What is Solana (SOL)?

What is Solana?

Solana is a project developing a scalable blockchain protocol for building decentralised applications and smart contracts.

Who created Solana, and when?

Solana was founded by former Qualcomm engineer Anatoly Yakovenko, former BREW developer Greg Fitzgerald and particle-physics PhD Eric Williams.

In 2017 Yakovenko published a draft white paper introducing a blockchain synchronisation algorithm called Proof-of-History (PoH). Later, Yakovenko and his former Qualcomm colleague Greg Fitzgerald built a Rust-based blockchain that uses PoH as an “internal clock”. In February 2018 Yakovenko and Fitzgerald published the project’s official white paper and launched the first internal testnet.

In 2018 Yakovenko and Fitzgerald founded the company now known as Solana Labs. The team includes former programmers from Google, Microsoft, Qualcomm, Apple, Intel and Dropbox.

The founders initially named the project Loom, later renaming it Solana to avoid confusion with the Loom Network layer-two solution. The project is named after Solana Beach, a town 30 minutes from San Diego where Anatoly Yakovenko lives.

From April 2018 to July 2019 the project raised more than $20m in venture funding through several private token sales. In the third quarter of 2020 the public testnet Tour de SOL went live. In March 2020 the mainnet beta launched.

In June 2020 the project created the Solana Foundation, an organisation focused on growing the Solana ecosystem and advancing decentralised technologies. Solana Labs transferred 167 million SOL tokens and all intellectual-property rights to the Foundation.

How does Solana work?

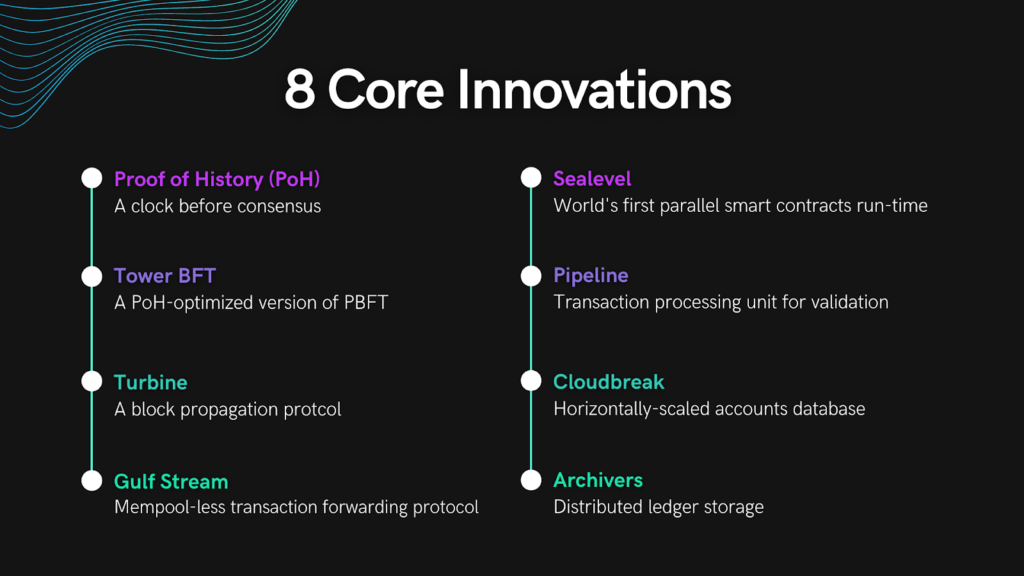

Solana aims for a decentralised network of nodes to match the performance characteristics of a single node. That requires optimising how nodes interact. Solana tackles this with eight key technologies.

Proof-of-History blockchain synchronisation algorithm

One challenge for cryptocurrencies is node synchronisation. Synchronisation speed affects blockchain throughput: the faster it is, the more transactions per second the network can process. To synchronise by time, one needs clocks. Cryptocurrencies have an internal clock—timestamps—but without a central source of truth they are inexact. Such synchronisation is imperfect: relying on timestamps, a new block can appear to precede the previous one.

Proof-of-History is not a consensus mechanism but a way to optimise the time cost of confirming operations when ordering transactions. It is used in tandem with Proof-of-Stake.

PoH acts as decentralised timekeeping, addressing synchronisation. It creates a chronological record proving that an event occurred at a specific moment. PoH is a high-frequency verifiable delay function (VDF): it requires evaluating a set number of sequential steps yet produces a unique, publicly verifiable output.

Other blockchains require validators to communicate to agree that time has passed. Solana requires validators to maintain their own clocks by continuously solving a VDF based on the SHA-256 hash function. Validator selection is scheduled in advance for an epoch that lasts thousands of blocks. Validators are rewarded for their work.

Proof-of-History keeps the network running continuously via automatic rotation without validator participation. It also lets Solana optimise block creation time, replay, throughput and data storage in the ledger.

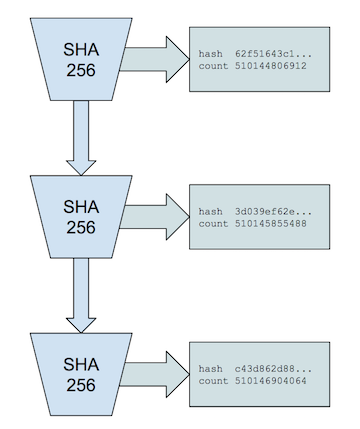

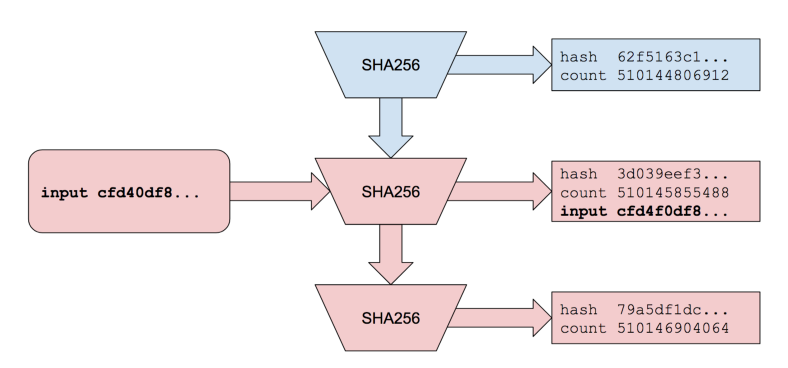

- SHA-256 is chained as fast as possible, with each output serving as the next input.

- Samples of the chain are taken; the iteration count and state are recorded.

The recorded samples represent elapsed time encoded as a verifiable data structure. The chain can also be used to account for events.

- A message referencing any sample is guaranteed to be created after that sample was created;

- Messages can be embedded into the chain and hashed with the state, guaranteeing the message was created before the next insertion.

This data structure guarantees precise timing and ordering of events.

Tower BFT

Tower BFT is an implementation of the Practical Byzantine Fault Tolerance (PBFT) algorithm. To reach consensus, Tower BFT uses PoH as a clock to reduce computational cost and latency.

Turbine

The Turbine transaction-propagation protocol addresses the blockchain scalability trilemma by analogy with BitTorrent. Most blockchains have fixed node bandwidth; adding nodes increases the time to deliver data to each node. Turbine mitigates this by sending data over UDP. Each user-data packet is transmitted over a randomly chosen path.

The block producer (leader) splits a block into smaller packets (no larger than 64 KB). For example, a 128 MB block is split by the leader into 2,000 packets of 64 KB, then sent to different validators. They forward packets to a new group of nearby validators (in Solana they are called a neighborhood — the neighbourhood). This allows each neighbourhood, which includes 200 nodes, via a tier-three network starting with the new leader, to expand to roughly 40,000 validators in about 200 milliseconds.

Gulf Stream

Gulf Stream is a transaction-forwarding protocol without a mempool, enabled by pre-knowledge of validator schedules. Every Solana validator knows the order of future leaders and can therefore forward transactions to the expected leader ahead of time. This enables early execution, shortening confirmation times, speeding leader rotation and reducing memory pressure from unconfirmed-transaction pools.

Sealevel

The Sealevel virtual machine processes transactions in parallel, horizontally scaling across GPUs and SSDs. Most other blockchains are single-threaded. Solana supports parallel transaction execution and signature verification within a single shard. This is enabled by the operating-system driver technique known as scatter–gather.

Transactions declare in advance which state they will read and write during execution. Sealevel finds non-overlapping transactions in a block and schedules them. Execution is performed by hardware using native Berkeley Packet Filter (BPF) bytecode.

Pipeline

Pipeline is the transaction-processing unit (TPU) used to optimise validation. Solana’s validation employs a pipelined optimisation method, effective for sequential streams of incoming data. Dedicated hardware handles each stage.

With Pipeline, data collection occurs at the kernel level, data verification on the GPU, banking on the CPU and writing at the kernel level.

As Pipeline sends blocks to validators, it fetches the next batch of packets, verifies signatures and begins crediting tokens. GPU-level parallelism lets Solana’s TPU operate at high performance.

Cloudbreak

Cloudbreak is a horizontally scalable accounts database. It optimises parallel reads and writes to SSDs. Each additional disk increases memory available to on-chain programs and the volume of parallel I/O.

This enables prefetching accounts from disk and preparing the execution environment. Nodes can begin executing transactions before they are encoded into a block, reducing block-production time and execution latency.

Archivers

Archivers are the distributed-ledger storage layer. Storing data on a high-performance network tends to centralise: if storage is costly, only well-resourced users can act as validators and participate in consensus. In Solana, data storage is handled not by validators but by a network of nodes called archivers.

Archivers do not participate in consensus. The state history is split into many fragments and error-tolerant codes. Archivers store parts of the state. Solana uses Proofs of Replication (PoRep), borrowed from Filecoin. Archivers have not yet been implemented, but they are part of the project’s long-term road map.

Which consensus mechanism does Solana use?

Tower BFT—a Proof-of-Stake-based consensus mechanism—uses Proof-of-History as a clock, reducing throughput loss and network latency.

When a validator votes for a given fork, the vote is bound to a fixed period of hashes called a slot. A slot lasts roughly 400 milliseconds. Every 400 milliseconds a potential restart point is created. Each subsequent vote doubles the time that must elapse before the network can lock in that vote. Additional votes make it harder to roll back transactions executed in a given slot.

Thus, a block with multiple votes is likelier to remain part of the chain. For example, suppose each validator has voted 32 times over the past 12 seconds. The vote cast 12 seconds ago has a timeout of 2³² slots—approximately 54 years. The network will never revert that vote.

The most recent vote, by contrast, has a timeout of two slots—about 800 milliseconds. As blocks are added to the ledger, the odds that older blocks are confirmed increase, because the number of earlier vote slots doubles every slot.

Finality arrives after two-thirds of validators vote for a given sequence of events. After finality, transactions cannot be reversed.

Token holders can participate in block production as stakers and validators and earn rewards. They can also delegate tokens to trusted validators.

There is no minimum stake. The right to become leader—the validator proposing the next block—depends on the amount of tokens staked.

What role does the SOL token play in the Solana ecosystem?

SOL is the native utility token of the Solana blockchain. SOL uses SPL, Solana’s token standard analogous to ERC‑20 on Ethereum.

The smallest unit of SOL is called a lamport, after computer scientist Leslie Lamport, whose work underpins distributed-systems theory. One lamport equals 0.0000000000582 SOL.

There are three uses for SOL:

- Staking;

- Transaction fees;

- Governance.

Solana’s deflationary model provides for burning SOL.

SOL can be stored in sollet.io, developed by Serum Academy, in Trust Wallet for mobile devices, and in other wallets that support the SPL standard. Some wallets support staking—for example, SolFlare.

How is Solana developing?

In August 2020 the decentralised exchange Serum launched on Solana. Serum employs Optimistic Rollup, a layer-two solution for Ethereum, to enable cross-chain swaps and tokenisation.

In October 2020 the Solana project unveiled Wormhole, a cross-chain solution linking tokens on Ethereum and Solana.

In May 2021 Solana Foundation launched five funds with a combined $100m to support application development in China, with help from Huobi, Gate.io and NGC Ventures, MATH Global Foundation and Hash Key.

That same month the project raised $60m from Hacken, Gate.io, Coin DCX and BRZ. The money will go to three funds focused on expanding the ecosystem in Ukraine, India, Brazil and Russia, supporting development of blockchain applications in DeFi, NFTs and cybersecurity.

In June 2021 Solana Labs raised $314m in a private token sale led by Andreessen Horowitz (a16z) and Polychain Capital, with participation from Alameda Research, CMS Holdings, CoinShares, Jump Trading, Multicoin Capital, Sino Global Capital and others. Solana Labs will use the proceeds to establish a venture arm to invest in its ecosystem and to launch a studio to develop projects on Solana.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!