What is margin trading?

Key points

- Margin trading is spot trading with borrowed funds. A trader pledges their own assets—margin—as collateral. For using borrowed capital, they pay an hourly interest charge.

- Margin lets users increase purchasing power and potential gains from rising prices, and also profit from falling cryptocurrency prices.

- Margin ensures the client meets debt obligations under the exchange’s rules, with the exchange acting as an intermediary between borrowers and lenders.

What is leverage?

Leverage is the ratio of borrowed funds to margin. In crypto markets it ranges from 2x to 100x.

Trading with 10x leverage means that with a 1,000 USDT deposit a trader can borrow 9,000 USDT and open a position of up to 10,000 USDT.

What are a margin call and liquidation?

Margin call and liquidation are safeguards used by exchanges to prevent borrower defaults and lender losses.

A margin call is the broker’s request to add collateral to restore coverage for open positions. It arises when the trader’s margin level enters a risk zone, computed for each pair depending on market depth and trading volume.

Liquidation is the forced closure of a position when the loss is close to the posted margin.

When the risk zone is reached, the trader receives a pop-up or an email recommending an additional deposit. If they ignore it and the price moves further against the position, the exchange liquidates it.

The trader can close the trade before liquidation—manually or with a stop-loss. In that case only part of the margin is lost.

What are cross margin and isolated margin?

Cross margin and isolated margin are modes of using collateral. With the former, all funds on the account back all open positions; with the latter, a set amount backs each trade.

With cross margin, profit from one trade can offset losses in others. Conversely, one losing trade can cause all open positions to be liquidated.

With isolated margin, liquidation of a given trade does not affect other positions.

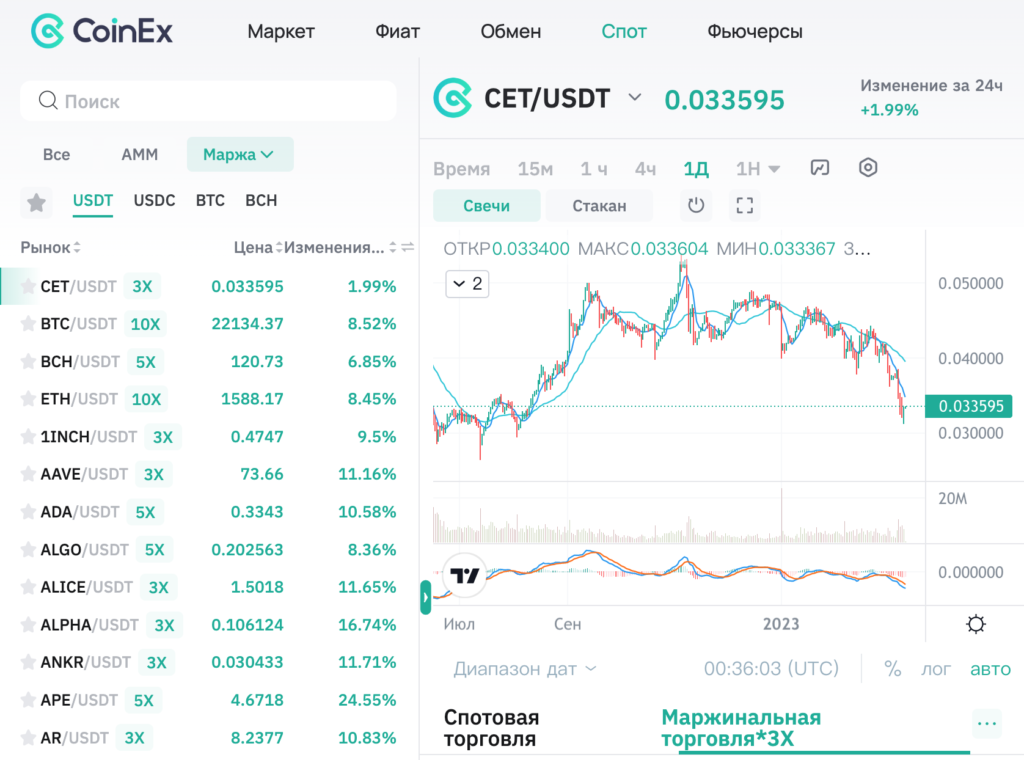

What is the index price in margin trading?

The index price is a weighted average price of an asset based on data from several markets. Exchanges use it to minimise price manipulation.

Binance calculates price indices for instruments using data from Huobi, OKX, Bittrex, HitBTC, Gate.io, BitMEX, MXC, Bitfinex, Coinbase, Bitstamp, Kraken, Binance.US and Bybit.

CoinEx, in turn, computes these values using data from Binance, Huobi Global, KuCoin and Gate.io.

When the index price moves beyond a set range during bouts of high volatility, the exchange warns users of elevated liquidation risk.

If one venue is under maintenance and/or its latest trade-price and volume feeds fail, CoinEx temporarily excludes it from the calculation and rebalances the weights.

When placing a stop-loss, you can choose the index price as the trigger. This helps avoid losses caused by local price swings on a single venue.

How to profit from a long trade on margin?

A long, or long position, is buying an asset in anticipation of a rise. Leverage increases potential profit from the subsequent sale.

Example: a trader expects bitcoin to rise from 15,000 USDT to 25,000 USDT.

They top up a margin account with 3,000 USDT and borrow 12,000 USDT on CoinEx to trade with 5x leverage. The borrowing rate is 0.15% per day.

The trader buys bitcoin for 15,000 USDT and sells the coins ten days later when the price reaches 25,000 USDT.

Net profit:

proceeds from selling 1 BTC (25,000 USDT) — debt to the exchange (12,000 USDT) — interest on borrowed funds (180 USDT) — the trader’s initial capital (3,000 USDT) = 9,820 USDT.

Profit from a similar trade without leverage would be:

| proceeds from selling 0.2 BTC (5,000 USDT) — the trader’s initial capital (3,000 USDT) = 2,000 USDT |

How to profit from a short trade on margin?

A short, or short position, is selling an asset with the aim of buying it back at a lower price. Profiting from falling prices requires margin trading.

Example: a trader expects bitcoin to drop from 25,000 USDT to 15,000 USDT.

They buy 0.2 BTC at the current price and borrow 0.8 BTC on CoinEx to trade with 5x leverage. The borrowing rate is 0.1% per day.

The trader sells 1 BTC and receives 25,000 USDT. Ten days later the price falls to 15,000 USDT and they buy 0.8 BTC to repay the debt.

Net profit:

| proceeds from selling 1 BTC at 25,000 USDT (25,000 USDT) — purchase of 0.8 BTC at 15,000 USDT to repay the debt (12,000 USDT) — initial cost of 0.2 BTC (5,000 USDT) — interest on borrowed funds (120 USDT) = 7,880 USDT. |

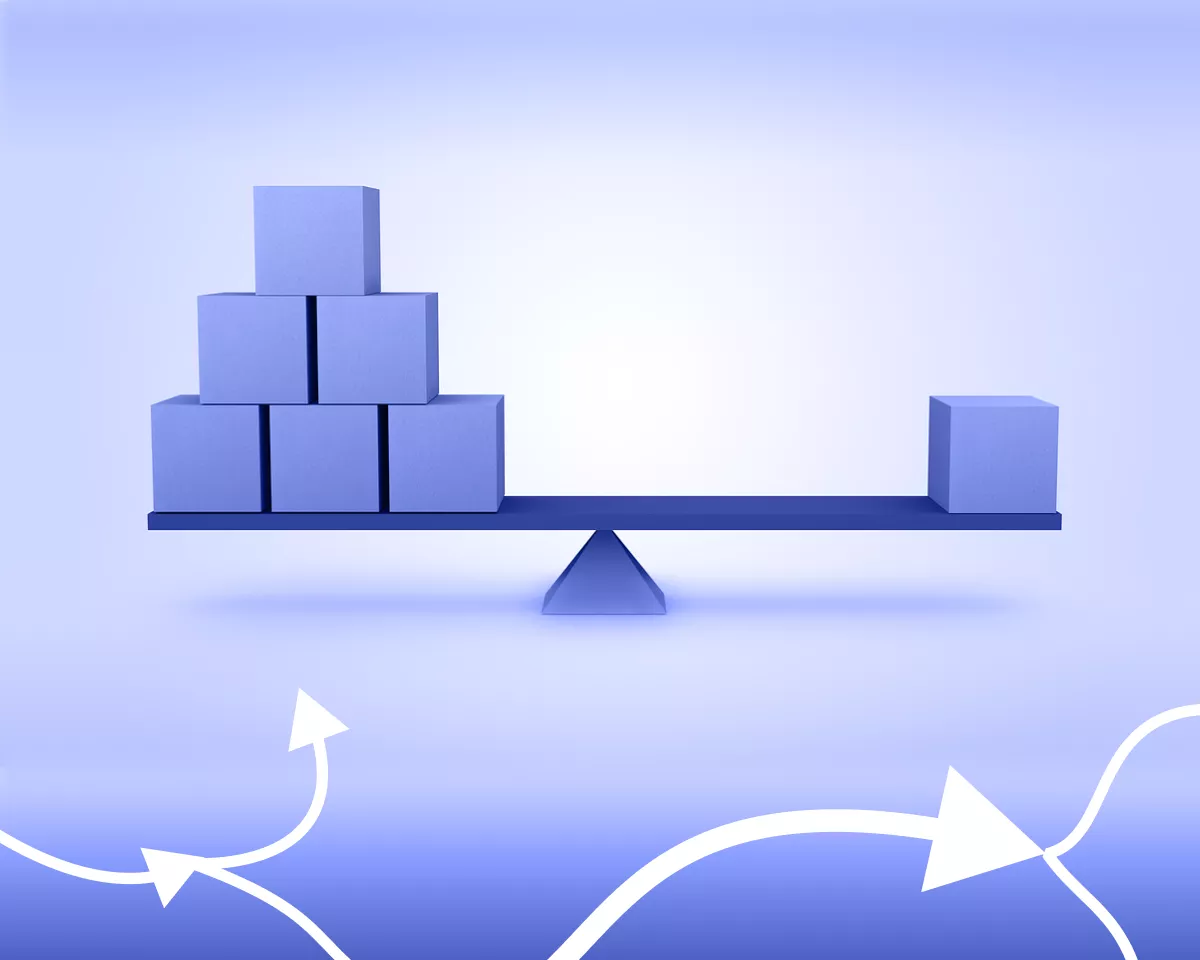

How to start trading with leverage?

First choose an exchange that supports margin trading. These include Binance, Coinbase Pro, Huobi, Bitfinex, Kraken, CoinEx and others.

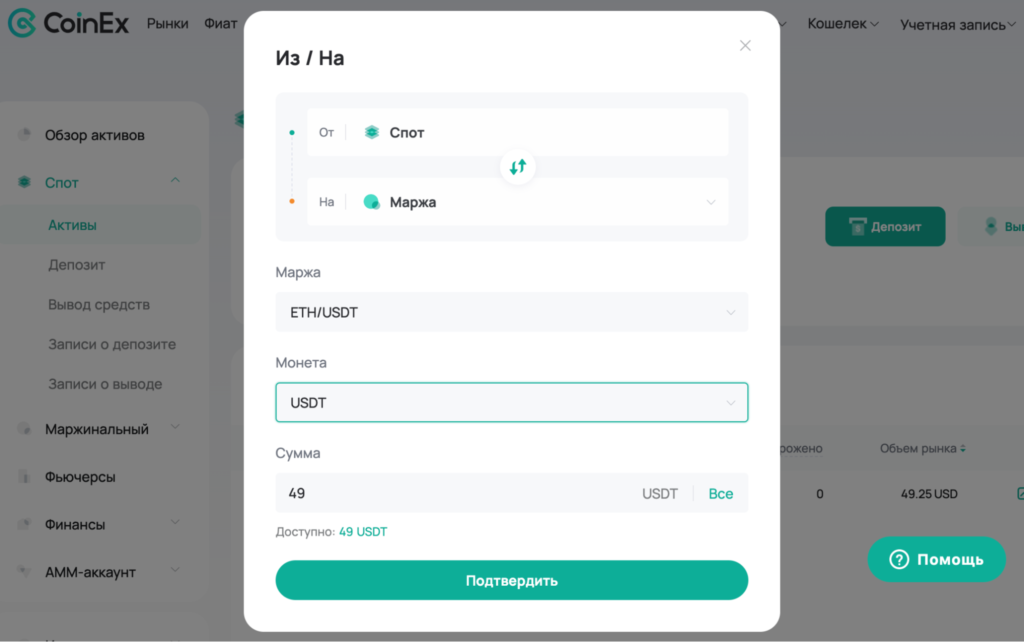

On CoinEx only isolated margin is available. To proceed:

- Register and activate your account.

- Make a deposit.

- Choose a pair for margin trading and transfer assets to the corresponding account.

- Select trade direction — long or short.

- Wait for an entry point and borrow funds.

- Trade the chosen asset.

- Repay the broker.

What is a margin insurance fund?

A margin insurance fund is capital the exchange uses to cover clients’ losses in margin trading.

CoinEx allocates liquidation fees and 30% of crypto‑lending income to the fund. If, after liquidation, a trader’s balance turns negative, CoinEx uses the fund to repay the debt.

If the fund lacks sufficient reserves at that moment, CoinEx advances the remaining part of the debt. However, the user will not be able to withdraw funds from the main account.

To settle the outstanding obligation, the trader must add funds to the margin account or wait until the fund holds enough to repay all debts in chronological order. After repayment, withdrawals are restored.

Advantages of leveraged margin trading

With leverage you can:

- trade across markets in several assets thanks to larger working capital;

- reach financial goals faster than with comparable spot trading without leverage;

- enjoy unlimited potential profit—the exchange does not trigger auto-deleveraging as on the futures market.

Risks of trading with leverage

- With leverage, losses can reach 100% or more of the deposit.

- The strategy is particularly risky during periods of high volatility.

- Technical problems on the trading platform can lead to order‑execution delays and loss of funds.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!