Weekly Highlights: Durov’s Detention and New Lawsuit Against Binance

A new class-action lawsuit has been filed against Binance and Changpeng Zhao, the Fed chairman has expressed readiness to lower the key rate, Harris’s campaign has confirmed her intention to support the crypto industry, among other events of the past week.

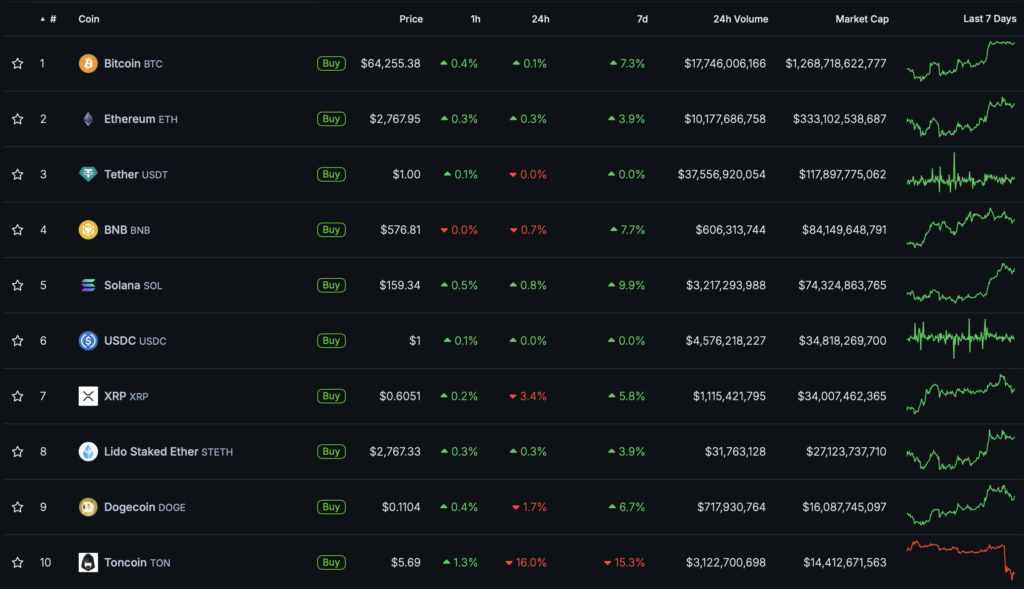

Bitcoin Price Surpasses $64,000

The leading cryptocurrency started the week at $60,000 but fell below $58,000 on Monday, August 19. In the following days, digital gold traded in the range of $59,000–$61,000.

On the night of Saturday, August 24, the asset’s quotes surpassed the $64,000 level. The leading cryptocurrency approached $65,000 but did not break the psychological mark.

At the time of writing, Bitcoin is trading at $64,200.

Most digital assets in the top 10 by market capitalization ended the week in the “green zone.” The exception was Toncoin (-15.3%).

The total cryptocurrency market capitalization is $2.36 trillion. Bitcoin’s dominance index is 57.3%.

Media: Pavel Durov Detained in France

According to French media, Telegram founder Pavel Durov was detained at Le Bourget airport in Paris. He may face numerous charges, including terrorism, drug trafficking, fraud, and money laundering.

Sources suggest that the French court believes the lack of thorough moderation on Telegram and the platform’s unwillingness to cooperate with law enforcement make Durov an accomplice to crimes committed via the messenger.

The detention of the billionaire was criticized by Tesla and SpaceX founder Elon Musk, Ethereum co-founder Vitalik Buterin, journalist Tucker Carlson, and others. TON and the Telegram Wallet promised to continue operations.

New Class-Action Lawsuit Filed Against Binance and Changpeng Zhao

A lawsuit has been filed in the federal court in Seattle against Binance and its founder Changpeng Zhao. According to the statement, three crypto investors failed to recover stolen assets because the exchange could not prevent money laundering.

The document states that the perpetrators stole cryptocurrencies from the plaintiffs and subsequently used the platform to withdraw funds. The prosecution claims that Binance was aware of and to some extent encouraged these actions as part of its profitable business model.

Investor representatives are convinced that the exchange was a significant part of the laundering process and effectively participated in racketeering, violating the RICO Act. The latter implies triple damages, noted ConsenSys lawyer Bill Hughes.

According to the expert, the plaintiffs’ lawyers are well-qualified. They represented groups that filed lawsuits against Facebook for privacy violations and Wells Fargo for fraudulent accounts.

This week, Binance CEO Richard Teng also stated that the company is in a stable financial position and is not considering an IPO.

What to Discuss with Friends?

- Elon Musk outplayed Trump’s proposal with a Dogecoin reference.

- McDonald’s Instagram account was hacked to promote a fake meme coin.

- The DOGS team warned about a fake meme coin listing on exchanges.

- About 12,000 BTC “disappeared” from USDD reserves.

Fed Chairman Signals Readiness to Lower Key Rate

During a speech in Jackson Hole, Wyoming, Fed Chairman Jerome Powell stated that “the time has come to lower the rate.” The pace of monetary policy easing will depend on economic indicators.

The next meeting is scheduled for September 18. Market participants expect a 0.25% rate cut with a 64% probability, and a 0.5% cut with a 36% probability.

A rate cut is considered a positive signal for financial markets and cryptocurrencies in particular, as the Fed provides greater liquidity, which can be directed towards asset purchases.

Harris Campaign Confirms Support for Crypto Industry

Democratic presidential candidate Kamala Harris intends to support measures for the development of digital assets by developing regulatory rules. This was stated by her advisor Brian Nelson.

A representative of Harris’s team noted that if elected, the politician will create conditions for “further growth of new technologies and industries of this kind.”

Nelson emphasized that the administration will bring clarity to the regulatory landscape of the Web3 industry, moving away from the uncertainty and ambiguity associated with it during Gary Gensler’s chairmanship at the SEC.

Also on ForkLog:

- Donald Trump supported his sons’ crypto project.

- Ethereum Foundation transferred 35,000 ETH to Kraken.

- Tether will launch a stablecoin pegged to the UAE dirham.

- Glassnode: 74% of bitcoins have moved into the “hodling” category.

Report: 77% of Hacked Cryptocurrencies Did Not Recover in Price

Most hacked cryptocurrencies are unable to recover their price after an exploit. This is stated in a report by Immunefi.

Over 77.8% of projects attacked by hackers experienced a sustained negative impact on the price of their native coin within six months after the incident.

Moreover, 51.1% of such tokens lost more than 50% of their value within six months.

According to Immunefi founder and CEO Mitchell Amador, hacked protocols bear most of the damage after the attack:

“Millions lost due to a hack immediately lead to even greater losses caused by market impact and dependency [on other projects], as well as many months spent restoring your emotionally shattered team and operational activities.”

However, some cryptocurrencies become more successful after a hack. According to Amador, tokens with more established teams belonging to large projects are historically more resilient to exploits.

Opinion: Ethereum Will Surpass Bitcoin in Market Capitalization Within Five Years

Ethereum will eventually overtake the leading cryptocurrency in market capitalization. This will happen in the next five years, said 1confirmation founder Nick Tomaino.

He noted that Bitcoin’s current market capitalization is approximately $1.2 trillion, which exceeds the second cryptocurrency’s figure by about four times ($321 billion).

“I believe both [assets] will continue to grow, but ETH will eventually surpass BTC. The reason is simple. Bitcoin has a straightforward narrative (digital gold) that institutions are already involved in. Ethereum has been the most influential blockchain in the industry over the past five years, but it is not fully understood,” wrote Tomaino.

According to the expert, with Ethereum, the world’s most talented developers are building a decentralized internet, powered by digital oil in the form of ETH. It is a scarce, income-generating, and useful asset.

What Else to Read?

This week, ForkLog explained how decentralized prediction markets work.

The traditional digest compiled the main events of the week in the field of cybersecurity.

The cryptocurrency industry is attracting an increasing number of institutional players. This is evidenced by new investments in infrastructure and the growing attention companies are paying to Bitcoin as an asset class. The most important events of recent weeks are in ForkLog’s review.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!