What are hashrate and mining difficulty in cryptocurrencies?

1

What is mining difficulty in cryptocurrencies?

2

Why was the difficulty parameter introduced?

3

How does mining difficulty change?

In the Bitcoin network, difficulty is recalculated every 2016 blocks and depends on how long it took to find the previous 2016 blocks. If a block is found every ten minutes, as Satoshi Nakamoto originally intended to maintain a planned supply of 21 million coins, finding 2016 blocks takes two weeks.

If the prior 2016 blocks were found faster, difficulty increases; if it took longer, difficulty decreases. The greater the deviation in time from the target, the larger the upward (or downward) adjustment.

4

What affects mining difficulty?

Difficulty depends on the network hashrate and the time spent finding previous blocks.

If hashrate has risen, new participants have joined the mining process. They have connected their hardware, so the network’s computing power has increased. As a result, blocks are found more quickly than at a lower hashrate.

Hence:

- the higher the hashrate, the more miners are involved and the less time is needed to find blocks—difficulty rises;

- the lower the hashrate, the fewer miners there are and the more time is spent on mining—difficulty falls.

5

What is hashrate?

Hashrate is the total computing power of mining hardware engaged in producing a cryptocurrency.

Hashrate is measured in the following units:

Hash/s (H/s);

Kilohash/s (KH/s);

Megahash/s (MH/s);

Gigahash/s (GH/s);

Terahash/s (TH/s);

Petahash/s (PH/s);

Exahash/s (EH/s)

As mining constantly becomes more demanding, you will hardly see “hashes per second” in modern blockchain networks. Today, such tasks require higher-power devices, starting from tens of megahashes per second.

For example, a processor rated at 10 MH/s can generate 10 million different combinations per second to find the one hash that meets all parameters set by the network.

6

What determines hashrate?

Hashrate depends on several key factors, including the chosen mining algorithm. For instance, some devices deliver peak performance on SHA-based networks (Bitcoin, Namecoin, Peercoin, etc.), but are much less efficient on networks using the Scrypt algorithm (Litecoin, Dogecoin, Gridcoin, etc.).

Hardware specifications also matter and vary by manufacturer. Those planning to mine should study device performance to choose the most optimal and economically viable option.

Do not forget the popularity of the cryptocurrency itself: the more popular it is, the more miners are interested in producing it. As they connect their computing power, the network hashrate—and, accordingly, mining difficulty—increases.

7

How and where can you calculate mining profitability?

Special mining-profitability calculators can help: knowing your equipment’s hashrate, you can estimate potential profit over a given period. However, given how dynamic hashrate is, such estimates are not perfectly accurate. For this reason, it is advisable to consult several sources and take an average.

For example, you can use tools on the websites of Cryptocompare (data available for several cryptocurrencies, including BTC, ETH, ZEC, XMR, LTC and DASH) or Nicehash.

8

How is difficulty calculated?

The following formula is used to calculate mining difficulty:

difficulty = difficulty_1_target / current_target

where difficulty is the difficulty, and target is a 256-bit number.

Difficulty_1_target can take different values. It is usually a hash whose first 32 bits are 0, with the remainder consisting of digits and letters (this is also called pdiff or pool difficulty).

This formula may be hard to grasp, so you can monitor difficulty on dedicated resources with charts, including Bitcoinwisdom, Coinwarz (multiple selection), Blockchain.com, Bitcoincity, Etherscan (for ETH).

It is advisable to assess mining difficulty using several sources at once, since the indicator is dynamic and the value can change over time.

9

How does difficulty affect mining profitability?

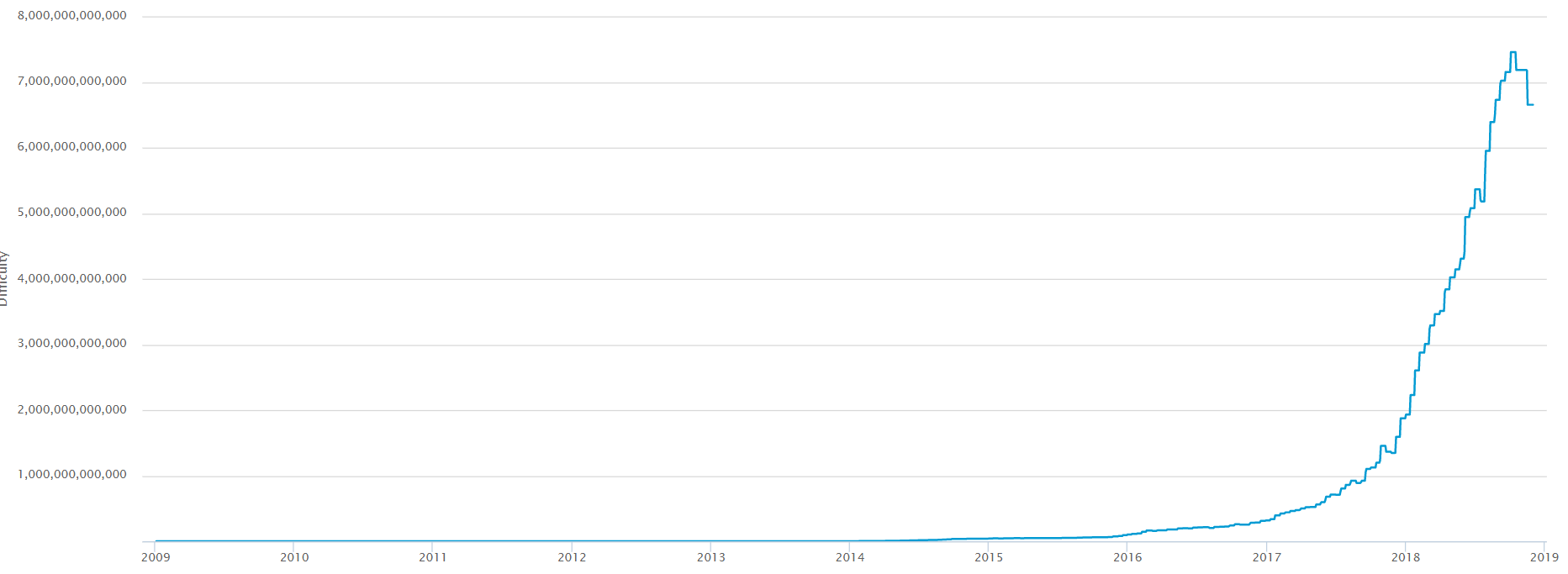

The chart below shows that Bitcoin’s mining difficulty began to rise sharply in 2017. It paused only in November 2018, when the market plunged. A decline in hashrate was observed at the same time.

Источник: Blockchain.com

A similar picture is seen across other liquid cryptocurrencies. Until recently, experts estimated an average monthly increase in the leading altcoins’ difficulty of about 8%. While the situation has since changed somewhat, on those figures an 8% monthly rise would push mining hardware close to breakeven in about nine months.

As for Bitcoin’s breakeven point, at the end of 2018 some analysts said that, given the then difficulty level, the first cryptocurrency had to cost at least $7000 (for mining on Bitmain’s S9 Antminer devices).

Thus, when bitcoin fell to $4000, users were left either to buy even more expensive equipment, or switch to mining coins with lower difficulty. The first option can be too costly; the second, rather risky. An optimal approach can be a “golden mean”—mining cryptocurrencies with a middling level of difficulty. Many, however, prefer to switch off equipment altogether to ride out a bear market, or find alternative uses for it.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!