How World War Could Trigger Bitcoin’s “1984” Hard Fork

A bleak scenario of a decentralised world war

What if leading states extended large-scale hybrid conflicts to the crypto-economy, putting the integrity of Bitcoin’s network at risk? Anatoly Kaplan posed the question—and found it less idle than it first appears.

From private actors to states

Bitcoin has travelled a long road from a project of a few enthusiasts to the world’s largest and most secure PoW network. In 2010 its hashrate passed 1 GH/s and kept rising. Today it hovers around 1 ZH/s, roughly 20–25 GWh of daily energy consumption, costing $800–1000 million.

One of Bitcoin’s most turbulent periods came in 2017. Debate over block size failed to produce consensus, and the network underwent a hard fork. First came Bitcoin Cash, followed by several more forks of the original cryptocurrency. By 2025 only Bitcoin Cash endured, backed by Roger Ver.

The entrepreneur spent years in disgrace, but this year he struck a favourable deal with the US authorities. Ver has long cultivated an aura of extravagance. Early on he styled himself “Bitcoin Jesus”, monetised the Bitcoin.com domain amid disputes, and by 2017 his personal standing let him push through a successful hard fork and mint a private version of digital gold.

Now, at the end of 2025, a once-fanciful question looks less far-fetched: if one person pulled this off, why shouldn’t entire states—let alone corporations—do the same? Imagination supplies the grimmest possibilities.

At the start of the 21st century millennial euphoria gave way to disappointments and tragedies. The bloody conflicts in the Balkans smouldered on, while the wars in Afghanistan and Iraq dominated the global news cycle. As it turned out, that was only the beginning.

By 2010 a wave of truly large-scale confrontations had swept the planet. Judging by current conditions and the rhetoric of global leaders, this could soon morph into a kind of “decentralised world war”.

Crypto—above all Bitcoin—would not be spared. The issue is not price, tighter controls or new restrictions, but a series of fresh splits of digital gold via hard forks. States that are actively adding to their Bitcoin reserves could be involved.

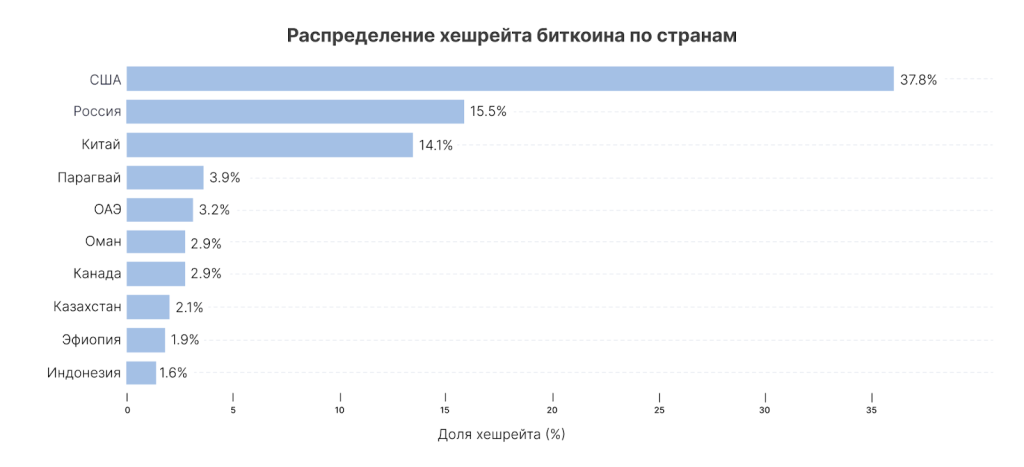

At present the distribution of Bitcoin hashrate by country looks like this:

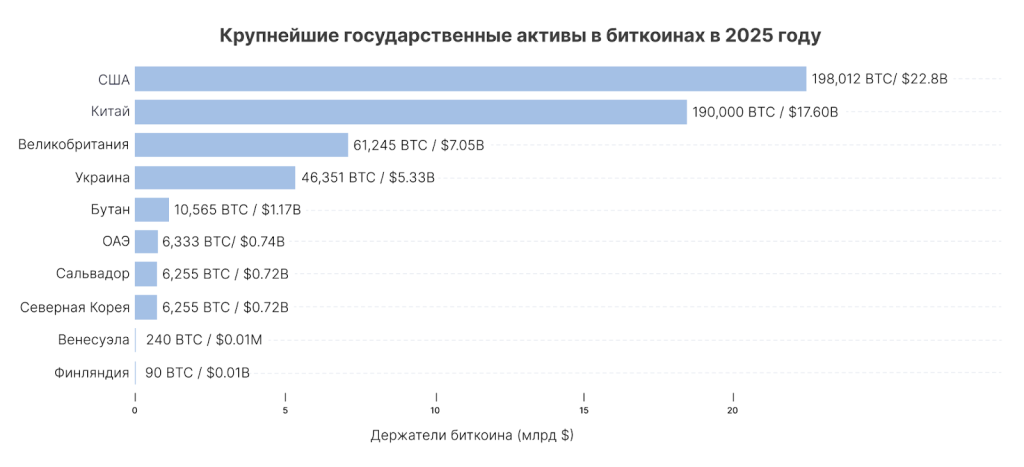

The distribution of coins is even more intriguing. The figures below are rough estimates of the Bitcoin holdings under state control:

There are also coins attributed to Satoshi—early holdings of unknown provenance, some likely inaccessible. Their total is variously estimated as follows:

- 500,000 to 1.5 million BTC — “Satoshi’s coins”.

- 2 million to 4 million BTC — “lost” coins.

Why would warring states hard-fork Bitcoin at all? To depress an adversary’s wealth: a split would inevitably redistribute liquidity across new chains.

It would also curb an opponent’s financial operations within the initiator’s economic zone. Suppose all coins on the post-fork chain accrue to the forker. The adversary would hold nothing on that alternative chain and could no longer use the infrastructure it once relied on. Because the move comes from a state, major exchanges and brokers within its orbit would refuse to support the enemy chain.

Such a hard fork would likely be preceded by transaction censorship in specific economic zones, enforced via miner control and KYC/AML tools. These would exclude deposits and processing of funds from designated addresses; miners would ignore their transactions; exchanges would freeze assets, and so on—sanctions by another name. Yet that would scarcely suffice to inflict serious damage.

A hard fork is the far more advantageous play. It would not only expropriate the opponent but also sow panic across markets and society.

Bitcoin was not the first protocol to grapple with the consequences of a hard fork. A notable precedent came when Ethereum split after The DAO collapsed in 2015, giving rise to Ethereum Classic. Today ETH has successfully migrated to PoS, while its alternative version remains on PoW for ideological reasons. The episode legitimised future hard forks.

If a “decentralised world war” escalates, another Bitcoin hard fork looks inevitable—likely triggering similar moves across many other PoW and PoS networks.

How to protect oneself or reduce risk? It is hard to anticipate every challenge users would face in such a scenario. The key risks would probably centre on centralised platforms. First, markets would need time to parse the consequences and integrate one chain or another. Second, many large players—exchanges above all—would face pressure from multiple states at once.

How Oceania, Eurasia and Eastasia divided Bitcoin

Consider how a Bitcoin hard fork might unfold in the world of George Orwell’s “1984”, where much of the planet is split among three superstates: Oceania, Eurasia and Eastasia.

In this reality four versions of Bitcoin exist:

- Bitcoin Ocean;

- Bitcoin Eurasia;

- Bitcoin OST;

- Bitcoin Core — the original network maintained by participants who rejected every superstate-led hard fork and support a neutral chain operating on Bitcoin’s founding principles.

How did it start? One fine day the president of Oceania declared war on Eurasia. In response Eurasia and Eastasia jointly announced a Bitcoin hard fork. Controlling a significant share of miners, they swiftly executed a split dubbed Bitcoin Global, mustering roughly 70% of hashrate and a large share of liquidity.

Beyond severing Oceania’s segment of the network, the fork moved all coins dormant for more than ten years to addresses controlled by the Bitcoin Global Foundation (BGF).

Oceania, in turn, was forced to initiate its own hard fork and impose direct control over all mining firms and exchanges on its territory. The superstate lost over 70% of its Bitcoin savings owing to the split and the market’s panic.

While Oceania grappled with the fallout, something went awry at Bitcoin Global. Several BGF officials stole all coins seized from early Bitcoin addresses and vanished. Along the way they sold at least half the haul, crashing the price.

Authorities in both countries blamed each other, and the scandal split the allies. Eastasia launched its own hard fork, christening the new network Bitcoin OST. Soon after, Eurasia demanded that Eastasia transfer all the stolen coins to its control. Instead, Eastasia declared war on Eurasia.

Amid the chaos a small band of enthusiasts kept the original Bitcoin Core alive. Thanks to quick work and a handful of security updates, they maintained about 10% of the network’s computing power and liquidity.

Each of the new Bitcoins, apart from Bitcoin Core, acquired extra features: in some, the state could reverse transactions; in others, an account could be created only after full identification and disclosure of personal data. Little of the original Bitcoin survived in these chains. Yet the original Bitcoin Core endured.

Let us leave Oceania, Eastasia and Eurasia to their many Bitcoins and return to 2025.

Tensions are rising by the day, claiming thousands of lives. If this continues, Bitcoin, too, will be split. The combined capitalisation of digital assets is still small beside world GDP. Yet cryptocurrencies have long proved useful not only to fans of decentralisation and hard money, but also to participants in international politics.

A new Bitcoin split would likely entrench financial stratification. In such a reality, allegiance to one chain or another would determine not just a user’s geography and politics, but their entire socio-economic lot. Which Bitcoin would you choose?

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!