Zimbabwe sells gold-backed digital tokens worth $39 million

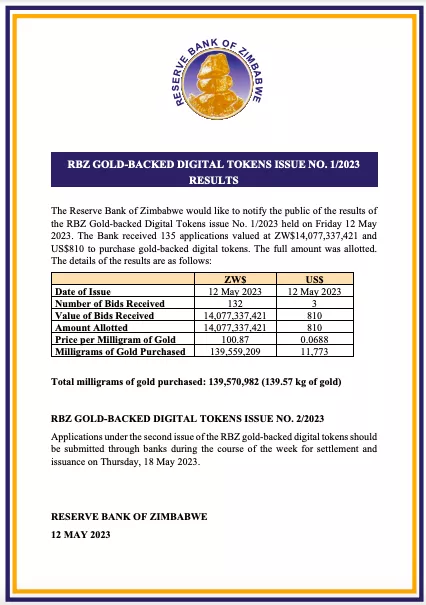

On 12 May, the Reserve Bank of Zimbabwe (RBZ) объявил about 135 applications totalling 14.07 billion ZWD (~$39 million) for the purchase of gold-backed digital assets.

The tokens were sold at prices starting at $10 for individuals and $5,000 for corporations and other organisations. Such rules established by the RBZ before the sale.

The minimum holding period for the tokens is 180 days, and they may be stored in specially created wallets or cards.

A second round of sales is also planned; the bank will accept applications until May 18.

“The issuance of gold-backed digital tokens is intended to safeguard the economy and diversify investment opportunities, as well as to provide appropriate instruments to the population,” — заявил RBZ head John Mangudya.

Zimbabwean authorities backed the sale of gold-backed tokens despite warnings from the International Monetary Fund (IMF). According to a Bloomberg report, on 9 May the organisation highlighted risks to macroeconomic stability and financial stability. The IMF also noted potential legal and operational issues.

The country presented a plan to tokenise gold in April. According to the government, the assets are backed by 139.57 kg of the precious metal.

Back in December 2021, the Swiss crypto bank SEBA released a gold-backed token that would allow investors to own a digital form of the precious metal through a ‘fully regulated, economical and forward-looking solution’.

In February 2022, Japanese trading company Mitsui announced a gold-backed stablecoin.

Later, US senators put forward a proposal for launching a digital currency for the state of Texas backed by a precious metal.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!