Weekly Highlights: Bitcoin Halving and BTC-ETF Approval in Hong Kong

The Bitcoin network experienced its fourth halving, Hong Kong approved spot ETFs based on the leading cryptocurrency and Ethereum, Pavel Durov gave an interview to Tucker Carlson and spoke at Token2049, among other events of the past week.

Bitcoin Ends the Week at $65,000

The leading cryptocurrency began the week at $64,000. On April 15, Bitcoin rose above $66,000, but the next day it plummeted to $60,000. By April 17, digital gold had recovered to $63,700. On April 18, the leading cryptocurrency fell again to $61,000, but returned to the $65,000 level the same day.

At the time of writing, Bitcoin is trading at $65,000.

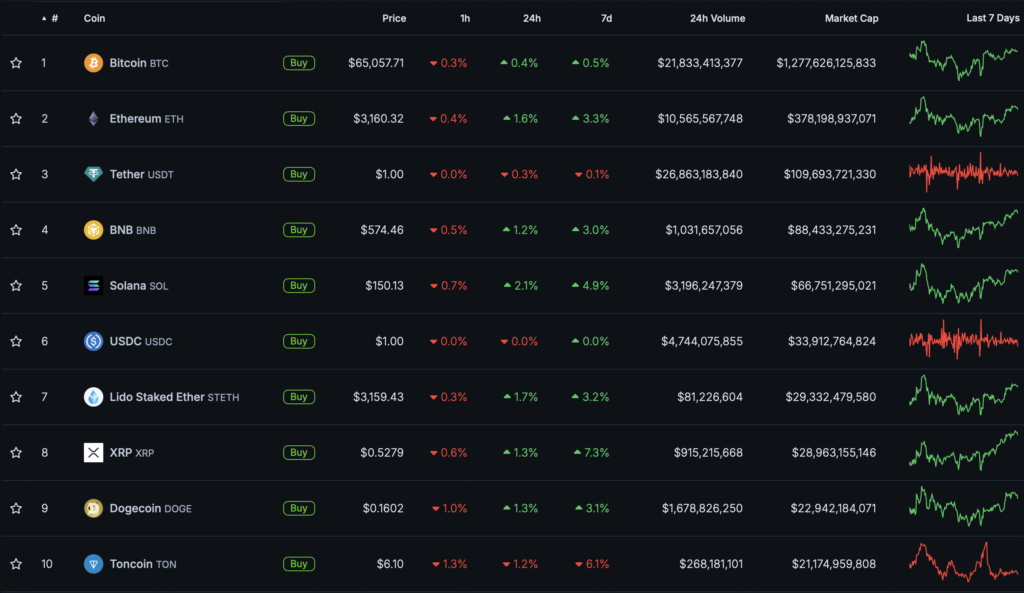

Most digital assets in the top 10 by market capitalization ended the week in the “green zone.” The exception was Toncoin (-6.1%).

The total cryptocurrency market capitalization stands at $2.5 trillion. Bitcoin’s dominance index is 55.1%.

Bitcoin’s Fourth Halving Occurs

On April 20, at block height #840,000, Bitcoin’s fourth halving took place. The block reward was reduced from 6.25 BTC to 3.125 BTC.

The block was mined by the ViaBTC pool. The mining difficulty of the leading cryptocurrency was 86.39 T.

Users paid 37.6256 BTC (about $2.4 million) in fees to include 3050 transactions in Bitcoin’s halving block #840,000.

Amid the halving and the launch of Runes, fees in the leading cryptocurrency’s network soared above $200.

Hong Kong Regulator Approves Spot Bitcoin and Ethereum ETFs

The Hong Kong Securities and Futures Commission approved applications from Boshi International, HashKey Capital, China Asset Management, and Harvest Investment to launch spot Bitcoin and Ethereum ETFs.

According to Matrixport’s calculations, demand for local exchange-traded funds based on the leading cryptocurrency will reach $25 billion.

Topics to Discuss with Friends

- A miner moved bitcoins worth $3.3 million that had been “dormant” for nearly 14 years.

- Trust Wallet developers warned of an iOS vulnerability.

- The Open Network launched a hub for meme coins called Memelandia.

- DEX Drift on Solana will launch a governance token and conduct an airdrop.

Pavel Durov Interviewed by Tucker Carlson and Speaks at Token2049

Telegram founder Pavel Durov stated in an interview with American journalist Tucker Carlson that he solely owns the messenger and keeps part of his savings in Bitcoin.

According to Durov, he initially rejected the idea of attracting venture capital for Telegram’s development to maintain independence — “the company’s goals and mission may conflict with the priorities of investment funds.”

Moreover, the businessman admitted that he never thought about money in the context of Telegram, as it does not align with his lifestyle.

“I have several hundred million dollars in a bank account, bitcoins bought 10 years ago, but I do nothing with them. I don’t spend them on real estate, planes, or yachts,” Durov said.

His main priority is freedom, and acquiring things “ties you to a physical location.” Additionally, he prefers to focus on work and the development of Telegram.

“I want to make decisions that will affect the communication of a billion people, not choose the color of seats in a house,” the businessman noted.

The only external funds the messenger received were from bond issuance and the launch of the Telegram Open Network (TON) cryptocurrency project. There was never any talk of selling a stake in the company.

According to Durov, Telegram currently does not plan an IPO, although such a possibility is not ruled out in the future. The messenger’s team is currently aiming to reach 1 billion monthly users within a year.

Durov describes Telegram’s growth as “organic.” Users love the product for its features, speed, and security, and recommend it to friends, comparing it to other services. According to Durov, others are still copying what Telegram implemented six years ago.

The businessman also spoke about pressure on the messenger from governments of various countries. Some requests were legitimate — concerning groups promoting violence or terrorist activities. Others crossed the line — infringing on freedom of speech and privacy. Telegram ignores the latter.

Additionally, the FBI attempted to recruit one of the messenger’s engineers to embed certain tools in the code, which would evidently become backdoors.

On April 19, during the Token2049 conference in Dubai, Durov announced Toncoin payments to content creators and the ability to purchase goods with cryptocurrency.

On the same day, the issuer of the stablecoin USDT — Tether — added support for the TON network.

Also on ForkLog:

- Boston Dynamics unveiled a new type of Atlas robots.

- Binance announced the launch of the Megadrop platform.

- Notcoin postponed its listing date.

- Avail will distribute 600 million AVAIL as part of an airdrop.

Animoca Brands Founder Predicts Bitcoin at $1 Million

Animoca Brands founder Yat Siu stated that he has no doubt the price of the leading cryptocurrency will reach $1 million.

“I believe Bitcoin can eventually reach over a million dollars. But I’m confident — not because it’s a store of value, but because it will become one of the most important status symbols of the digital economy,” he said.

According to Siu, the accessibility of financial blockchain services and Web3 games is more important than the entry of major players from traditional finance into the industry. He noted that in places like the Philippines or some Latin American countries, “millions of people” lack access to banking services and even education.

What Else to Read?

This week, ForkLog explained how to recognize AI manipulation on the internet.

In the traditional digest, we compiled the main events of the week in the field of cybersecurity.

The cryptocurrency industry is attracting an increasing number of institutional players. This is evidenced by new infrastructure investments and the growing attention companies are paying to Bitcoin as an asset class. The most important events of recent weeks are in ForkLog’s review.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!