What is regenerative finance (ReFi)?

What is ReFi?

Regenerative finance (ReFi) is a concept and strand of decentralised finance (DeFi) that creates holistic economic models. Beyond material rewards, these aim to deliver positive environmental effects and address social problems.

ReFi’s main goal is to support the growth of a regenerative economy, with an emphasis on environmental outcomes, social well-being and resource resilience, while fostering large-scale collaboration on global issues such as climate change and biodiversity loss.

The foundational principles and concept of regenerative finance were proposed in 2015 by John Fullerton of the Capital Institute.

ReFi has much in common with the circular economy, as projects in this segment also focus on resource renewal and clean energy.

Conventional economic systems are often criticised for uneven resource allocation and for prioritising short-term profits over long-term sustainability.

ReFi, in turn, seeks:

- a holistic approach that recognises the interdependence of economic, social and environmental factors;

- an emphasis on sustainability — particularly financing environmental initiatives and firms linked to renewable energy;

- a social focus — ReFi aims to reduce economic inequality and improve societal well-being (for instance by funding initiatives that expand access to education, create jobs and build affordable housing);

- a shift from long-term gains to a sustainable long-term effect;

- encouragement of openness, transparency and accountability;

- active community participation in decision-making.

To achieve these aims, ReFi projects may raise capital, including through token sales, and adopt DAO principles. Such platforms are typically built on smart contracts, linking the segment to DeFi.

ReFi also overlaps with the decentralised science (DeSci) movement, which uses Ethereum and other ecosystems to fund, create, store and disseminate scientific knowledge.

What areas does ReFi cover?

One of ReFi’s principal thrusts is the tokenisation of carbon credits, intended to help cut harmful emissions.

The voluntary carbon market (VCM) is a funding mechanism for initiatives that have a verified positive impact on CO₂ emissions (VCM). After verification, these projects receive assets known as carbon credits, which they can sell to individuals and organisations wishing to support climate activity.

The shift to a digital carbon market (DCM) is meant to broaden access, eliminate intermediaries, and improve liquidity and transaction speed.

Notable elements of the DCM landscape include Verra, Gold Standard, Toucan Protocol, C3, Moss.Earth, Klima Infinity, Senken and Nori. They facilitate investment in carbon credits and help organise climate-preservation initiatives.

A prominent ReFi project is Celo. It describes itself as a “mobile-first” and “carbon-negative” blockchain. The “Ultragreen money” initiative is based on a token-burning mechanism that directs 20% of network transaction fees to a carbon-offset fund, making the CELO token deflationary.

Regenerative finance also aims to preserve historical records and cultural-heritage artefacts using blockchain and NFTs. Monuverse, in particular, focuses on this.

ReFi also includes projects specialising in “socially responsible lending”. Such platforms let borrowers access funding for educational and other initiatives aligned with “regenerative principles”.

Web3 also makes possible the issuance and trading of decentralised “green bonds”. These allow a broad set of users to fund environmental initiatives, with blockchains and smart contracts ensuring transparent payments and automating the accrual of interest on invested funds.

What risks does ReFi face?

Like any other segment of the crypto industry, ReFi carries risks and pitfalls.

For one, the financial sustainability of decentralised-finance projects can be uncertain. Critics argue that long-horizon investments focused on environmental and social impact offer lower returns than traditional ventures.

Another aspect is the difficulty and labour-intensiveness of assessing the social and environmental consequences of financial decisions. ReFi projects can mitigate this by introducing common technology standards and by using blockchains and other advanced tools to improve transparency in process monitoring.

It is also important to consider potential regulatory hurdles, which may arise owing to gaps in the rulebook. Constructive dialogue with authorities, traditional financial institutions and businesses, as well as educational outreach to popularise ReFi, could help.

Scalability matters too — ReFi projects may have limited global impact due to fundraising constraints and logistical difficulties. Technology advances, global networks and joint ventures, and partnerships with communities that share regenerative-finance principles could change this.

Some ReFi projects set lofty goals while offering vague explanations of how those goals will be achieved. Often such firms seek to profit from hype around environmental and other social initiatives.

Investors should be especially wary if:

- tokenomics disclosures are insufficient;

- a large share of the token supply is concentrated in the hands of founders and a narrow circle of early investors;

- the project lacks a detailed roadmap with clearly defined dates and planned actions to achieve its stated goals.

Before committing funds to a new ReFi initiative, market participants should carefully review the team’s background.

If a platform asks a user to disclose a seed phrase, it is a scam designed to drain the wallet. Interact only with vetted projects — for example, those that have raised capital from well-known venture firms.

How do ReFi and DeFi relate?

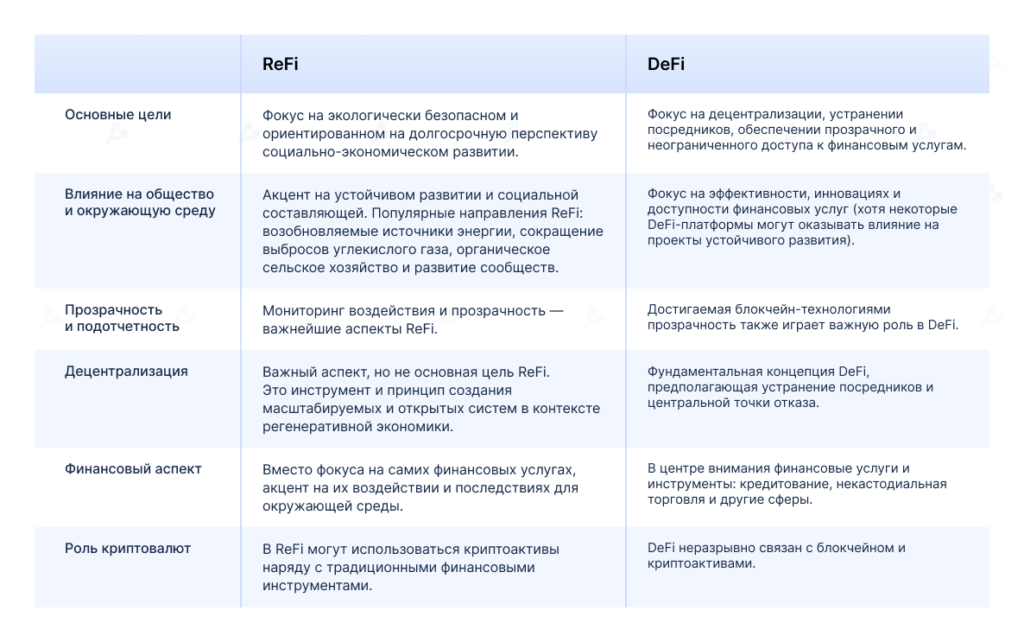

Using blockchains and smart contracts, DeFi and ReFi have much in common. Yet, though closely connected, they serve somewhat different purposes.

The table below summarises their key similarities and differences:

In the broader crypto industry, DeFi can be seen as the larger category, with ReFi as one of its components. This direction is developing alongside new, non-financial subsegments such as DeSci, DePIN and DeSoc.

What are ReFi’s prospects?

For all the significance of the concept, it is too early to speak of the practical benefits of these projects. The main reason is limited mainstream interest — few are ready to take part.

For example, daily trading volume in the Moss Carbon Credit (MCO2) token is $39,400, according to CoinGecko on 23 December. The asset is illiquid and not listed on popular platforms such as Binance or OKX.

The ReFi model is still scarcely represented in real-world project development. The solutions on the market are used by only a small number of genuinely interested participants.

Supporters of regenerative finance are trying to solve an important, somewhat utopian task. Yet the segment’s growth and the spread of the idea could, over time, make ReFi far more popular and change public attitudes to cryptocurrencies overall.

Profit is not the main goal when engaging with regenerative-finance platforms. Liquidity flows are viewed as a link in a chain and a means to solve environmental, social and scientific challenges in a holistic way.

A large part of the public still sees cryptoassets as detached from the “real world”. Many associate the blockchain industry only with speculation in valueless coins for quick riches. With the possible popularisation of ReFi, decentralised finance and cryptocurrencies as a whole have a chance to refresh their image.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!