CoinShares Evaluates Bitcoin Miners’ Prospects Post-Halving

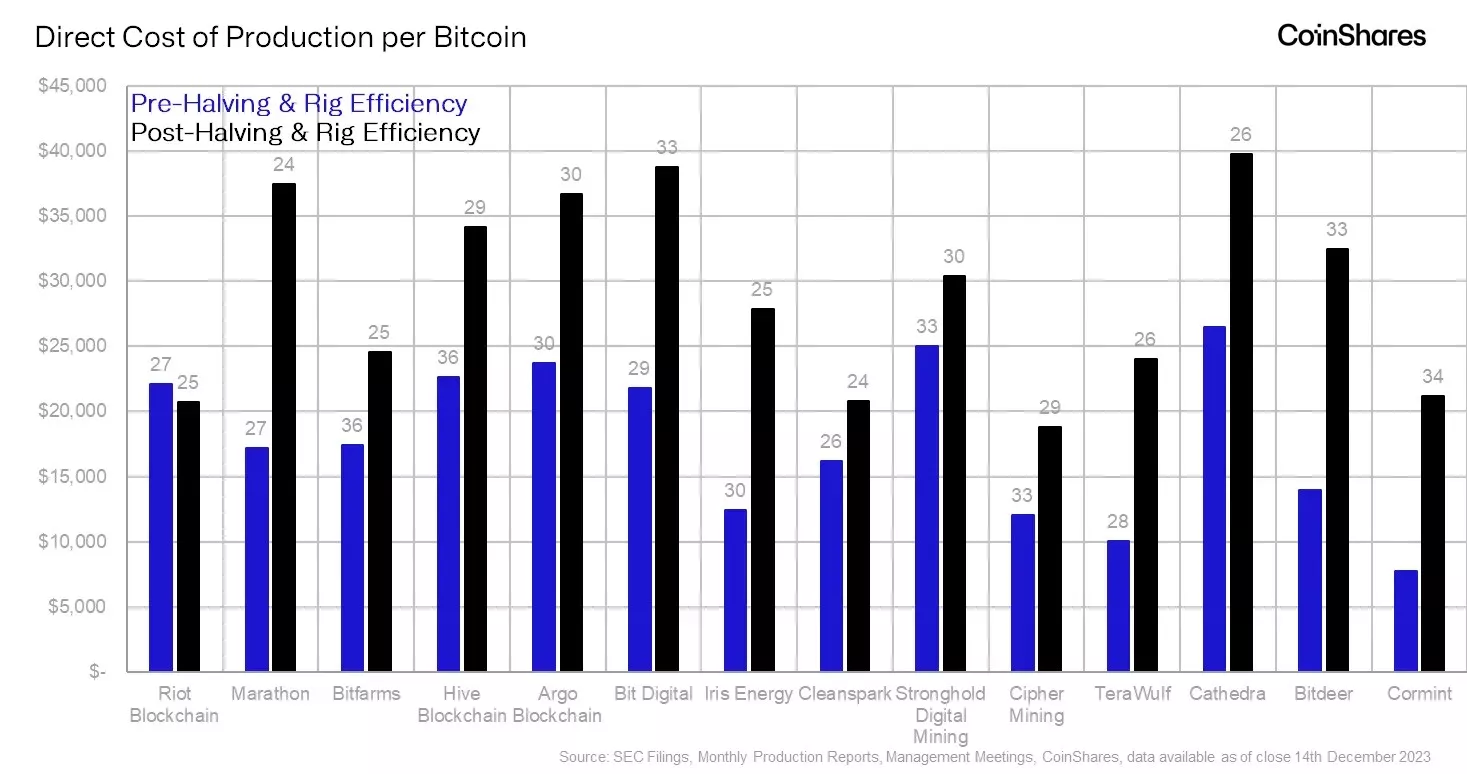

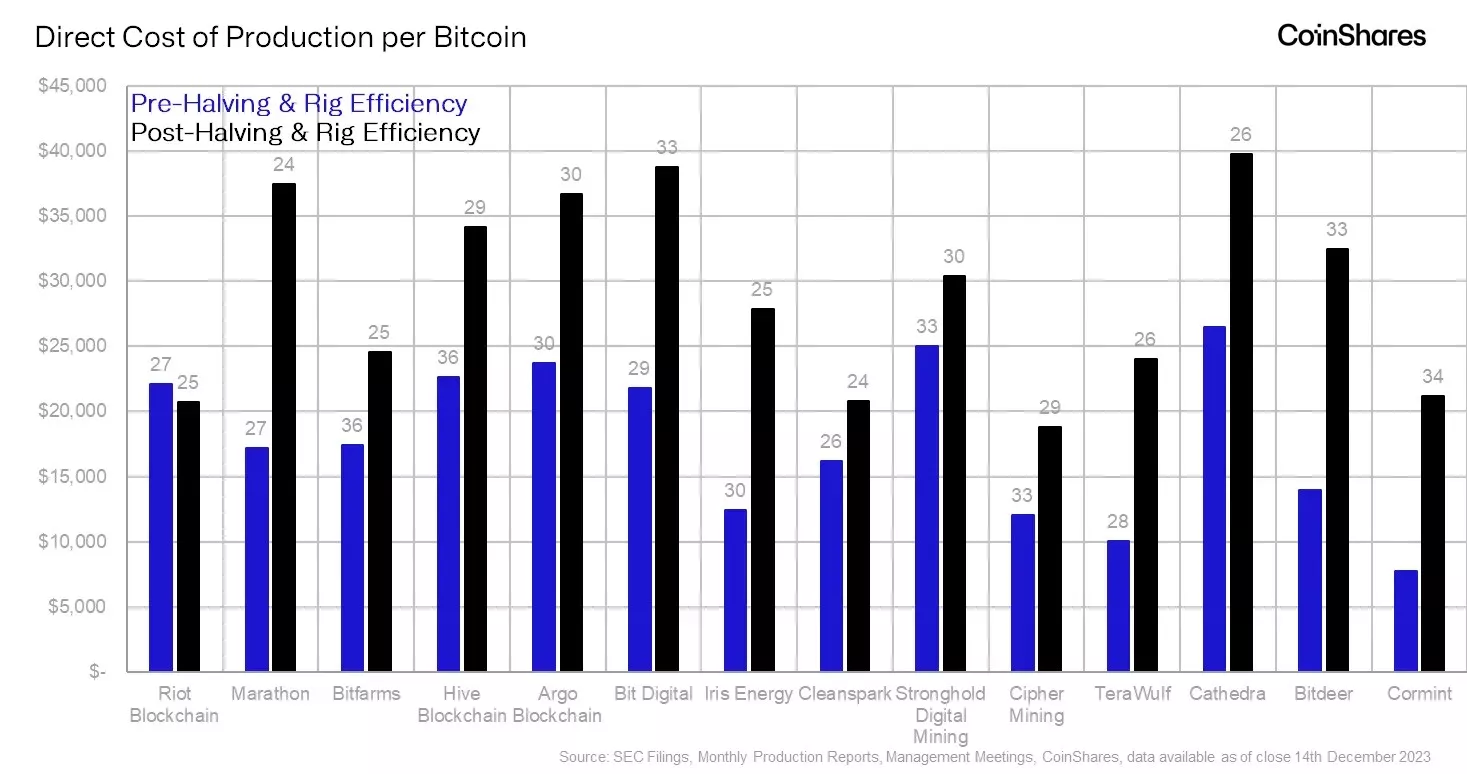

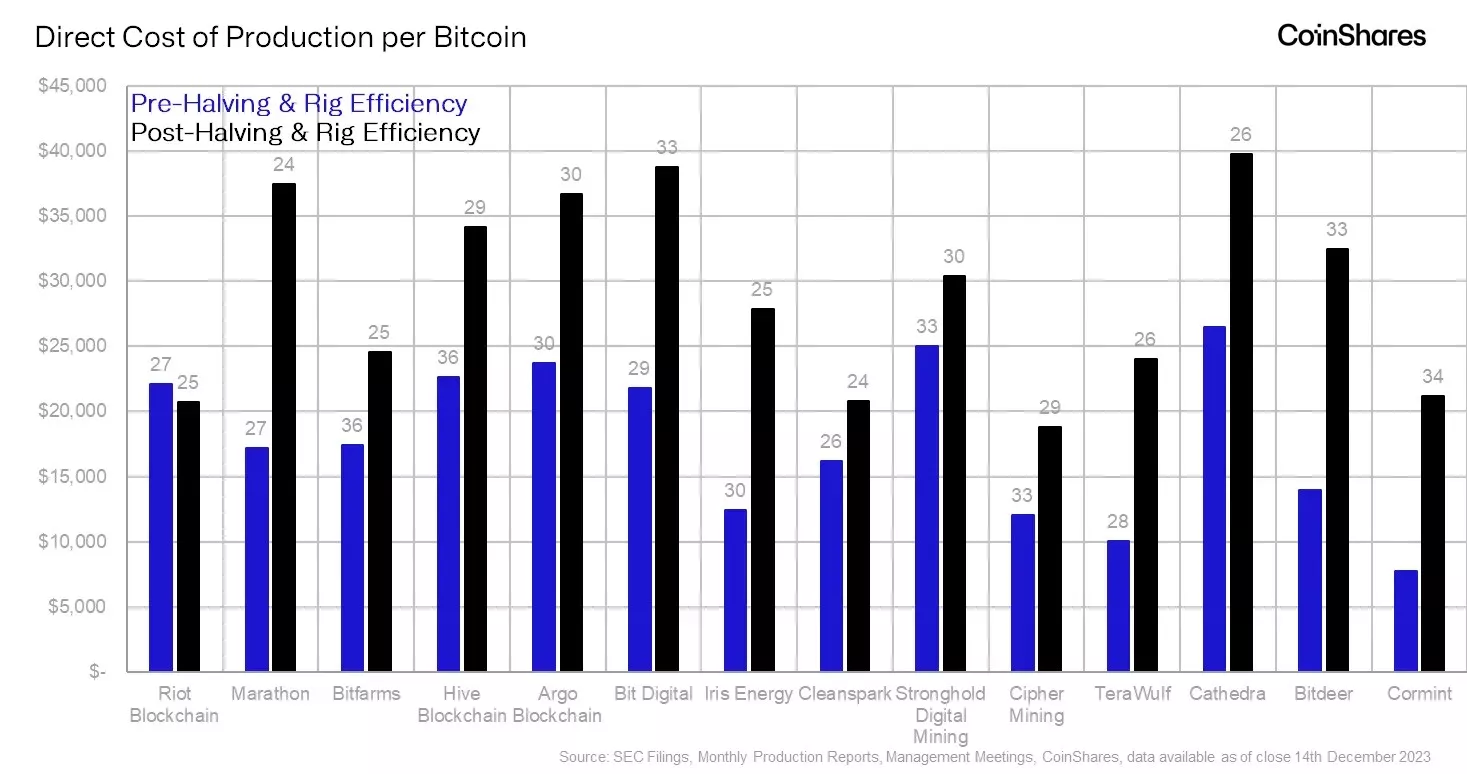

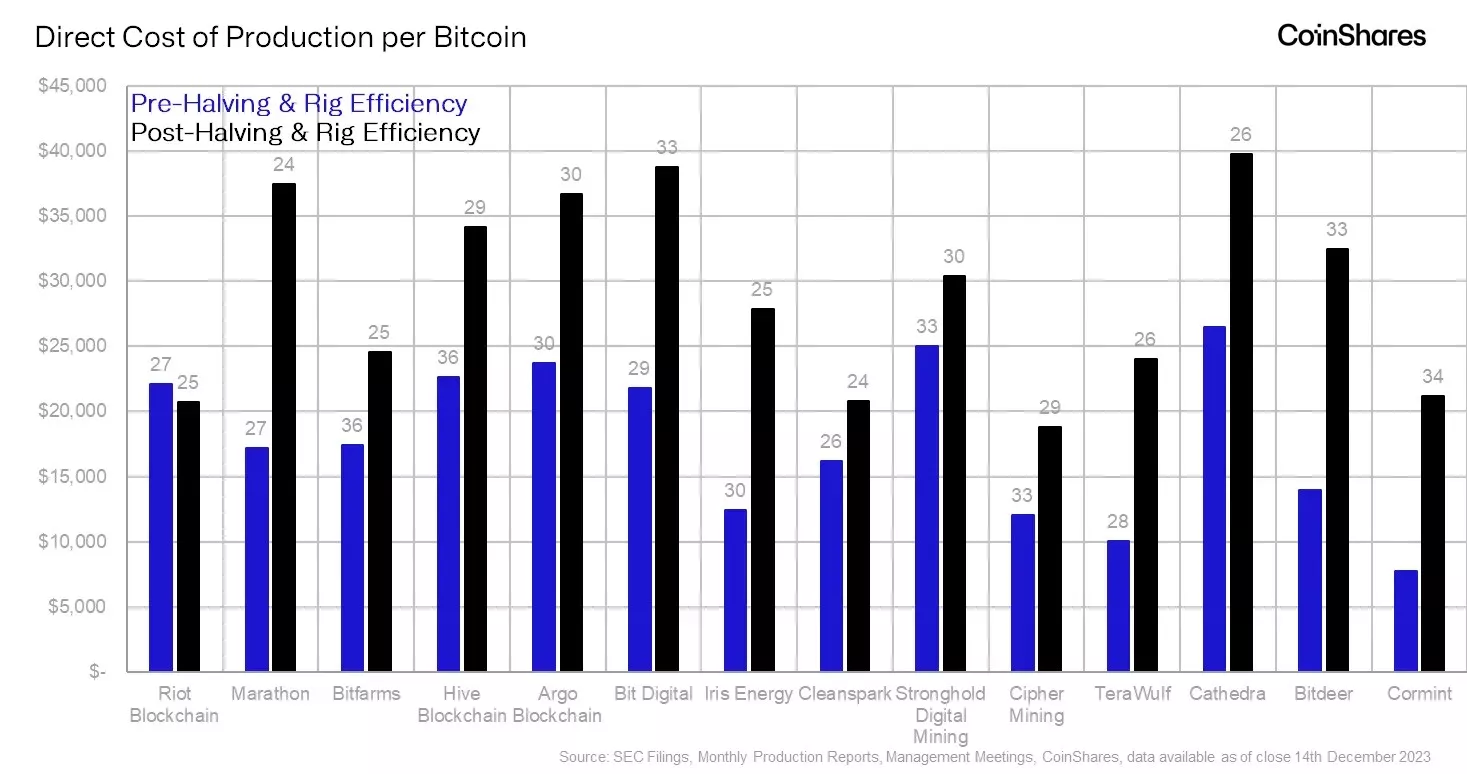

According to CoinShares, only public miners such as Bitfarms, Iris, CleanSpark, TeraWulf, and Cormint will remain profitable after the halving if Bitcoin’s price does not exceed $40,000.

Want to understand the impact of the halving on Bitcoin Miners revenues and how bitcoin mining can reduce global CO2 emissions? Please do read our 2024 mining reporthttps://t.co/0gJBTMB4yq

— James Butterfill (@jbutterfill) January 12, 2024

According to the firm’s experts, in the third quarter of 2023, the average weighted costs of Bitcoin production and cash expenses were $16,800 and $25,000, respectively. Following the expected reduction in block rewards in April, these figures will rise to $27,900 and $37,800.

Experts predict that the average cost of Bitcoin mining will reach $37,856.

CoinShares specialists believe that one of the main challenges for miners is the high costs of selling, general, and administrative expenses (SG&A). To break even, companies will likely need to reduce these expenses.

Based on cost structure and financial reserves, Riot Blockchain is in the best position ahead of the halving. Experts also mentioned TeraWulf and CleanSpark in this context.

In 2023, the hash rate of the first cryptocurrency’s network increased by 90%, while the network’s energy consumption grew year-on-year by only 44% to 115 TWh. This was due to an approximately 8% increase in the efficiency of miners’ equipment.

Currently, the average energy cost in the network is 34 W/TH. CoinShares forecasts that by mid-2026, this figure will reach 10 W/TH.

Experts expect the network’s hash rate to reach about 450 EH/s by the halving. Historically, the figure has decreased by approximately 9% about six months after the block reward halving. Therefore, it could potentially drop to 410 EH/s, but by the end of 2024, the trend line predicts growth to 550 EH/s.

On average, over the past three years, Bitcoin’s hash rate has grown annually by 53%. To maintain market share and the volume of mined cryptocurrency, miners have accordingly increased their computing power. However, compensating for the halving will be challenging, according to CoinShares specialists.

Modernizing equipment to reduce electricity costs is crucial. Experts cited deals by CleanSpark and Iris Energy to purchase Bitmain Antminer S21 units with an efficiency rate of 17.5 W/TH as examples of such a policy.

It is estimated that the average energy cost for public miners will decrease from 29 W/TH to 26 W/TH after the halving.

The weighted average share of electricity in total Bitcoin mining costs will increase slightly from 68% to 71%.

“The more mining installations a miner has for self-mining, the larger the data center required in megawatts. These large capital expenditures are financed either through equity or debt, with the latter potentially harming the overall cost of mining due to higher interest expenses and exposing them to risk during Bitcoin downturns,” experts emphasized.

They cited Core Scientific as an example, which filed for bankruptcy at the end of 2022, unable to service its debts.

Earlier, ForkLog detailed how the industry prepared for the upcoming halving in 2023 in a New Year article.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!