What is Chainlink (LINK)?

Key points

- Chainlink is a decentralised oracle network that verifies and supplies data from external sources to blockchain smart contracts.

- Chainlink is the largest provider of decentralised oracles in the crypto industry. The technology is particularly in demand in decentralised finance. Large companies outside blockchain use oracles, too.

- LINK is Chainlink’s native token. It is used mainly to pay node operators who run the oracles.

Who created Chainlink, and when?

Chainlink was created by Sergey Nazarov and Steve Ellis. The project first emerged in 2017, when Nazarov and Ellis released a white paper. Chainlink officially launched in 2019. The project is built on a network of node-based decentralised oracles.

The system was developed together with Ari Juels, a professor at Cornell University. He now works alongside the founders and other team members at Chainlink Labs, whose main task is to develop the project’s protocol and architecture.

In late 2021, Eric Schmidt, Google’s former chief executive, became an adviser to Chainlink Labs.

What problem do oracles solve?

Smart contracts power decentralised applications, but many business models require off-chain data. Delivering and verifying off-chain inputs for contract execution was a core challenge.

Early oracles handled this, but were unreliable and centralised: creators often controlled them, and each oracle typically drew on a single data source. That created a single point of failure and exposed smart-contract users to risk.

A case in point is operations using flash loans. Centralising data—prices of cryptoassets, in this case—led to an exploitable smart contract. In 2020 a hacker stole nearly $1m in cryptocurrencies from the bZx protocol, which relied on a single oracle, Kyber Network.

Chainlink’s creators improved the technology by introducing decentralised oracles. Their main feature is the absence of a single data source and resilience to manipulation.

A smart contract connected to the Chainlink network requests information from multiple oracles at once to obtain the most reliable data possible. Hence Chainlink’s decentralised oracles are also called consensus oracles.

How do Chainlink oracles work?

Chainlink is an oracle network made up of many nodes. A single node operator can deploy several oracles. Each oracle, in turn, can connect to multiple data sources.

Oracles use price data feeds (Chainlink Price Feed). They allow smart contracts in decentralised applications to obtain quotes for various cryptocurrencies from centralised trading platforms. This is needed, for example, when swapping one cryptoasset for another via a decentralised exchange.

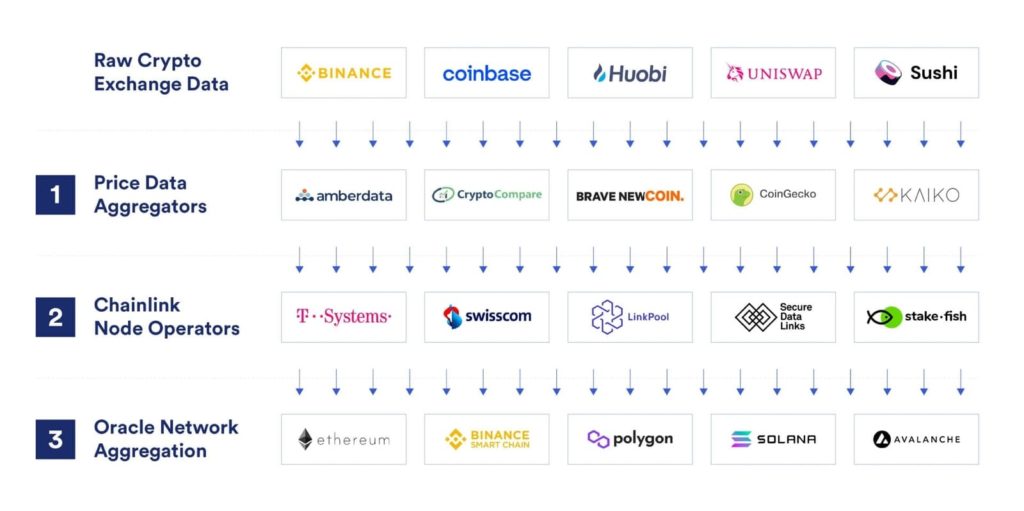

The price-data delivery system shown above consists of three layers:

1. Well-known aggregators—CoinGecko, CoinMarketCap, CryptoCompare and others—receive trading and price data directly from exchanges and other venues.

2. These values are passed to Chainlink nodes. They do not produce blocks but process requests and manage oracles. When a request arrives, a randomly selected group of suitable oracles responds. They fetch the requested data from relevant external sources and pass it to Chainlink.

Chainlink nodes are of two kinds: Core, which receive user requests, and Adapter, which act as a “bridge” between a node and an external data source.

3. The data obtained by the oracles are compared and reconciled by a special contract, the Chainlink Aggregating Contract. Once the nodes reach consensus on the answer, a single value is sent to the requester—the smart contract of the decentralised application that issued the original query.

What data can Chainlink oracles deliver?

The technology suits far more than cryptocurrencies and finance. In summer 2021 Chainlink announced a partnership with the popular weather-forecasting service AccuWeather. Under the deal the platform supplies its data to decentralised oracles via Google Cloud.

That partnership, in turn, helped Chainlink attract another client. In spring 2022 the American insurance platform Lemonade, together with several blockchain projects, launched a new climate-risk insurance service for farmers. Instead of a conventional policy, the buyer becomes a participant in a smart contract connected to a Chainlink oracle.

In April 2022 DeFi firm Truflation used Chainlink oracles to create its own US Consumer Price Index (CPI). Unlike the official index calculated by the government, Truflation uses an alternative methodology, with Chainlink responsible for data sources and integrity.

What other services does Chainlink offer?

Chainlink oracles can perform various functions with wide applicability:

- Verifiable Random Function (VRF). For each request, Chainlink VRF generates one or more random numbers and a cryptographic proof. VRF is used in contracts that require randomness per a defined formula, notably in blockchain games and NFTs. The first game to use VRF was PoolTogether.

- API integration—Chainlink enables smart contracts to connect to external data sources, including APIs.

- Automation of smart-contract functions and their regular maintenance via “keepers” (Chainlink Keepers).

Which blockchains does Chainlink run on?

Chainlink does not have its own network. Project nodes run on the blockchains whose applications they serve. Chainlink was initially launched on Ethereum. Its oracles now run on Solana and on networks compatible with the Ethereum Virtual Machine, including BNB Chain, Arbitrum, Optimism, Polygon, Avalanche and Fantom.

Which companies and projects use Chainlink oracles?

As of June 2022 the project’s ecosystem counted more than 1,300 projects.

Leading DeFi protocols use Chainlink oracles: Aave, Ampleforth, bZx, Celsius Network, Loopring, Polkadot, Synthetix, Lido and others.

In February 2022 Bank of America called Chainlink one of the main drivers of DeFi’s growth. At the time, the project’s oracles were used by DeFi applications whose share of the sector’s overall TVL exceeded 59%.

“The adoption and growth of DeFi [in 2021] were driven by the ability of [Chainlink’s] hybrid smart contracts, or self-executing and tamper-proof digital agreements, to provide reliable and secure access via oracle nodes to real-world data such as market prices, time of day, weather and GPS coordinates,” the bank’s report says.

Among Chainlink’s node operators running oracles are several large enterprises: Swiss telecoms operator Swisscom, Germany’s Deutsche Telekom, and the Associated Press (AP) news agency.

What is Chainlink 2.0?

In early 2021 the developers published a white paper titled Chainlink 2.0. The authors focused on the development of so-called hybrid smart contracts, as well as new ways to use Chainlink oracles to unlock additional capabilities on the network.

According to Chainlink co-founder Sergey Nazarov, the defining feature of hybrid smart contracts is the combination of code executed on-chain with data and computation performed off-chain.

Chainlink also plans to launch CCIP (Cross-Chain Interoperability Protocol)—a cross-chain interoperability protocol, a global standard for messaging and communication between blockchains. CCIP aims to do for blockchains what the TCP/IP protocol did for the internet: create a unified “internet of blockchains”.

What is the LINK token for?

LINK is Chainlink’s token, issued on the Ethereum blockchain. It is among the top-50 cryptocurrencies by market capitalisation. The supply of LINK is capped at 1bn tokens.

The cryptoasset is required to pay oracles for their work and serves as an economic incentive for node operators. LINK is also used to improve data-processing accuracy and support contract stability on the network.

After launch, Chainlink quickly gained popularity and its token climbed in price. In 2020 alone, the price of LINK rose by several hundred percent. Chainlink also built an active community—the “LINK Marines”—who promote the project on social media.

At the same time, observers noted a high concentration of LINK: by early spring 2021, 81% of the entire supply was held by 1% of holders.

In May 2021 the price of LINK peaked after the white paper 2.0 was published, but then began to fall. As of early June 2022 the asset trades around $8.

In the second half of 2022 the project plans to launch staking for LINK.

What incidents have involved the project?

In 2020 the project suffered an information attack. Unknown actors published a fabricated report in the name of the British bank Zeus Capital on a fake website. The anonymous authors claimed the developers were dumping large volumes of LINK and predicted a collapse in the token’s price. The allegations were not confirmed, and the cryptoasset rose in price.

In September of the same year a spam attack was carried out against several Chainlink nodes: attackers sent mass requests for price data. Chainlink representatives said the attack was minor and did not affect the operation of the network or the oracles. Node operators, however, spent some funds on Ethereum fees.

What else to read?

What is decentralised finance (DeFi)?

What are Flash Loans (instant loans)?

What are ERC-20 tokens?

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!