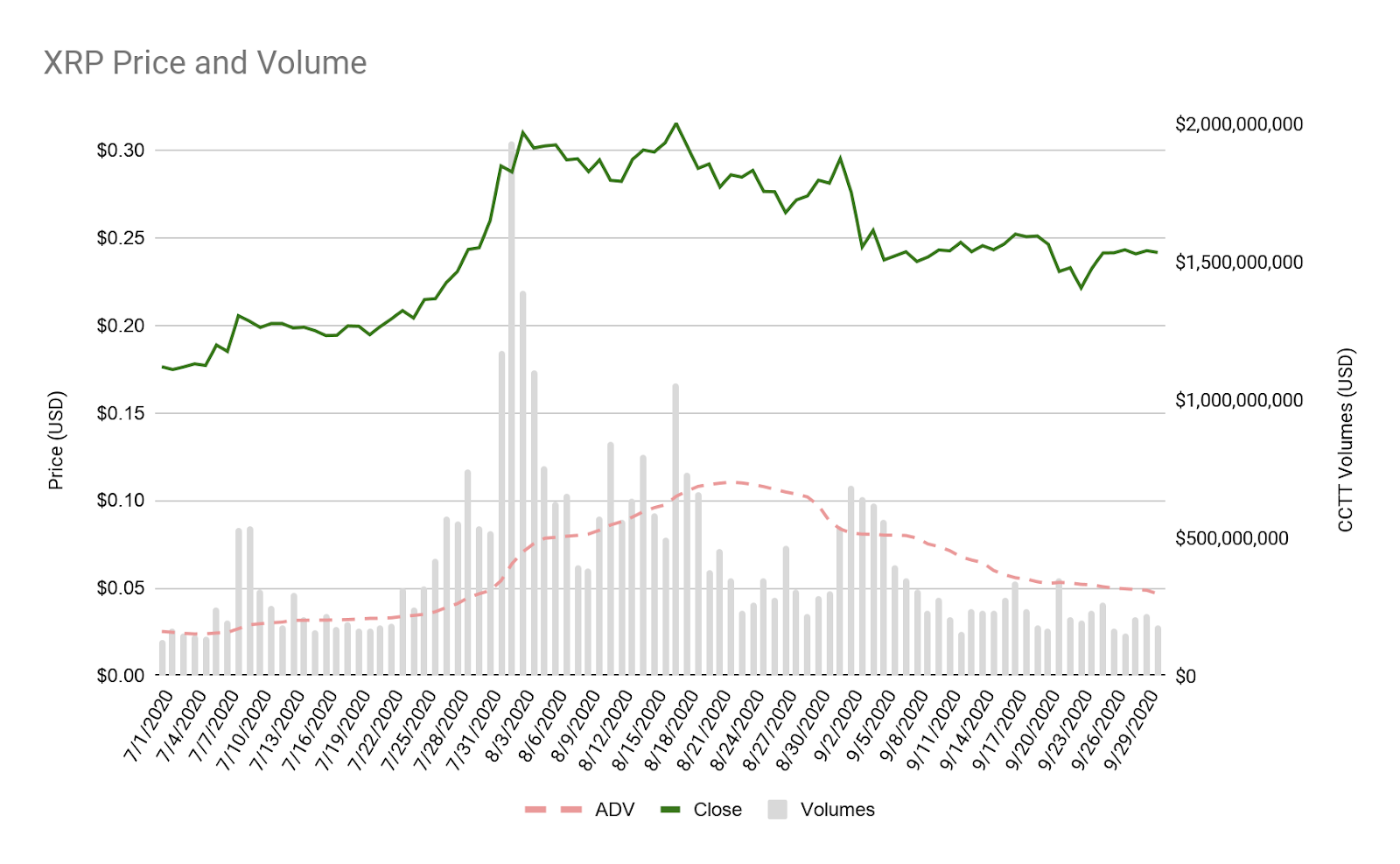

XRP trading volumes in Q3 rise to $37 billion

According to Ripple’s Q3 2020 report, XRP’s aggregate trading volumes, compared with the second quarter, rose by 108% to $37.13 billion. In the second quarter this figure was $17.86 billion.

The average daily volume rose from $199.28 million to $403.58 million.

The average daily XRP volume in Q3 2020, calculated using the CryptoCompare API. Source: Ripple.

In general, in terms of liquidity and trading volumes, XRP during the period ranked fourth most popular asset on the markets, rising one place.

The company said it is developing new tools for the On-Demand Liquidity (ODL) system, used for cross-border payments. This is to enable access to liquidity from the open market, not only from Ripple.

To this end, the company launched the Line of Credit business lending program, which operates on the RippleNet network and targets fintechs and small- and medium-sized businesses. According to the release, after testing the product with a limited circle of companies, Ripple received exclusively positive feedback.

Ripple notes that it continues to buy XRP to support markets. In Q3 the company purchased XRP for a total of $35.84 million. In the previous quarter, this figure was $32.55 million.

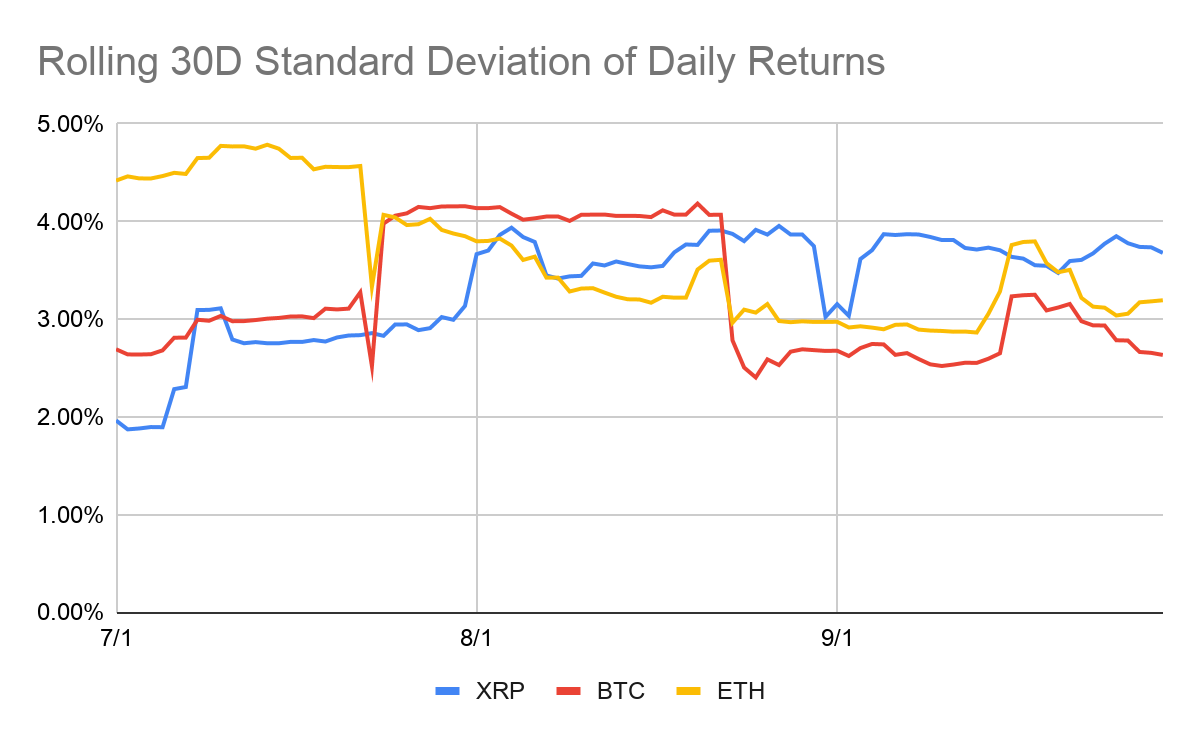

The standard deviation of daily returns in Q3 was 3.5% versus 3% in Q2, making XRP somewhat more volatile than BTC (3.2%) and ETH (3.3%).

Daily return standard deviation in Q3 2020. Source: Ripple.

During the period, Ripple withdrew 3 billion XRP from escrow accounts, returning 2.4 billion tokens to them.

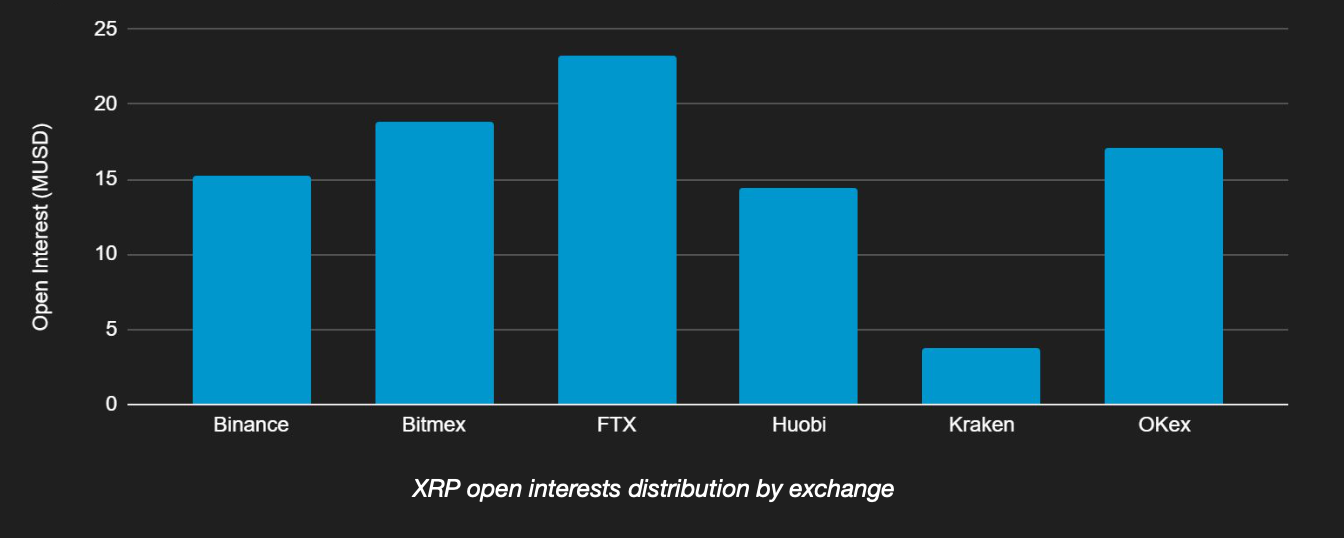

Source: Ripple.

The company also notes the advantages of XRP as a tool for arbitrage trades. Among them are low fees, high transaction speed, and the asset’s reliability.

In a phishing attack, Ledger hardware-wallet owners lost more than 1,150,000 XRP (over $292,000).

Subscribe to ForkLog news on Telegram: ForkLog FEED — the full feed of news, ForkLog — the most important news and polls.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!