Weekly Highlights: Bitcoin Reaches $93,000, Elon Musk to Lead DOGE

Bitcoin surged past $93,000, US inflation met expectations, Elon Musk is set to lead DOGE, MicroStrategy acquired 27,200 BTC for $2.03 billion, and other notable events of the past week.

Bitcoin Price Hits New ATH at $93,000

The leading cryptocurrency began the week below $80,000 but quickly gained momentum. By Monday, November 11, digital gold tested $85,000, continuing its ascent the following day to approach $90,000. On Wednesday, November 13, the asset reached a new ATH above $93,000.

At the time of writing, Bitcoin is trading at $90,400.

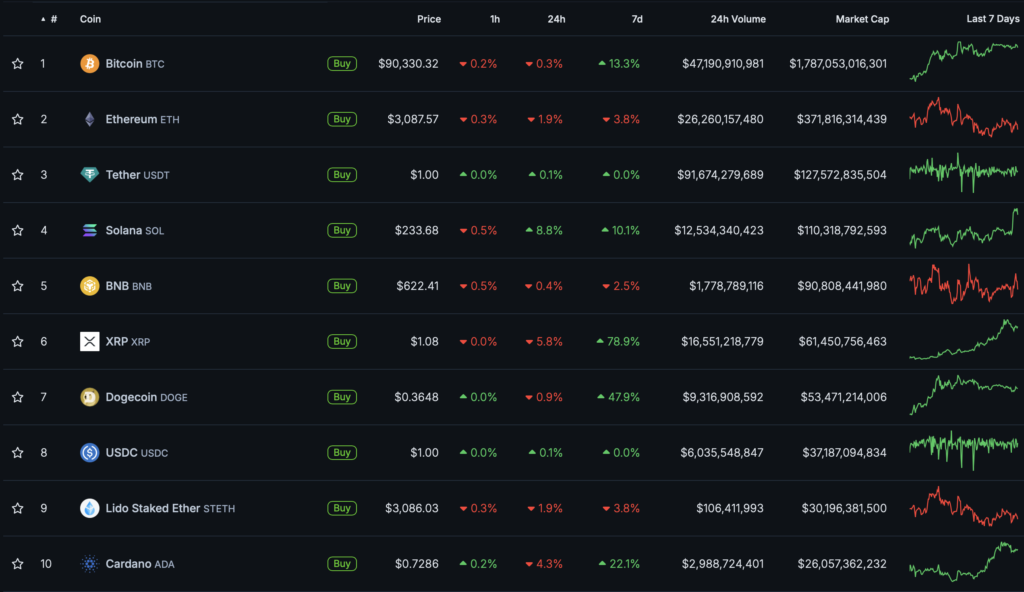

Most top-10 digital assets by market capitalization ended the week in the “green zone.” XRP (+78.9%) and Dogecoin (+47.9%) saw the largest gains.

The total cryptocurrency market capitalization stands at $3.17 trillion. Bitcoin’s dominance index is 60.2%.

US Inflation Meets Expectations

In October, the annual inflation rate in the US was 2.6%, up from 2.4% the previous month. This figure matched market expectations of 2.6%.

On a monthly basis, the consumer price index rose by 0.2%, consistent with September. The consensus forecast anticipated a 0.2% increase.

Excluding food and energy prices, the index rose by 0.3% from the previous month and by 3.3% compared to October last year. The previous report showed values of 0.3% and 3.3%, respectively. Analysts expected September’s pace to continue.

Prices for services excluding housing and energy rose by 0.31% after increasing by 0.4% in September, 0.33% in August, 0.21% in July, and declining by 0.05% and 0.04% in May-June.

Elon Musk to Lead DOGE

Billionaire Elon Musk and former US presidential candidate Vivek Ramaswamy will head the new Department of Government Efficiency (DOGE) under the US government.

Their task will be to reform the government to reduce administrative costs and combat bureaucracy. DOGE will employ an “entrepreneurial approach” and offer a fresh perspective on the US government apparatus.

This will involve abolishing some government structures and reducing staff in others. The necessary reforms are promised to be completed by July 4, 2026, marking the 250th anniversary of US independence.

Topics to Discuss with Friends

- A trader lost $25.8 million due to an address error.

- Whales profited millions from the PEPE meme coin surge.

- XRP’s price exceeded $1 for the first time in three years.

- The meme token PNUT quadrupled in price in a day.

MicroStrategy Acquires 27,200 BTC for $2.03 Billion

Between October 31 and November 10, MicroStrategy purchased an additional 27,200 BTC for $2.03 billion (at ~$74,463 per coin). This was announced by the company’s founder, Michael Saylor.

As of November 11, the firm holds 279,420 BTC, acquired for $11.9 billion at an average rate of $42,692. At the time of writing, these assets are valued at $22.87 billion.

Saylor also stated that creating a strategic reserve in Bitcoin is “the best deal of the 21st century.” He expressed confidence that such a structure will emerge in the US.

“Welcome to the Bull Market.” Bernstein Urges Crypto Asset Purchases

Analysts from brokerage firm Bernstein urged investors to “add crypto assets to their portfolios as soon as possible.”

“Don’t fight it. Welcome to the bull market. Buy everything you can,” experts noted in a client note led by Gautam Chhugani.

He urged all investors who previously refrained from investing in crypto assets due to regulatory issues to reconsider after the US elections.

The expert anticipates a crypto-friendly regulatory environment under Donald Trump, starting with the appointment of a new chairman of the US Securities and Exchange Commission.

Also on ForkLog:

- A “dormant” address for 14 years moved bitcoins worth $180 million.

- NFT project Doodles partnered with McDonald’s.

- Tesla’s bitcoin holdings exceeded $1 billion.

- In Thailand, a Ukrainian was forced to transfer 250,000 USDT.

Bitwise CIO: Bitcoin’s “Early Stage” Ends at $500,000

A price of $500,000 will signify Bitcoin’s transition to maturity; until then, the first cryptocurrency remains in its “early stage.” These insights were shared by CIO of Bitwise, Matt Hougan.

“In my view, $500,000 per coin is the right boundary between the early and late stage for a very simple reason: it’s the point at which Bitcoin becomes ‘mature’,” the expert noted.

He also reminded that governments worldwide continue to accumulate debt and devalue their currencies, increasing demand for gold and cryptocurrency.

What Else to Read?

This week, ForkLog explored who “white hats” are and how they protect the blockchain industry, how miners become speculators and the risks this poses to the market, as well as what scaling solutions should look like in 2025.

The traditional digest compiled the week’s main events in the field of cybersecurity.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!