Weekly Recap: SEC Ends Ethereum Probe, Notcoin Shifts Focus

The SEC has concluded its investigation into Ethereum’s status, MicroStrategy has acquired an additional 11,931 BTC, Notcoin is abandoning its clicker game concept, the Winklevoss twins have donated $2 million in Bitcoin to Trump, and other notable events from the past week.

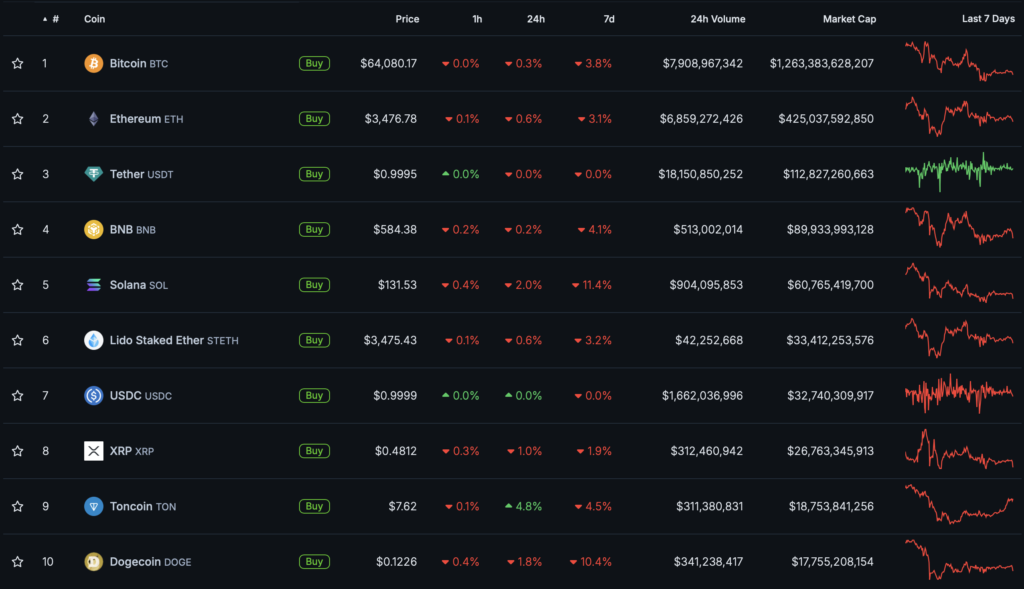

Bitcoin Price Falls to $64,000

The leading cryptocurrency began the week above $66,000, but by Monday, June 17, it had dropped to $65,000. By Friday, June 21, digital gold had fallen below the $64,000 mark.

At the time of writing, Bitcoin is trading at $64,100.

All top-10 digital assets by market capitalization ended the week in the “red zone.” Dogecoin (-10.4%) and Solana (-11.4%) suffered the most losses.

The total market capitalization of the cryptocurrency market stands at $2.45 trillion. Bitcoin’s dominance index is 55.4%.

SEC Ends Ethereum Status Investigation

The Enforcement Division of the U.S. Securities and Exchange Commission (SEC) has closed its investigation into Ethereum 2.0. This was reported by ConsenSys.

The SEC took this step after the organization sent a letter requesting clarification on the asset class when approving spot ETH-ETFs.

The request from ConsenSys was submitted on June 7. In it, the company’s employees asked the regulator to confirm that the registration of 19b-4 filings was based on the premise that the asset is categorized as a commodity, and therefore, the agency would close the investigation.

“Ethereum has survived the SEC. In other words, the agency will not press charges that ether sales are securities transactions,” ConsenSys wrote.

On April 26, the organization filed a lawsuit against the Commission and its five unnamed employees over “ETH regulation.” It called on the court to officially approve a formulation under which the asset would not be considered a security.

ConsenSys stated its intention to seek greater regulatory clarity regarding cryptocurrencies. To this end, the organization will continue its legal battle with the SEC.

MicroStrategy Acquires 11,931 BTC and Issues $800 Million in Shares

MicroStrategy has purchased an additional 11,931 BTC for $785 million (~$65,883 per coin), using proceeds from convertible notes and excess cash.

In total, the firm now holds 226,331 BTC, acquired for approximately $8.33 billion. At the time of writing, these assets are valued at $14.5 billion.

Simultaneously, MicroStrategy founder Michael Saylor announced the issuance of convertible bonds with a yield of 2.25% maturing in 2032. The total value of the securities sold amounted to $800 million.

Topics to Discuss with Friends

- Binance announced airdrops for BNB holders.

- Nvidia became the most valuable company in the world.

- LayerZero project launched the ZRO token airdrop.

- Marathon will heat 11,000 Finnish residents through Bitcoin mining.

Notcoin Abandons Clicker Game Concept

Developers of the Web3 gaming project Notcoin are moving away from the clicker concept to create a more sustainable model. This was revealed by the game’s creator, Alexander Plotvinov.

According to him, “clickers” will not achieve long-term success among users and do not contribute to revenue generation.

“I don’t think this will last forever. From my perspective, only games with sustainable models will survive,” said Plotvinov.

Over the next four years, developers plan to transform Notcoin into an independent hub for launching third-party ecosystem projects, where users can earn NOT tokens. The number of such campaigns will reach 50-100 per week.

“It’s similar to farming, but not for liquidity provision, rather for offering your time and attention. This model allows us to be sustainable, as we don’t need to issue new coins,” said the founder of Notcoin.

Other potential development directions for the application include contests and other means of participant engagement, gaming platforms, or even a decentralized AI-based university.

Winklevoss Twins Donate $2 Million in Bitcoin to Trump

In the United States, support for Donald Trump is gaining momentum, as he, ahead of his opponent—current President Joe Biden—has embraced cryptocurrencies. While the former receives million-dollar donations from industry participants, the latter is attempting to shift the situation in his favor.

On June 20, Gemini co-founders Tyler and Cameron Winklevoss announced their support for Trump and donated $1 million each in Bitcoin (15.47 BTC each at the time of the transaction).

They also criticized the Biden administration for its “open war” against the crypto industry. According to them, the SEC “has not developed a single rule for the industry that would help any of its participants understand how to navigate the regulatory framework for this new asset paradigm.”

The Winklevoss twins described Trump as a supporter of Bitcoin, cryptocurrencies, and business, who will end the Biden administration’s war on digital assets.

According to Bloomberg, the Gemini co-founders were refunded part of their donation, as it exceeded $844,600—the maximum amount Trump’s committee can accept from an individual.

Also on ForkLog:

- Bug hunters withdrew $3 million from Kraken due to an “extremely critical” vulnerability.

- Hashdex proposed a “dual” ETF for Bitcoin and Ethereum.

- Binance added USDT support on the TON network.

- Trading of the ZK token began at $0.25.

Binance CEO Predicts Bitcoin to Surpass $80,000 by Year-End

Binance CEO Richard Teng expressed the view that by the end of 2024, the price of the leading cryptocurrency will surpass the $80,000 mark.

According to the top executive, next year will be better for digital assets than the current one, thanks to an improved macroeconomic environment.

Teng also noted that the approval of Bitcoin ETFs and the upcoming launches of similar funds based on Ethereum will attract additional liquidity to the cryptocurrency market, fostering a bullish phase.

In his view, by the end of this year, a softening of the monetary policy by the Fed can be expected, creating a favorable macroeconomic environment and a more reasonable interest rate policy. This will lead to further cryptocurrency price increases in 2025, noted the Binance CEO.

“So, my base forecast for the end of 2024 was $80,000… But what I didn’t foresee was the strong and sustained inflow of funds from institutions following the launch of Bitcoin ETFs. I didn’t expect new structures to be approved so quickly, at the beginning of the year. I predict the approval of funds [based on Ethereum], possibly closer to the end of 2024 or in 2025,” shared the top executive.

Teng did not specify a new forecasted price for Bitcoin. However, he stated that it is significantly higher than his initial estimate.

What Else to Read?

This week, ForkLog explained what DYOR is and why it is so important for crypto investors, as well as what Schnorr signatures are and how they are used in Bitcoin.

In the traditional digest, we compiled the main events of the week in the field of cybersecurity.

The most important news from cryptocurrency industry participants was published in a separate digest.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!