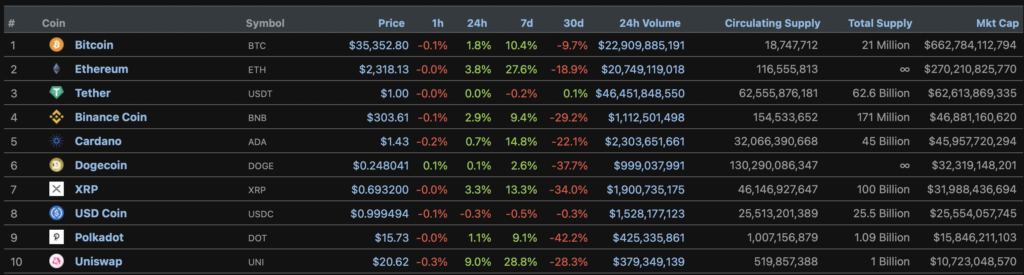

Weekly roundup: Bitcoin hash rate falls to the 2019 level, and Craig Wright wins the white paper case

Bitcoin’s hash rate fell to the level of mid-2019; the self-proclaimed Bitcoin creator Craig Wright won the white paper case, Robert Kiyosaki urged again to buy Bitcoin ahead of the “largest crash in history” and other developments from the past week.

Bitcoin price back above $36,000

On Tuesday, June 29, the price of the first cryptocurrency rose above $36,000.

During the week the price fell below $33,000. At the time of writing, digital gold was trading around $35,400.

Analyst Willy Woo said that Bitcoin has not entered a bear market, as long-term “hodlers” continue to accumulate assets in their wallets, and on-chain indicators point to a turning point in the negative price dynamics of digital gold.

He believes the market is in a speculative phase. According to the analyst, the cryptocurrency sold earlier this year is gradually returning to hodlers’ wallets.

Woo stressed that the current cycle bears no resemblance to any of the ones the market has seen before, because its fundamental structure is entirely different.

Galaxy Digital founder Mike Novogratz called the exodus of miners from China “a big plus” for the crypto industry. He said the PRC’s repressive policies will not hinder Bitcoin’s development.

He added that the May sell-off proved the resilience of the digital asset ecosystem.

The head of Celsius Network, Alex Mashinsky forecast Bitcoin rising to $160,000 by the end of 2021. He stressed that the crypto industry “has not yet seen the highs” this year.

According to a CNBC poll, 44% of institutional investment managers believe that Bitcoin will finish 2021 at a price below $30,000. 25% of respondents think the price will reach $40,000.

A similar share selected the $50,000 level, and only 6% forecast Bitcoin finishing the year at $60,000.

On July 4, the second-largest cryptocurrency by market cap breached the $2,300 mark. Over the week, the asset’s price showed high volatility and jumped 27.6%.

Over the past seven days all major altcoins rose, according to CoinGecko. Cardano rose 14.8%, XRP 13.3%, Polkadot 9.1%, Uniswap 28.8%.

According to Messari, in the ranking of the coins that rose the most over the past week, the Axie Infinity NFT game token stood at 139% second, with Flexacoin up 354% the only higher gain.

Over the week the OLY cryptocurrency dropped 42%, a record decline for digital assets. The Midas Touch Gold and CasperLabs also fell 33% and 30%, respectively.

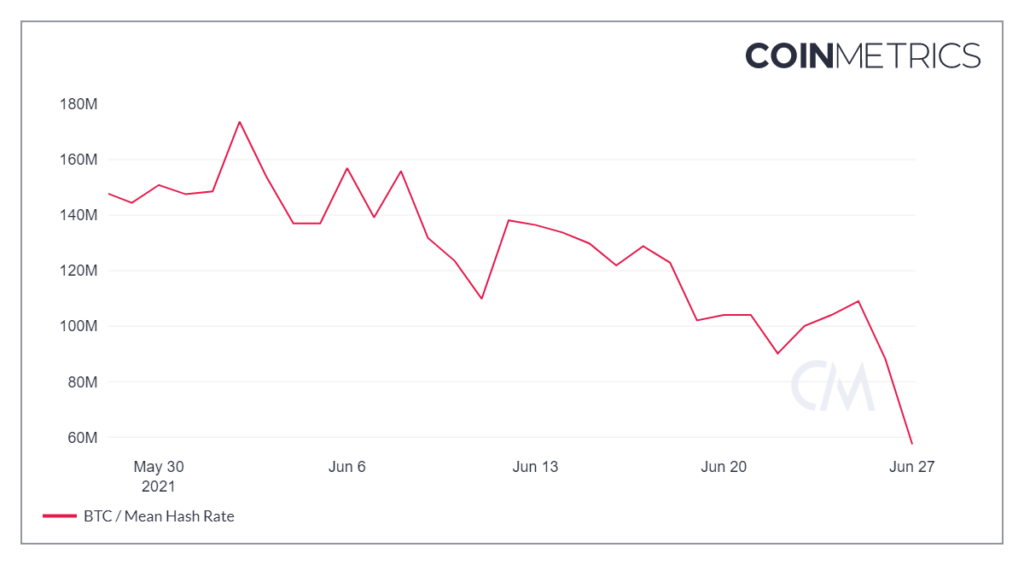

Bitcoin hash rate falls to the level of July 2019

On Monday, June 28, the hash rate of the first cryptocurrency fell to 57.47 EH/s. According to Coin Metrics, the indicator had not dipped below 60 EH/s since July 2019, when Bitcoin traded around $10,000.

The decline in hash rate may be related to China’s crackdown on digital gold and the migration of local miners who move computing power abroad.

On Saturday, July 3, following another difficulty adjustment, Bitcoin mining difficulty fell by a record 27.94% — to 14.36 trillion hashes (TH). BTC.com forecasts a further 28% decline in the metric.

Poolin vice-president Alejandro de la Torre stated that the era of China’s dominance in the crypto mining industry can be considered over. Miners are leaving the PRC under government pressure and relocating equipment to other regions.

The main migration destinations are the United States, Canada and Kazakhstan. Although the latter is already “packed to capacity,” de la Torre noted.

In the United States, the most attractive electricity tariffs are reported in Texas, Nebraska, North Carolina, Ohio and Wyoming. Poolin itself is considering sites in North Carolina.

Craig Wright wins the white paper Bitcoin case

The High Court of London ruled in favor of the self-proclaimed Bitcoin creator Craig Wright in the case against the owner of Bitcoin.org, who uses the pseudonym Cobra.

The judge barred the defendant from infringing Wright’s copyright in the UK “both by providing the opportunity to download the white paper from Bitcoin.org and by any other means”.

Cobra must publish a copy of the judgment on his site within six months. The hearing was held remotely. The defendant attended the hearing but declined to make statements to preserve anonymity, and the court ruled by default.

“Delighted to cover Craig Wright’s costs in the white paper case. How about paying in BTC to the address linked to block #9?”, — Cobra wrote.

Cayman Islands and Thailand take aim at Binance

The Cayman Islands Monetary Authority (CIMA) stated that the cryptocurrency exchange Binance and related entities Binance Group and Binance Holdings Limited are not registered in the jurisdiction.

“The Authority is currently investigating whether Binance, the Binance Group, Binance Holdings Limited or any other company affiliated with this group carries out any activity on or from the Cayman Islands or within its territory that may fall under supervision”, the notice said.

CIMA reminded that for carrying out crypto activities, companies must comply with the Virtual Assets Act.

Binance representatives told ForkLog that the company has “always operated” within a decentralized model and did not run a cryptocurrency exchange on the Cayman Islands.

“However, we have legal entities registered under Cayman Islands law that carry out activities permitted by law and not related to trading cryptocurrencies. We will work with regulators to resolve any questions they may have,” Binance said.

The Thailand Securities and Exchange Commission accused Binance of operating without a license. The regulator filed a complaint with the national police’s economic crime division.

According to the press release, in the course of further checks the Commission found that Binance provided exchange and trading services for digital assets via its site in violation of local law. In April 2021 the regulator sent a warning to the exchange but did not receive a response.

“Only providers that have the appropriate licenses may offer services related to the trading of digital assets, exchange, custody, transfer, withdrawal or any transactions involving digital assets. Violators may be liable under the law”, the statement said.

Representatives of the Commission noted that the police report marks the start of a criminal process, under which investigators will conduct an inquiry “before sending the case to a prosecutor with authority to prosecute”.

Robert Kiyosaki urges buying Bitcoin before the “largest crash in history”

The author of the bestseller “Rich Dad, Poor Dad” and entrepreneur Robert Kiyosaki again warned of an impending “greatest catastrophe in world history” and urged buying Bitcoin.

According to him, it is better to prepare for this catastrophe before it begins.

“The good news: the best time to get rich is during a crash. The bad news is that the next one will be longer. Buy more gold, silver and bitcoins while you can”, he added.

Elon Musk backs Dogecoin fee-reduction plan and refutes Dojo mining rumors

Elon Musk backed Patrick Lodder’s Dogecoin (DOGE) proposal to lower network fees and increase its decentralisation.

“This proposal to all Dogecoin stakeholders envisions reducing standard transaction fees by 100x, splitting full control over all fee aspects between miners and node operators, less reliance on key developers, and restoring a functional (small) transaction space that incentivises the upkeep of the network”, Lodder explained in a Reddit thread.

According to him, the 1 DOGE fee in 2021 is “too constraining” on transactions given the rise in crypto prices relative to Bitcoin and the US dollar.

“This situation keeps people holding their DOGE on centralized platforms longer because the perceived loss of value when transferring to a secure wallet is too high”, the developer explained.

Musk also stated that the Dojo supercomputer will not be used for mining Dogecoin. He said the company’s supercomputer is intended for processing video streams and training neural networks.

“The device will not compete with the Scrypt hashing algorithm, and it cannot be used for mining Dogecoin”, Musk wrote.

He also apologised for his February tweet “Dojo 4 Doge” being potentially misinterpreted.

Dojo 4 Doge

— Elon Musk (@elonmusk) February 21, 2021

Paraguay clarifies Bitcoin regulation initiative

Congressman Carlos Rejala stated that Paraguay does not plan to give Bitcoin legal tender status, but intends to develop a “robust” cryptocurrency regulation.

“This is a digital assets bill, and it differs from El Salvador’s initiative, since they adopt it (Bitcoin) as legal tender, whereas in Paraguay that would be impossible”, a source said.

According to him, authorities intend to involve regulators and banks in drafting the regulatory framework. Rejala added that Paraguay wants to be a “cryptocurrency-friendly country”.

Study: United States is the most crypto-ready country

Crypto Head rated the United States as the most prepared country for the mass adoption of digital assets in a study.

Analysts used data from 76 jurisdictions, including:

- the number of year-long Google searches related to crypto and their growth over the last 48 months;

- the number of installed cryptocurrency ATMs;

- the level of legalization of cryptocurrencies under tax and financial laws.

All figures were normalised to population, and for bitcoin-ATM coverage the country’s area was also considered. In each category, experts assigned scores, with a maximum possible total of 10.

The United States scored 7.13 points overall. Cyprus and Singapore followed with 6.47 and 6.3 respectively. Hong Kong and the United Kingdom completed the top five.

The United States also led in the number of crypto ATMs with 17,436 devices installed. Canada followed with 1,464 Bitcoin ATMs.

The US also posted the highest population per crypto ATM—19,023 people per machine. Canada counted 26,265 people per ATM.

ForkLog also noted:

- In China began selling small hydroelectric plants following an attack on miners.

- Former Ukrainian deputy Oleg Lyashko took up Ethereum mining.

- The Spiritus electric car began mining cryptocurrencies on a live stream.

- An NFT sold for $5.4 million containing the original source code of the Internet was found to contain an error.

- Elon Musk’s tweets were dubbed the main fear of crypto traders.

- 1inch Network will launch its own stablecoin.

- Jim Cramer who sold Bitcoin invested in Ethereum.

- Artificial intelligence discovered hidden connections between the Milky Way and Andromeda.

- Rosseti discovered two illegal mining farms. Damage exceeded 2 million rubles.

- In Ukraine, a bitcoin farm was shut down, with damages from its operation exceeding 3 million hryvnias.

What else to read

In an exclusive ForkLog interview, Sino Global Capital head Matthew Graham explained the Chinese authorities’ policy toward cryptocurrencies and outlined the motives behind the latest harsh decisions.

He also offered his view on eco-friendly mining, the technological arms race between Washington and Beijing, and signs of a cult in the Bitcoin maximalist community.

To recall the most notable recent news from the venture-capital sector, see our “Institutional Almanac”.

The week’s notable events in cybersecurity and artificial intelligence technology are gathered in our traditional digests.

Read ForkLog’s Bitcoin news in our Telegram — cryptocurrency news, prices and analysis.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!