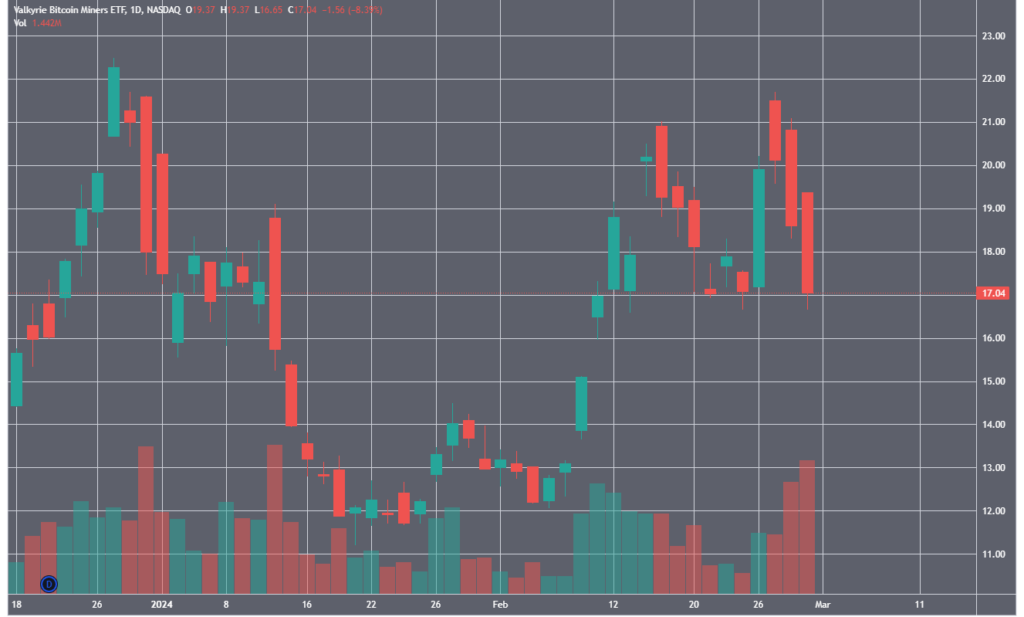

Mining Stocks Plummet Despite Bitcoin Surge

The Valkyrie Bitcoin Miners ETF, which is based on publicly traded mining company stocks, has lost over 20% since February 27, despite Bitcoin’s rise above $64,000.

Shares of two of the industry’s largest companies — Marathon Digital Holdings and Riot Platforms — fell by 18.5% and 21.9% respectively. CleanSpark CleanSpark (27.5%) and TeraWulf (25.4%) were hit even harder.

Peter Schiff, a well-known Bitcoin critic and founder of Euro Pacific Asset Management, noted the decline. He suggested it might signal upcoming issues for the cryptocurrency itself.

What’s going on with Bitcoin miners? $WGMI, a Bitcoin miners ETF is down 22% from its high just two days ago. Is this a sign of trouble ahead for #Bitcoin itself and for all of those new #BitcoinETFs?

— Peter Schiff (@PeterSchiff) March 1, 2024

A trader stated that he invested in CleanSpark, whose shares rose from $3 to $24 in four months. However, as Bitcoin approached $65,000, he chose to exit the position, as “the situation started to look unclear.” He anticipates new opportunities in the sector post-halving.

Mitchell Askew, chief analyst at Blockware Solutions, told Cointelegraph that the most logical explanation for the divergence is that investors are weary of investing in miners as the block reward halving approaches.

The expert noted that in 2023, such significant trend divergence was observed twice.

“Both times proved to be excellent opportunities to acquire miner stocks at a discount,” Askew added.

Previously, Hashlabs Mining founder Jaran Mellerud suggested that the halving might lead to a collapse of industry companies. According to the expert, “investors understand that these firms barely make money.”

According to CoinShares specialists, after the block reward reduction, only Bitfarms, Iris, CleanSpark, TeraWulf, and Cormint will be able to operate profitably. The experts based their calculations on a Bitcoin price of $40,000.

JPMorgan predicted that the halving could trigger a price correction to this level.

Mellerud speculated that declining revenues threaten to drive the least efficient miners out of the US in search of “cheap electricity.” Askew strongly disagreed with this view.

“With some of the lowest electricity costs, they are also acquiring next-generation equipment in preparation for the block reward reduction,” he explained.

According to Galaxy Digital, approximately 15-20% of the total computing power of the Bitcoin network will become unprofitable after the halving.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!