OKX Launches L2 Network, Strike Expands to Europe, and More Crypto Developments

We have compiled the most significant news from the crypto industry over the past two weeks.

- OKX, in collaboration with Polygon Labs, has launched its own L2 network, X Layer.

- Ledger Live will integrate an instant crypto purchase and exchange option through a partnership with MoonPay.

- The Strike app for Bitcoin payments, supporting the Lightning Network, has entered the EU market.

- Germany’s largest federal bank, LBBW, will offer crypto custody services.

- Woo X has opened access to tokenized US Treasury bills for retail clients.

OKX Launches Its Own L2 Network X Layer in Collaboration with Polygon Labs

Bitcoin exchange OKX has launched its own Ethereum-based L2 network called X Layer. The initiative aims to provide low fees and interoperability for users interacting with dapps.

The proprietary L2 protocol will allow platform users to transfer assets, deposit, and withdraw cryptocurrency on OKX. Additionally, it will provide access to nearly 200 dapps offering token swaps, staking, and various smart contract functions. OKB will be used to pay fees in the L2 network.

The solution is based on ZK-Rollup. The network is built using CDK Polygon and ensures shared state and liquidity across multiple blockchains via the Aggregation Layer, an Ethereum scaling protocol.

According to OKX’s Chief Marketing Officer Haider Rafique, X Layer and other L2 networks are expected to become integral infrastructure for the interconnected Web3 ecosystem.

In November 2023, ForkLog reported that Bitcoin exchange Kraken is in talks with Polygon, Matter Labs, and Nil Foundation about a potential partnership to launch an L2 similar to Coinbase.

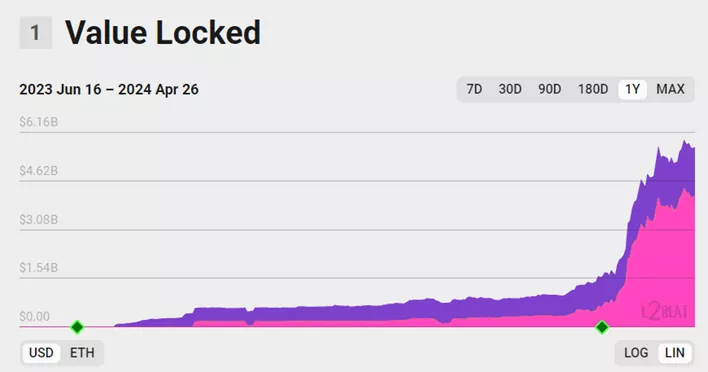

The total value locked (TVL) in Base’s L2 network from the latter has increased to $5.45 billion at the time of writing.

Ledger Live to Integrate Instant Crypto Purchase and Exchange Option via MoonPay

The Ledger Live app, associated with the Ledger hardware wallet, will feature instant purchase and exchange of digital assets through the MoonPay processing service.

As part of the collaboration, Ledger Academy will launch new self-study guides on cryptocurrency trading and other educational resources, including content focused on MoonPay services.

In August 2023, Ledger announced the integration of PayPal, allowing US users to purchase digital assets using their payment service account.

Strike App for Bitcoin Payments with Lightning Network Support Launches in EU Market

The Strike team has launched its Bitcoin payments app services for clients in Europe.

The Send Globally feature allows users to quickly and affordably buy, sell, send, and withdraw the first cryptocurrency, as well as conduct transactions in local currency using the Lightning Network.

The iOS and Android app enables European users to purchase digital gold directly with free unlimited SEPA deposits in euros from their bank account instantly, where supported, and to schedule recurring purchases.

Clients can sell Bitcoin and similarly withdraw it to their bank accounts, transfer to non-custodial wallets, or make payments via the Bitcoin or Lightning Network without restrictions.

The app is available in over 70 countries, including Latin America and Africa.

Germany’s Largest Federal Bank LBBW to Offer Crypto Custody Services

Germany’s largest federal bank, Landesbank Baden-Württemberg (LBBW), with AUM of €330 billion, will offer crypto custody services in the second half of 2024. The partner will be the licensed platform Bitpanda, regulated by the FCA and BaFin.

Bitpanda will provide the technical and regulatory infrastructure for “investment as a service” for the secure storage of cryptocurrencies, including Bitcoin and Ethereum. LBBW targets the service at corporate clients.

In November 2023, Bitpanda agreed with Austria’s Raiffeisenlandesbank Niederösterreich-Wien (RLB NÖ-Wien) to integrate cryptocurrency trading into its investment platform in the first quarter of 2024.

Woo X Opens Access to Tokenized US Treasury Bills for Retail Clients

Bitcoin exchange Woo X has added tokenized US Treasury bills to its product list. The initiative was implemented in partnership with the OpenTrade platform.

According to a platform representative, this is the first time such an instrument has been made available to retail clients.

“RWA Earn Vaults bridge the gap between traditional financial securities and the dynamic world of cryptocurrencies, offering […] the opportunity to work with high-quality financial assets with low risk seamlessly, safely, and efficiently,” the press release states.

Key Metrics of the DeFi Segment

TVL in DeFi protocols has slightly decreased to $94.6 billion. Lido remains the leader with $29.8 billion. EigenLayer holds the second position with $15.45 billion, while Aave retains third place with $10.65 billion.

TVL in Ethereum applications moderately decreased, amounting to $54.3 billion.

Trading volume on decentralized exchanges (DEX) over the past 30 days declined to $159.6 billion. Uniswap’s dominance decreased, accounting for 53.1% of the total turnover (two weeks ago it was 56.2%). The second DEX by trading volume, PancakeSwap, increased its market share from 21.9% to 22.2%. Curve took the third position with 5.3%.

Also on ForkLog:

- Tether reorganizes the company and expands business beyond stablecoins.

- Aptos Labs partners with Microsoft and SK Telecom to create an institutional platform.

- Crypto exchange Kraken launched a non-custodial wallet.

- Binance received a full license in Dubai and plans to return to India.

- Bitget launched pre-market trading.

- Mt. Gox trustee updated creditor repayment information.

- Uniswap Labs increased the swap fee for trades through the interface.

- EigenLayer’s TVL exceeded $15 billion amid ecosystem expansion.

- BNB Chain to launch native staking in BNB Smart Chain.

- Arbitrum, Optimism, Polygon, StarkWare, and zkSync to integrate DA layer from Avail.

What to Read and Listen to Over the Weekend?

On April 30, a federal court in Seattle will sentence Binance founder Changpeng Zhao on money laundering charges. Prosecutors have requested a 36-month prison sentence for CZ for violating anti-money laundering laws. The maximum discussed was a 10-year term.

Zhao apologized for “poor decisions” and took “full responsibility” for his actions in a note to the court. A similar letter in defense of CZ was also sent by his colleague and head of Binance Labs, Yi He, detailing his goals and actions as the CEO of the exchange.

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!