ZeroLend DeFi Protocol Announces Closure

ZeroLend ceases operations due to low liquidity and lack of profitability.

The decentralized lending protocol ZeroLend has announced a complete cessation of its operations. The project’s founder, known by the pseudonym Ryker, attributed the decision to low liquidity in the supported networks and a lack of profitability.

— ZeroLend (@zerolendxyz) February 16, 2026

According to the developer, some of the supported blockchains have become inactive, and oracles have stopped supplying data to them. This has made reliable market management impossible. The situation was exacerbated by constant attacks from hackers, scammers, and the low margins of the business.

The team strongly recommended that clients withdraw their assets. Some user funds are locked in illiquid networks. To return them, the developers will update smart contracts and redistribute the frozen coins.

Ryker also announced partial compensation for liquidity providers affected by an exploit on the Base network in February of last year. The payments will be funded from the team’s personal airdrop allocation.

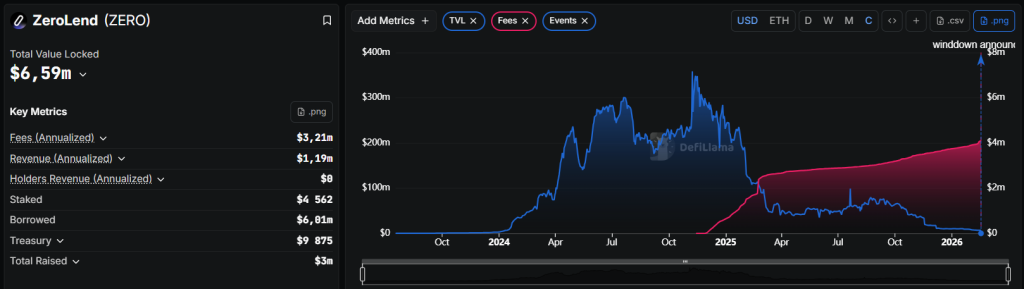

The total value locked in the protocol plummeted from a peak of $359 million in November 2024 to $6.59 million at the time of writing.

Following the closure announcement, the price of the native token ZERO fell by 33.5%.

Back in August 2025, the MEV protocol Eden Network announced its closure. The decision was due to fierce competition in the sector and high operating costs.

In November, the analytics service DappRadar decided to cease operations, citing the “financial instability” of the market.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!