Weekly Recap: Tigran Gambaryan’s Release and Denmark’s Unusual Tax Proposal

Bitcoin tested $69,000, all charges against Tigran Gambaryan in the Binance case were dropped, the mining difficulty of the leading cryptocurrency reached a new high, Denmark considered introducing a 42% tax on unrealized cryptocurrency gains, and other events of the past week.

Bitcoin Price Tests $69,000

At the start of the week, the leading cryptocurrency tested the $69,000 level before entering a correction. On Saturday, October 26, digital gold momentarily fell below $66,000 amid Israel’s attack on Iran.

At the time of writing, Bitcoin is trading at $67,600.

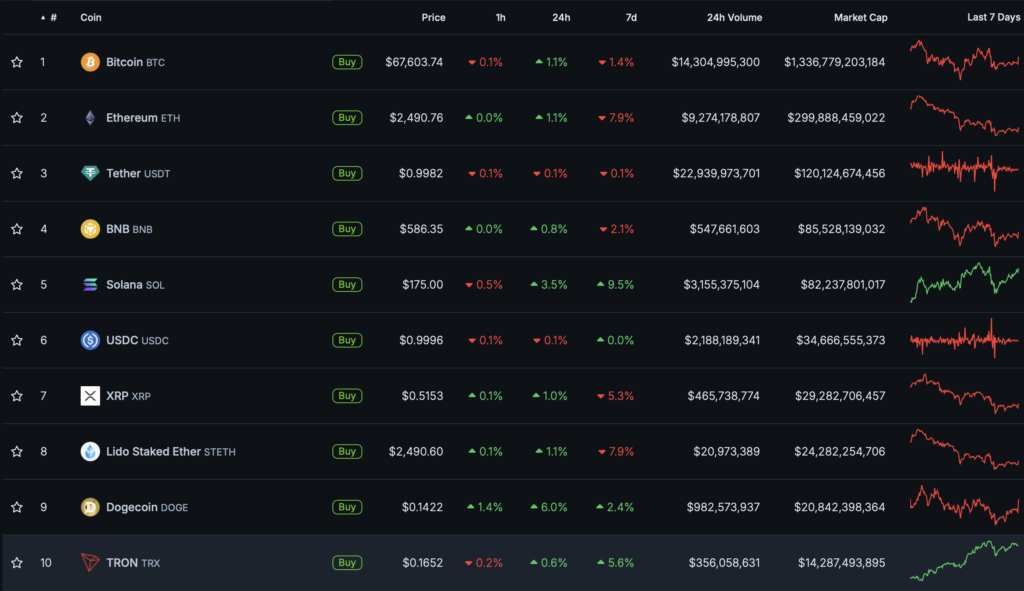

Most digital assets in the top 10 by market capitalization ended the week in the “red zone.” Exceptions were Solana (+9.5%), TRON (+5.6%), and Dogecoin (+2.4%).

The total cryptocurrency market capitalization is $2.4 trillion. Bitcoin’s dominance index is 59.3%.

All Charges Dropped Against Tigran Gambaryan in Binance Case

The Nigerian government has dropped all charges against Tigran Gambaryan, a top executive at the cryptocurrency exchange Binance.

The main reasons for halting the criminal proceedings were cited as diplomatic intervention and the defendant’s degree of involvement in the alleged crimes.

“The government reviewed the case and, taking into account that the second defendant (Gambaryan) is an employee of the first defendant (Binance Holdings Limited), whose status in this case is more significant than that of the second defendant, as well as considering some important international and diplomatic reasons, the state seeks to discontinue the case against the second defendant,” stated the prosecution’s lawyer.

Gambaryan’s defense attorney, Mark Mordi, agreed with the prosecution, stating that his client was not involved in the company’s larger financial decisions.

The prosecution also cited Gambaryan’s deteriorating health condition while in custody and the need for surgery:

“The defendant’s health condition is a constant issue that the state has successfully managed in the correctional center with the help of the national security advisor.”

The court ordered Gambaryan’s immediate release from prison but did not issue an acquittal. According to the prosecution, the case is still under review, and witness questioning continues. The lawyer emphasized that the charges were dropped against the Binance executive due to poor health, “not due to insufficient evidence.”

Gambaryan has left Nigeria. Binance is now the sole defendant in the case. The next court hearings are scheduled for November 22 and 25.

Bitcoin Mining Difficulty Hits New High

Following the latest recalculation, the mining difficulty of the leading cryptocurrency increased by 3.94%, reaching a record level of 95.67 T.

The average hash rate for the period since the previous adjustment was 688.3 EH/s, with the interval between blocks nearly matching the algorithm’s set 10 minutes.

Topics to Discuss with Friends

- Michael Saylor once again predicted Bitcoin at $13 million.

- Bill Miller revealed the average purchase price of his bitcoins.

- The creator of Notcoin explained the reason for the popularity of games on Telegram.

- The CEO of Polymarket emphasized the platform’s non-partisan stance.

Denmark Considers 42% Tax on Unrealized Cryptocurrency Gains

In early 2025, Denmark’s Tax Law Council will present a bill on taxing unrealized cryptocurrency profits.

The proposal aligns with the mark-to-market principle—requiring constant annual payments to the state in the event of a positive revaluation, regardless of whether digital assets are sold.

The bill is expected to include a requirement for crypto service providers to report information on their clients’ transactions.

Mads Eberhardt from Steno Research predicted that the tax rate on unrealized capital gains would be 42%.

“This will affect not only cryptocurrencies acquired from the current date but also coins obtained back in January 2009, when Bitcoin emerged. The gloves are off. This is a war on cryptocurrencies,” commented the expert.

Peter Todd Discusses Consequences of Being “Identified” as Bitcoin’s Creator

Canadian programmer Peter Todd has been forced into hiding for safety reasons after being named as Bitcoin’s inventor in an HBO documentary.

Following the October 9 release of Money Electric: The Bitcoin Mystery by director Cullen Hoback, Todd repeatedly denied being the alleged Satoshi Nakamoto.

“For the record: I am not Satoshi. I think Cullen made the claim for marketing purposes. He needed a way to draw attention to his film,” he told the publication.

Satoshi Nakamoto is believed to own approximately 2 million BTC. Hoback sees this as an additional argument for finding Bitcoin’s creator—as global adoption of the cryptocurrency grows, he could become the world’s richest person. For Todd, this aspect became a risk factor.

“Obviously, the false claim that ordinary people of average means are extraordinarily wealthy exposes them to threats such as robbery and kidnapping. This issue is not only foolish but also dangerous. Satoshi clearly did not want to be found for good reasons, and no one should assist in these searches,” noted the programmer.

This was the main reason he chose to go into hiding. Additionally, after the film’s release, Todd was inundated with letters, mostly requesting financial assistance. For example, one respondent sent 25 messages in two days, pleading for help to pay off a loan.

Hoback considers these fears exaggerated, as many people like Adam Back or Nick Szabo have been named as possible Bitcoin inventors, but “nothing terrible has happened in their lives.”

Also on ForkLog:

- A “sleeping” address for 14 years moved bitcoins worth $3.4 million.

- An AI bot earned 2843% trading meme coins.

- A miner from the Satoshi Nakamoto era sold bitcoins worth $9.6 million.

- Meta released a self-learning AI model.

Bernstein: Bitcoin at $200,000 by End of 2025 is a Conservative Forecast

Bernstein analysts reiterated their forecast of Bitcoin reaching $200,000 by the end of next year, calling it “conservative.”

“Bitcoin will be worth $200,000 in this cycle (end of 2025). […] We are conservative,” stated Bernstein’s head of digital assets, Gautam Chhugani, in a letter to clients.

The expert highlighted the investment appeal of the leading cryptocurrency amid the growth of the US national debt ($35 trillion) and the threat of inflation.

“If you like gold in this regard, you should love Bitcoin even more,” Chhugani emphasized, noting the cryptocurrency’s limited supply.

For investors wary of direct Bitcoin trading, the analyst suggested MicroStrategy shares—the largest corporate holder of digital gold. Another option could be crypto services from Robinhood, the expert believes.

What Else to Read?

This week, ForkLog explored who Justin Sun is, how meme tokens are renewing the idea of DAOs, and how to launch a crypto exchange from scratch.

In the traditional digest, we gathered the week’s main events in the field of cybersecurity.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!