Zcash Developers Propose Dynamic Fee System

Zcash team proposes dynamic fees to counter rising transaction costs.

The Zcash development team has unveiled a plan to introduce dynamic fees. This new system aims to protect users from network unavailability due to rising transaction costs amid the appreciation of ZEC.

Until now, fees in the network were fixed—initially at 10,000 zats, then reduced to 1,000 zats. This allowed malicious actors to overload the blockchain and user wallets with cheap transactions.

The update ZIP-317 partially addressed the issue by basing fee calculations on actions rather than their size. However, fees remained low.

As the price of ZEC increased, even regular transfers became significantly more expensive. Anonymizing large volumes of small payments could cost dozens of tokens.

The new mechanism proposes:

- calculation from the median—the base fee will be determined as the median value of fees for actions in the last 50 blocks;

- privacy protection—fees will be rounded to the tenth degree to complicate the analysis of specific user activity;

- priority queue—during high load periods, a temporary channel with a fee ten times the base will allow urgent transactions to enter the block faster.

Developers suggested implementing the system in three phases. Initially, it will operate in a test mode for data collection and analysis. Then, it will be available for anyone to try.

Only after thorough discussion and confirmation of its effectiveness can the mechanism be adopted as a consensus change in the protocol.

Among other proposed ideas is linking fees to mining difficulty to stabilize them in dollar terms.

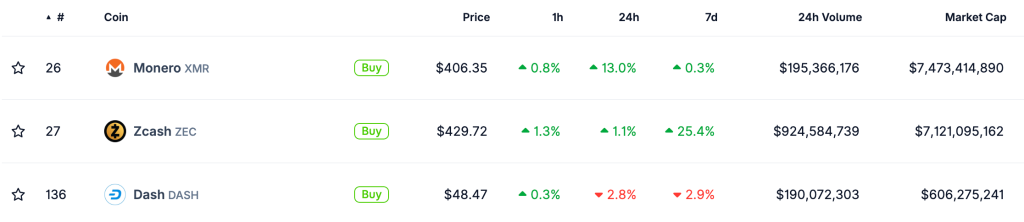

ZEC Dynamics

The initiative has boosted the ZEC rate—the price jumped by 12%. At the time of writing, the anonymous coin is trading at $433. Over the past week, the token has gained 25%.

However, current quotes are significantly below the local highs reached in mid-November above $720. Since then, the private coin sector has corrected—Monero has once again surpassed Zcash in market capitalization.

Analysts from the crypto exchange Toobit commented to ForkLog that regulatory pressure has been a factor in the correction:

“More countries are implementing Travel Rule standards. Some centralized exchanges have also delisted coins like Monero and Zcash; rules akin to MiCA/AMLR have created challenges for supporting fully private assets on CEX.”

Experts believe that further tightening will hinder the sector’s growth. For anonymous cryptocurrencies to recover and grow, three conditions must be met simultaneously:

- stronger real-world use of private payments;

- easing of regulatory pressure;

- a new powerful trigger that will make the market reassess the value of privacy.

In early December, crypto enthusiast Crypto Bitlord called the ZEC rally “the most successful scam in cryptocurrency history.”

Later, Arkham specialists de-anonymized more than half of the transactions in Zcash.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!