Weekly Recap: Apologies from Changpeng Zhao and Tether’s Stance on Sanctions

Bitcoin mining difficulty reached a new high, US prosecutors demanded a 36-month prison sentence for Changpeng Zhao, Tether announced plans to block payments circumventing sanctions, and other events of the past week.

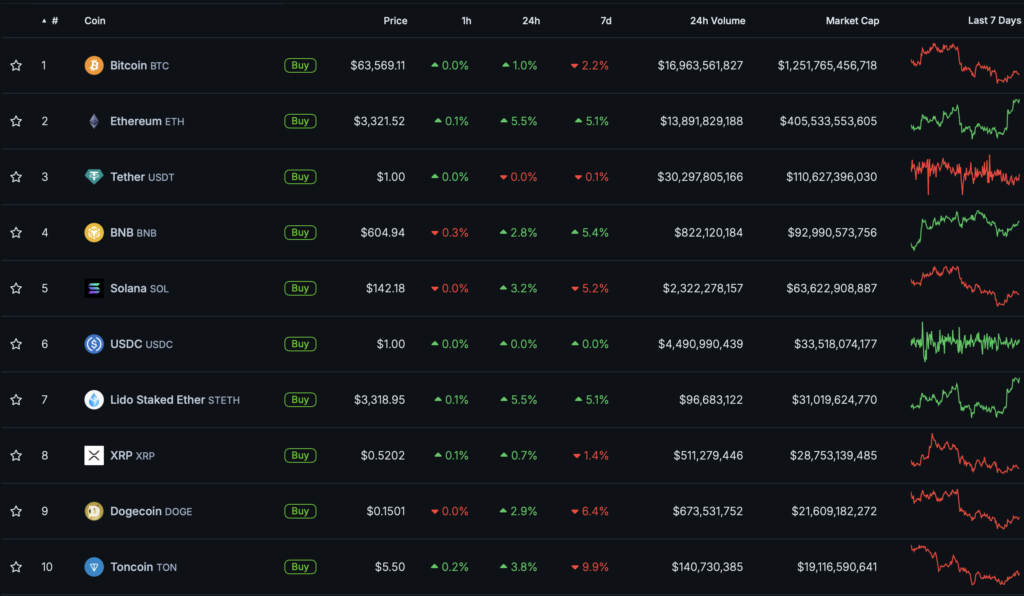

Bitcoin Price Falls to $63,000

The leading cryptocurrency began the week below $65,000. On Tuesday, April 23, digital gold surged to $67,000, only to plummet to $64,000 the following day.

At the time of writing, Bitcoin is trading at $63,600.

Most digital assets in the top 10 by market capitalization ended the week in the “red zone.” Exceptions were Ethereum (+5.1%) and BNB (+5.4%).

The total cryptocurrency market capitalization stands at $2.5 trillion. Bitcoin’s dominance index is 54.1%.

Bitcoin Mining Difficulty Hits New High Post-Halving

Following the latest recalculation, the difficulty of mining the first cryptocurrency increased by 1.99%, reaching a record high of 88.1 T.

The average hash rate since the previous adjustment was 726.3 EH/s.

According to Glassnode, the smoothed 7-day moving average reached a peak of 649.6 EH/s on the eve of the halving on April 20. After the block reward reduction, it slightly adjusted to 638 EH/s.

US Prosecutors Demand 36-Month Sentence for Changpeng Zhao

Binance founder and former CEO Changpeng Zhao (CZ) is to serve 36 months in prison after pleading guilty to violating anti-money laundering laws, according to a US prosecution motion.

Federal guidelines in Zhao’s case provide for a maximum sentence of 18 months. Prosecutors previously indicated their intention to seek a harsher sentence, with discussions of up to 10 years.

CZ apologized for “poor decisions” and accepted “full responsibility” for his actions in a letter to the judge.

“There is no excuse for my failure to establish necessary compliance controls at Binance,” Zhao wrote to Judge Richard Jones.

He assured that this would be his “only encounter with criminal justice.”

In addition to Zhao’s motion, the court received 161 letters requesting leniency from family members, friends, and others. Support also came from Binance co-founder and mother of his three children, He Yi.

His sister, Jessica Zhao, a former managing director at Morgan Stanley, noted that CZ made mistakes but did not allow client funds to be misused, as happened at FTX.

Topics to Discuss with Friends

- The founder of Notcoin announced a new listing date.

- A Telegram username bought for $80,000 was gifted to Pavel Durov.

- The meme inscription “Buy Bitcoin” sold for 16 BTC.

- An airdrop of two meme tokens covered the pre-order cost of Solana’s Web3 smartphone.

Tether to Block Payments Circumventing Sanctions

Tether will block wallets of organizations and individuals with USDT that have been sanctioned by the US Treasury. Any payments in their favor will be frozen.

A Tether representative emphasized that the company remains committed to halting transactions to addresses on the SDN list of the OFAC and aims to ensure their prompt blocking.

The statement followed reports that Venezuela’s state oil company PDVSA used USDT to bypass sanctions.

Jack Dorsey’s Block Develops Bitcoin Mining Chip

Jack Dorsey’s payment company Block has completed the development of a 3-nm chip for mining the first cryptocurrency. In the fall, the firm received the necessary silicon wafers from a manufacturing partner.

The company is now working on creating a full-fledged Bitcoin mining system based on its chip.

The team noted that as the program progressed, they spent “a significant amount of time” communicating with miners to identify technical issues they face.

“Based on this information and in line with our goal of supporting mining decentralization, we plan to offer both a standalone mining chip and a complete system of our own design,” the developers emphasized.

The production of devices will be handled by an unnamed “well-capitalized mining equipment supplier,” according to the statement.

Also on ForkLog:

- A trader earned $23 million on meme tokens.

- Fees on the TON network decreased by 2.5 times.

- Justin Bieber’s NFT investments depreciated by 95%.

- One day brought a trader a 1025-fold increase in assets.

Journalists Reveal Bitcoin ETF Trading Date in Hong Kong

Trading of the spot Bitcoin ETF launched by Bosera Capital and HashKey Capital on the Hong Kong Stock Exchange will begin on April 30.

On April 15, the Hong Kong Securities and Futures Commission approved applications from Boshi International, HashKey Capital, China Asset Management, and Harvest Investment to launch spot Bitcoin and Ethereum ETFs.

According to analyst Rebecca Sin, inflows into this category of products could reach $1 billion within two years.

Bloomberg analyst Eric Balchunas stated that cryptocurrency ETFs listed in Hong Kong would be “lucky” to collectively attract $500 million. The expert called Matrixport’s projected $25 billion “madness.”

What Else to Read?

This week, ForkLog explained what Proof-of-Personhood is and whether Bitcoin can protect wealth from devaluation.

In traditional digests, we compiled the week’s main events in cybersecurity and artificial intelligence.

The most important news from cryptocurrency industry participants was collected in a separate digest.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!