Wintermute Sees Crypto Market Narrowing Focus to Bitcoin and Ethereum

Bitcoin spiked to $94,000

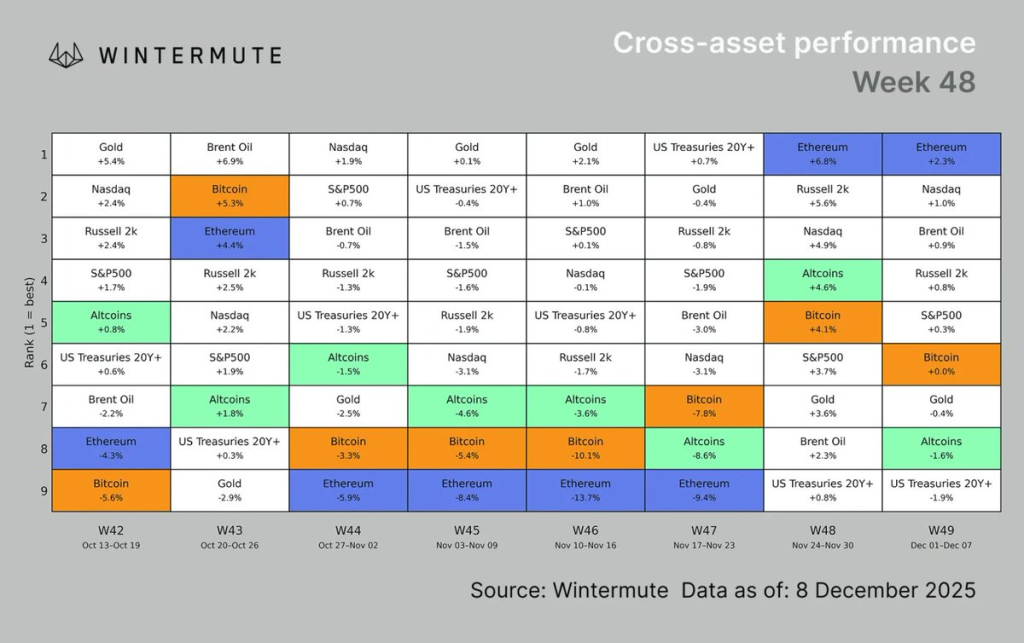

Digital-asset markets are consolidating in a choppy yet resilient range, but investor activity is largely confined to bitcoin and Ethereum, according to analysts at Wintermute.

“After two months of macroeconomic uncertainty, markets are starting to show greater tolerance for negative factors. Familiar worries about a reversal in central-bank policy, mixed macro data and persistent capital allocations to AI stocks remain, but they no longer elicit the previous reflexive risk-off response,” the experts noted.

In their view, markets have entered a “consolidation phase characterised by a mix of stability and instability”, as evidenced by tight price action over the past two weeks.

For digital assets, however, this looks more like a “period of digestion” than an established trend.

A fading Nasdaq impulse has led to selective risk-taking, with investors favouring quality over broad beta, according to Wintermute. In crypto, that has “narrowed interest” to the leading coins — BTC and ETH — across both retail and institutional cohorts.

“Despite this, the compressed base suggests a low probability of leverage being deployed, as the market waits for macro clarity. Meanwhile, elevated implied year-end volatility points to a split market: traders are targeting either $85,000 or $100,000,” the analysts added.

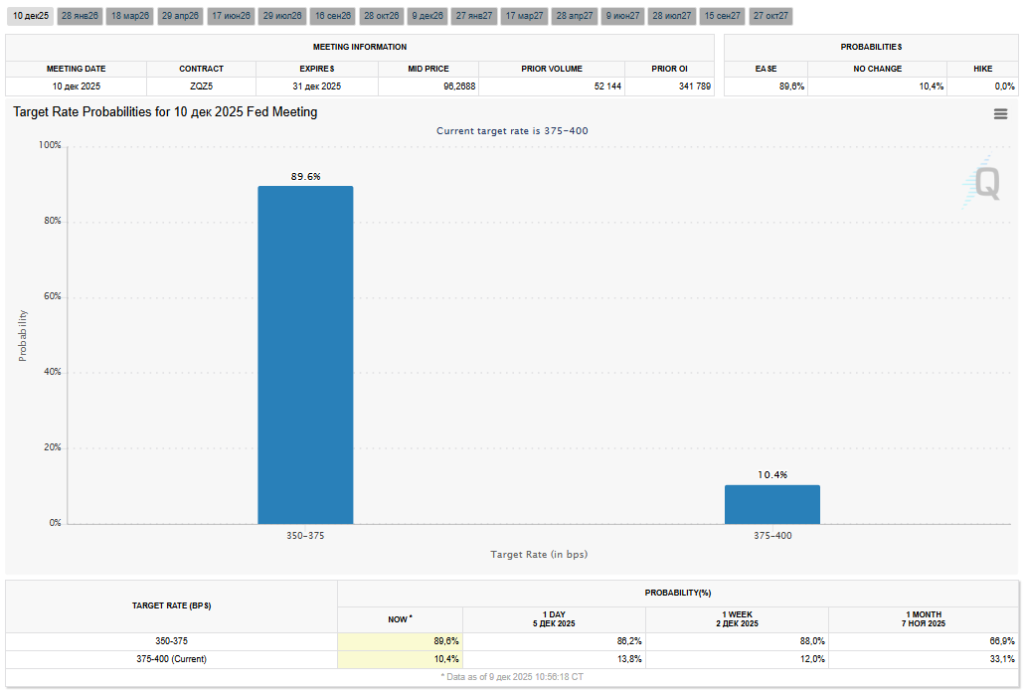

Attention now centres on the the Fed‘s rate decision on 10 December and a similar decision by the Bank of Japan next week. Absent decisive “macro surprises”, cryptocurrencies are likely to remain range-bound.

Market participants put the probability of a 25 bp cut at 89.6%.

Market conditions

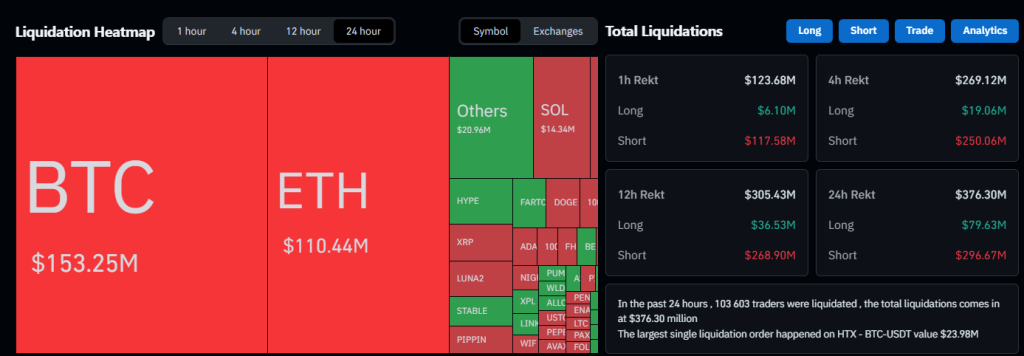

On 9 December, after the US session opened, bitcoin jumped from $90,000 to $94,000.

Ether rose from about $3,100 to $3,450.

Over the past 24 hours, liquidations totalled $376m, with $296m in shorts.

The crypto market’s rise also coincided with the publication of US labour-market data. Job openings in October were just under 7.7m versus 7.6m in September.

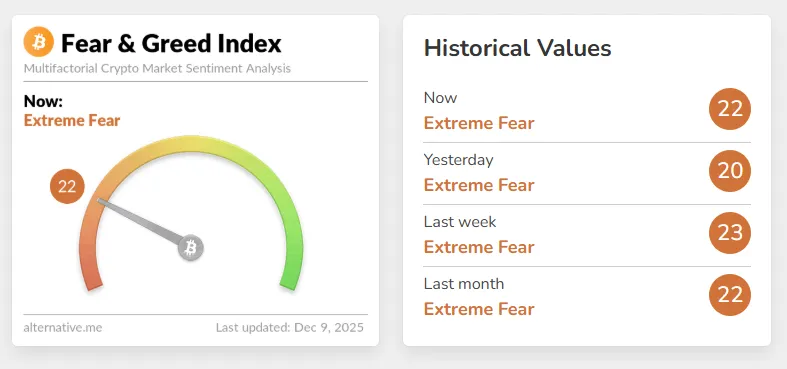

The crypto Fear and Greed Index remains in the “extreme fear” zone at 22.

Earlier, researchers at London Crypto Club predicted a sharp bitcoin surge, driven by the upcoming Fed meeting.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!