybersecurity and and artificial intelligence .

The cryptocurrency industry continues to attract more institutional players. This is reflected in new investments in infrastructure and the growing attention that companies devote to Bitcoin as an asset class. The most important events of the past weeks are in ForkLog’s review.

On January 10, in a ForkLog LIVE broadcast with Tone Vays, they summed up 2021 and discussed what comes next.

Read ForkLog’s Bitcoin news on our Telegram — cryptocurrency news, rates and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!