What is PayPal’s PYUSD stablecoin?

What is PYUSD?

PayPal USD (PYUSD) is a stablecoin from the payments giant PayPal.

The token is issued by infrastructure firm Paxos, which is supervised by the New York State Department of Financial Services (NYDFS).

PYUSD is pegged to the US dollar at 1:1 and is built on the Ethereum blockchain as an ERC-20 token.

The coin’s smart contract includes functions for freezing and wiping funds from balances.

In February 2023 the firm paused development of the stablecoin amid news that NYDFS was investigating Paxos, the issuer of BUSD and USDP.

Later the infrastructure company said it was in constructive dialogue with the US Securities and Exchange Commission, which had warned of its intent to sue.

PYUSD launched on 7 August 2023.

As of 18 September the circulating supply of PayPal’s stablecoin stood at 44.3 million. The asset ranked 414th on CoinGecko.

Why does PayPal need a stablecoin?

PayPal is a large centralised platform that enables individuals and companies to transact online.

In its Q1 2023 earnings report the company said it held about $1bn in cryptocurrency for its customers. PayPal has more than 350 million active users worldwide.

Rumours about plans to launch a “stablecoin” emerged in May 2021. Six months earlier, PayPal had opened access to cryptocurrencies for customers. In April 2021 the company added support for Bitcoin, Ethereum, Litecoin and Bitcoin Cash in Venmo, its mobile payment service.

The firm believes PYUSD will simplify transfers and cross-border payments and help drive broader adoption of digital assets.

“PayPal USD is intended for digital payments and Web3, as well as for compatibility with the most widely used exchanges, wallets and applications,” the release says.

Customers will be able to:

- transfer PYUSD within the service and between external wallets;

- send payments to individuals;

- pay for purchases;

- convert it into any supported cryptocurrency.

“The shift to digital currencies requires a stable instrument that is both digital and easily connected to fiat currency such as the US dollar,” said the company’s CEO Dan Schulman.

Bank of America (BoA) analysts are convinced that the launch of PayPal USD will improve payment efficiency and customer service. However, they are sceptical about its long-term prospects, forecasting competition from central bank digital currencies and yield-bearing stablecoins.

BoA also does not rule out regulatory risks, especially if non-bank entities are prohibited from issuing stablecoins.

What backs PayPal’s stablecoin?

According to the company’s release, the asset is fully backed by “US dollar deposits, short-term Treasuries and similar cash equivalents.”

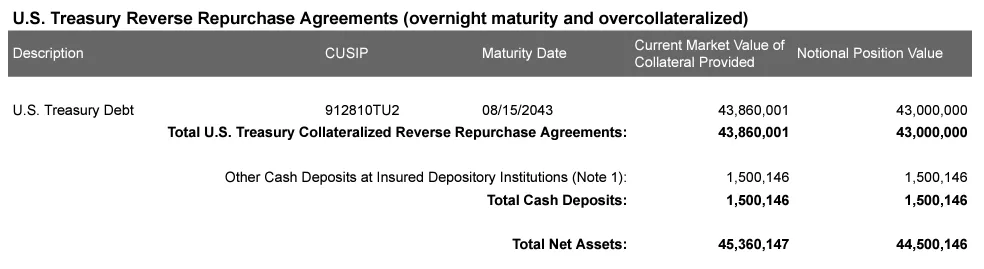

Since September 2023 Paxos has published a monthly reserve report for PayPal USD. The latest one states that as of 31 August the total assets in PayPal’s account “match or exceed the balance of PYUSD tokens.”

On that date there were $44.4m of PYUSD in circulation. Assets held by Paxos on behalf of PayPal’s stablecoin holders amounted to $44.5m at par value.

97% of reserves ($43m) were in overnight reverse repo agreements on US government bonds. The counterparties were “reputable financial institutions.” The remainder was in deposits at insured FDIC institutions.

“In the event of a counterparty default, Paxos may liquidate the collateral. Because all transactions are overcollateralised, the risk of loss is not considered material,” the report says.

The company could incur certain financial losses if a partner bank becomes insolvent, since insurance does not cover the full amount of deposits.

Where to buy PYUSD?

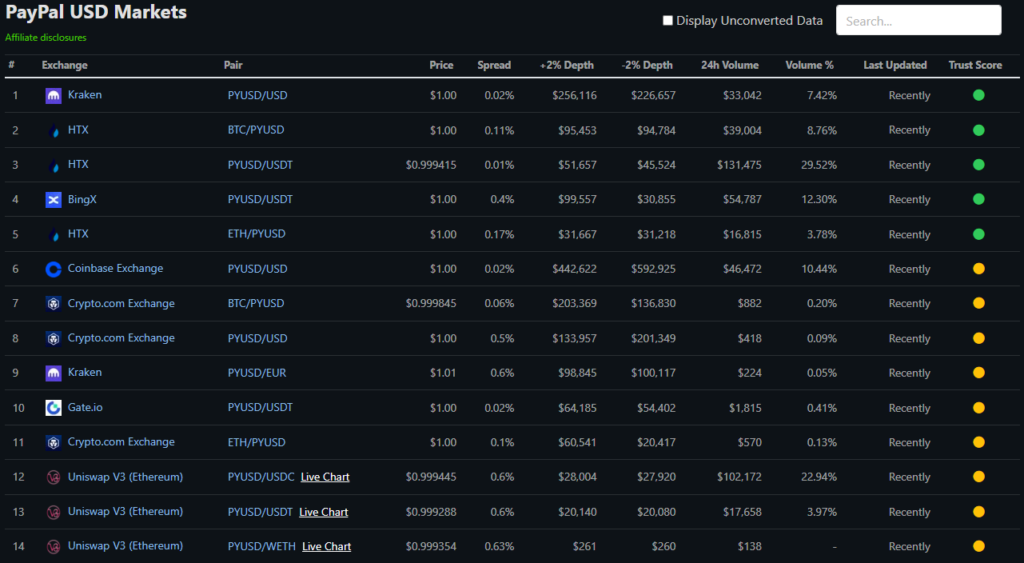

One of the first centralised exchanges to announce a listing for the new asset was HTX (formerly Huobi) — soon after PYUSD’s launch. Then the largest US crypto company Coinbase did the same.

PayPal’s stablecoin also trades on Kraken, BingX, Gate.io, Crypto.com and on the decentralised exchange Uniswap.

Nansen analysts noted weak demand for the stablecoin. Their report says that over 90% of total PYUSD issuance sits on the balance sheet of Paxos, its issuer. Only 7% of the coin’s supply is held in user wallets linked to Kraken, Gate.io and Crypto.com.

“We are observing a lack of demand for PYUSD from cryptocurrency users when other alternatives exist,” the experts noted.

How did regulators respond to PayPal’s stablecoin?

US lawmakers gave a mixed response to the payments giant’s launch of a “stablecoin”, calling for regulatory oversight of the sector.

US Representative Maxine Waters expressed “deep concern” over the debut of PYUSD. She pointed to the lack of a regulatory framework for such assets.

“PayPal’s 435m customers worldwide exceed the total number of online accounts at all megabanks. Given the size and reach, federal oversight and compliance of its operations with ‘stablecoins’ are necessary to guarantee consumer protection and mitigate risks to financial stability,” the congresswoman said.

House Financial Services Committee chairman Patrick McHenry also emphasised the need to pass a law on stablecoins.

“This announcement is a signal that stablecoins, if issued under a clear regulatory framework, promise to become the foundation of our payments system in the 21st century,” he wrote.

How does the crypto community view PayPal’s stablecoin?

Not only regulators but also the crypto community reacted ambiguously to PYUSD’s launch. In particular, Blockware Solutions’ chief analyst Joe Burnett said that those who support PYUSD have “lost their minds.”

“Buy bitcoin and hold it in a cold wallet. That is the innovation, not ‘dollars on a blockchain’ from big tech corporations,” he wrote.

Several smart-contract auditors noted that the “freezing” and “wiping” functions coded into PYUSD are textbook examples of centralisation attack vectors in Solidity contracts.

Other auditors added that PYUSD’s smart contract can be modified by PayPal at any time.

Blockchain engineer Patrick Collins called the choice of an outdated Solidity version “suboptimal”, and criticised the lack of gas-saving mechanisms in execution.

As HAPI Labs’ head of analytics and research Mark Letsiuk explained to ForkLog, the smart contract may be susceptible to known attacks (such as re-entrancy), bugs or vulnerabilities already fixed in later releases.

Some community members noted potentially high transaction costs due to the relatively expensive Ethereum network and the lack of support for layer-2 solutions.

Supporters welcomed the new coin’s impact on the Ethereum blockchain in the context of broader adoption. According to Bankless co-founder Ryan Sean Adams, the network of the second-largest cryptocurrency could become “the money layer of the internet.”

“430 million accounts actively use online payments processing, which means that more than 5% of the world’s 8 billion people could theoretically be connected to Ethereum through PayPal’s new stablecoin,” he explained.

Allbridge.io co-founder Andriy Velykyi suggested the new stablecoin could take off because it is backed by a major player.

“But regulation will affect it, so people will trust it weakly, especially because funds can be blocked at the smart-contract level,” he noted.

JPMorgan analyst Nikolaos Panigirtzoglou said PYUSD could benefit the second-largest cryptocurrency by increasing total value locked (TVL) in the ecosystem.

“This could boost activity in Ethereum and improve its network utility as a platform for stablecoins/DeFi. In other words, in the future more firms will choose the blockchain (or L2 solutions on it) for their projects,” the expert said.

He added that Ethereum could gain further if PYUSD fills the niche created by a $20bn reduction in Binance’s BUSD supply.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!