What are Bitcoin Runes and how do they differ from BRC-20?

What are Runes?

Over the past two years Bitcoin’s ecosystem has broadened markedly thanks to new assets—both fungible and non-fungible tokens such as BRC-20 and Ordinals. The combined market capitalisation of such coins has crossed the $2bn threshold, allowing miners to earn multi-million-dollar revenues on top of block rewards and fees for conventional payments in the digital gold.

Yet soon after their emergence the new assets drew fierce criticism from Bitcoin purists such as developer Luke Dashjr, who urged that BRC-20 and “inscriptions” be “banned” via a “spam filter”.

In September 2023 Ordinals creator Casey Rodarmor unveiled a new standard for fungible tokens—Runes. According to the developer, this format leaves little “junk” on the Bitcoin network, unlike BRC-20.

“UTXO-based protocols fit organically into the Bitcoin blockchain, helping to minimise the growth of unspent transactions and avoiding the creation of their ‘garbage’ counterparts,” the specialist explained.

He says Runes are built “for degens and meme coins” and are meant to simplify the creation and management of fungible tokens on the blockchain of the first cryptocurrency.

“But the protocol is simple, efficient, and secure. It is a full-fledged competitor to Taproot Assets and RGB,” Rodarmor wrote in early April.

The launch of Runes took place on the day of the fourth halving — 20 April.

How does the Runes protocol work?

To understand how Runes operate, it helps to grasp two key ideas:

- Bitcoin’s UTXO transaction model;

- the OP_RETURN opcode.

UTXO is a system for tracking cryptocurrency balances that have not yet been spent and can be used in new transactions.

Each unspent output represents funds available for new on-chain operations. This system secures transactions because every UTXO can be spent only once, preventing double-spending.

According to analysts at CoinGecko, each unspent output can contain any number of Runes.

The OP_RETURN opcode lets users attach arbitrary data (up to 80 bytes) to Bitcoin transactions without harming network efficiency. In Runes, token information is recorded in a separate output that cannot be spent.

This function is used to store information and determines how an operation is executed. Such data may include core token details: name, ID, a command for certain actions, and so on.

Runes messages stored in the OP_RETURN segment of a Bitcoin transaction are also known as Runestone. These enable the creation and transfer of tokens on the network of the first cryptocurrency.

Each transaction in the protocol can specify multiple operations across different “runes”. When a token is sent, Runes splits the transaction’s unspent output into several new UTXOs based on the instructions in the OP_RETURN data. Each unspent output represents different quantities of tokens, which are then sent to recipients.

If a transaction fails because of an incorrect protocol message, the “runes” are destroyed to prevent the creation of additional objects.

What are etching and minting?

Thanks to OP_RETURN, a user can perform several types of operations:

- Etching — creating an asset and registering its basic parameters: name, ticker, supply, divisibility and so forth. As part of this process, issuers can also provide for a “pre-mine”, allocating themselves some “runes” before they become available to the public;

- after etching it is possible to generate a certain number of Runes via open or closed minting. The first option lets anyone mint “runes”. In this case a mint transaction creates a fixed quantity of new assets. The second scenario allows new tokens to be created only when certain conditions are met—for example, within a set time window. After it ends, issuance is capped.

Another function—Edict (“decree”)—defines the rules for transferring Runes after they are etched or minted. For instance, an “edict” enables batch asset transfers, airdrops, or sending all issued “runes” to a single account.

What are the advantages of Runes?

Here are the main positives of Rodarmor’s system.

Simplicity. Runes offer a more straightforward way to create fungible tokens on top of Bitcoin than BRC-20, RGB or Taproot Assets. Users can generate various tokens and manage them efficiently on-chain without relying on off-chain data and without creating large amounts of “junk” UTXOs.

Resource efficiency. The system does not create unspendable outputs, and its storage parameters consume fewer resources. The OP_RETURN opcode takes only 80 bytes, whereas BRC-20 assets can contain up to 4MB of various data.

A boost to miners’ revenues. The April halving halved the block reward, reducing the profitability of mining the digital gold. Runes effectively provide an additional source of income for miners. Block space is scarce, so the more transactions are processed, the higher the fees.

Broadening the user base. In the protocol creator’s view, the primary use case for Runes is meme assets. These are popular in the current market cycle. Messari’s head of research, Martje Bas, is convinced that such tokens “unintentionally” introduce newcomers to Web3 fundamentals, including decentralised exchanges (DEX) and crypto wallets.

Expanding Bitcoin’s capabilities and ecosystem. Analysts at CoinGecko are convinced that various protocols enabling token creation on the first cryptocurrency’s blockchain benefit the network and the ecosystem as a whole.

In particular, Runes provide the ability to conduct transactions over the Lightning Network. This could spur the growth and development of the micropayments network built on the digital gold.

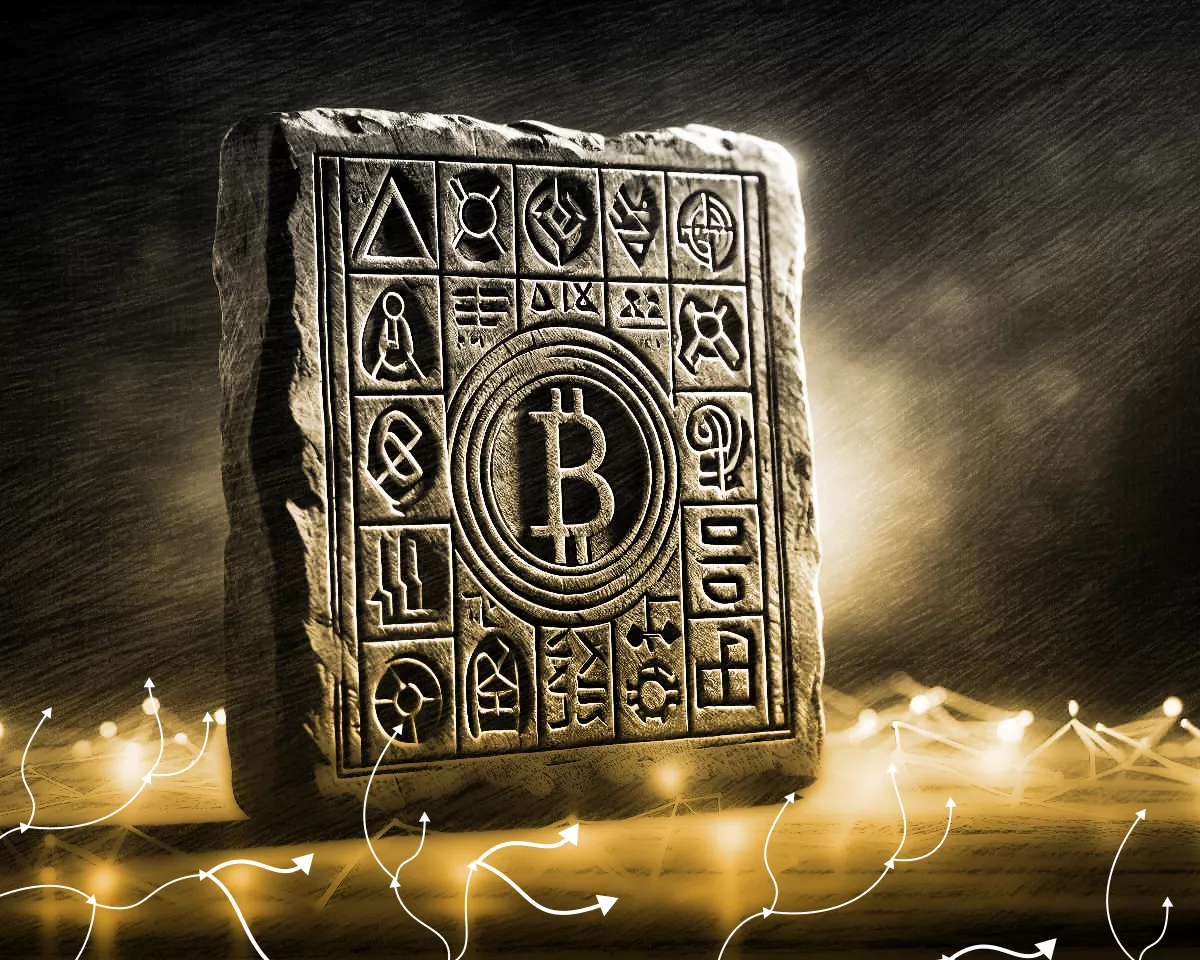

How do Runes differ from BRC-20?

Like BRC-20, Runes allow token creation on the Bitcoin blockchain. But “runes” are positioned as a refined system that is less demanding on the resources of the first cryptocurrency’s network.

Here are the main differences between the protocols:

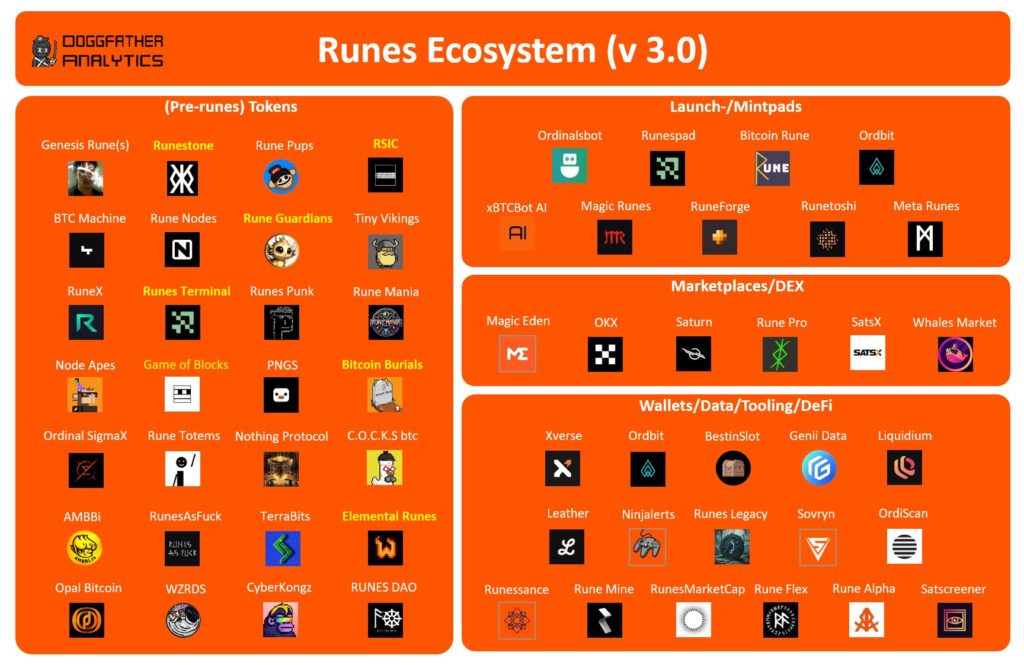

How is the Runes ecosystem developing?

New projects are emerging in the young ecosystem. Some existing platforms have announced support for Runes.

Some projects interact directly with the protocol to create assets on the Bitcoin blockchain; others offer utilities for working with Runes.

The infographic below highlights the main elements of the evolving ecosystem, including tokens, launch platforms (launchpads and mintpads), marketplaces and DEXs, wallets, analytics platforms, and more.

Although “runes” are issued on Bitcoin’s blockchain, managing the assets requires dedicated wallet apps—such as Xverse, which also supports Ordinals and BRC-20. As an alternative, consider UniSat.

Runes are also supported by some marketplaces that list and trade such objects. For example, OKX’s marketplace integrates with Runes, as well as the inscription standards Atomicals (ARC-20), Stamps (SRC-20) and Doginals (DRC-20).

The Magic Eden NFT platform also features a section for “runes”.

The Luminex service provides convenient tools to track new collections and to create, mint and transfer Runes. Access to key functions requires connecting a compatible wallet (Xverse, Magic Eden, UniSat, OKX or Leather).

Support for the Runes protocol is also implemented on the pre-market platform Whales Market.

How are Runes affecting the Bitcoin ecosystem?

Experts at Franklin Templeton called Runes, along with Ordinals and BRC-20, among the chief drivers of a revival of innovation in Bitcoin.

Even ahead of the halving, the average transaction fee on the first cryptocurrency’s network exceeded $16. Analysts at The Block attributed this to a pick-up in on-chain user activity as they anticipated the launch of Runes.

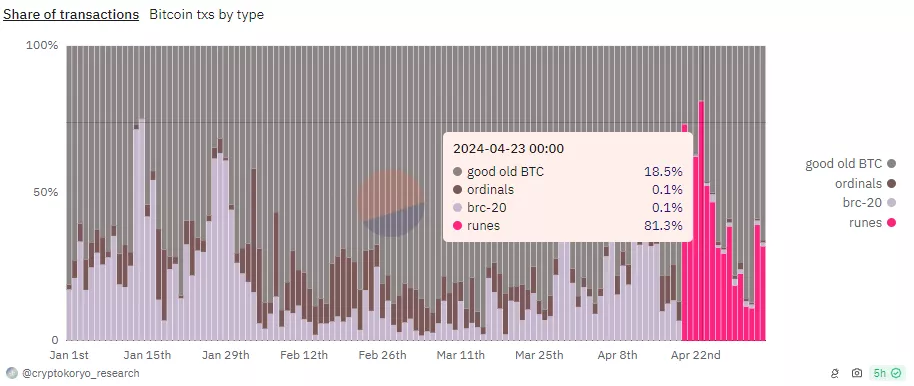

On April 23rd, the share of “runes” in the total number of daily transactions on Bitcoin’s blockchain accounted for 81%. Traditional BTC operations made up 18.8%.

The frenzy around the Runes launch on halving day, 20 April, pushed the average fee to a record $128.45.

In the following days, fees reverted towards earlier levels. At the time of writing (May 4th), the figure stands at $4.66, according to BitInfoCharts.

TeraWulf chief Nazar Khan called Runes a “lifeline” for Bitcoin miners. He said the protocol’s launch substantially supported miners’ revenues after the halving thanks to higher fees.

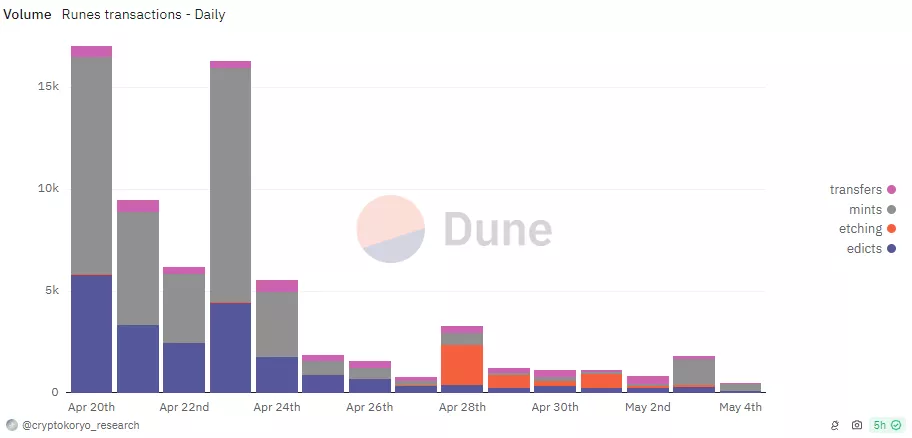

However, the recent hype around Runes has gradually waned. This is evident in the decline in transfers, issuance and other operations involving the new assets.

The total volume of all types of transactions with “runes” as of May 4th is approaching 4.7m.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!